Risk management

GFI buys exotic options model

LONDON -- Inter-dealer broker and market data firm GFI Group has bought options pricing model dVega, and integrated it with the latest release of its flagship options pricing tool Fenics FX, GFI will announce today (October 27).

Cashflow considerations in currency overlay

Active currency overlay can reduce the risk of adverse cashflow arising from a strategic hedge, say Andrew Davies, director of capital market research, and Damhnait Ni Chinneide, portfolio manager at Lee Overlay Partners in Dublin

UBS triumphs in currency derivatives

ZURICH -- UBS triumphed again in this year’s currency derivatives categories in FX Week ’s sister publication Risk magazine’s global derivatives rankings.

ACI Beirut Congress: exhibition preview

BEIRUT -- Between the challenging seminar programme and the exhaustive social schedule planned by hosts of the 43rd ACI World Congress this week, the 600+ delegates will get a chance to sample product demonstrations and promotions at the exhibition.

Forward hedge overlay for euro

A Middle Eastern importer could change its risk profile by overlaying its forward hedges, says Charlie Brown, head of structuring and solutions at Standard Chartered in London. By pairing euro puts at lower levels with euro calls, the importer can assure…

All eyes on the Middle East

Growing interest in Islamic banking, new technological developments and a wave of freshly repatriated money have put forex trading in the Middle East on the cusp of an exciting new era, reports Nikki Marmery

Dual deposits reap high-yield rewards

Ray Franzi, head of FX structuring at Dresdner Kleinwort Wasserstein in London, offers an opportunity for customers to achieve high Japanese yen deposit rates

Scandinavia beckons FX fund managers

LONDON – Low interest rates and relaxed legislation in Scandinavia and continental Europe could make institutional investors in those regions key prospects for currency fund managers.

PaR signals return of FX risk specialists

LONDON -- Growing interest from hedge funds in banks’ FX services have been a marked feature of the markets in the past 18 months. But that relationship can work both ways, reports one new currency fund, which has seen a wave of interest from banks…

PaR signals return of FX risk specialists

LONDON -- Growing interest from hedge funds in banks’ FX services have been a marked feature of the markets in the past 18 months. But that relationship can work both ways, reports one new currency fund, which has seen a wave of interest from banks…

German hedge fund reform raises FX hopes

MUNICH -- New proposals for the laws governing hedge funds and funds of funds in Germany could open up the market to a wider audience and heighten FX opportunities.

Politics mars eastern European FX process

BUDAPEST -- Political interference in Hungary’s monetary policy decisions could ultimately damage regional currencies and derail the accession process to the eurozone, analysts told FX Week .

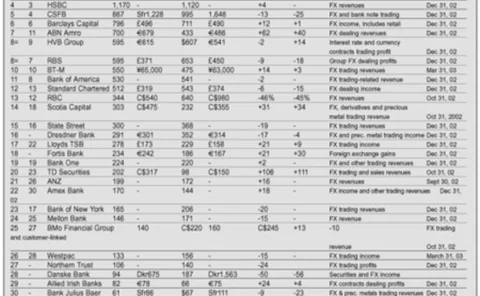

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Banks counter IAS39 threat

LONDON -- Banks are developing new structuring models for corporate clients to ensure the IAS39 accounting standards do not result in a reduction of complex FX hedging activity.

GFI targets corporates for options pricing

LONDON -- New York-based interdealer broker GFI Group today (June 16) launches a new online FX option pricing service targeting corporate firms and lower-volume FX users.

Cashflow control for pension portfolio hedges

Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency Management, offers a solution to an FX-related problem facing a UK pension fund

ETrade enters FX with Saxo Bank

LONDON -- Online bond and equity retail trader ETrade has made its first foray into FX by becoming a white-label partner of Danish FX dealer and technology provider Saxo Bank.

BTM top in Japanese FX

TOKYO -- Bank of Tokyo-Mitsubishi (BTM) has cemented its position as the top Japanese forex provider, reporting a 3% rise in yen terms in revenues for the full-year 2002.

Prop desks reap rewards of heightened FX volatility

LONDON -- Banks could be reaping rewards from their proprietary FX trading desks, as swift intra-day market moves continue, dealers have told FX Week .

Crackdown on risk budgets

Trader sign-off on revaluing data must end, says industry body NEW YORK -- The Professional Risk Managers’ International Association (Prmia) is considering issuing guidelines recommending banks separate their risk management budgets from FX and other…

HK launches euro clearing system

HONG KONG -- Hong Kong went live with a new euro clearing system last week, in an effort to reduce FX settlement risk in the Asian timezone.

BoA links major and emerging FX forwards in risk strategy drive

LONDON -- Bank of America (BoA) has merged its forwards and emerging markets forwards businesses in London, and hired three forwards traders globally as part of a continued drive to move to a strategic risk management model, a senior official told FX…

Plimsoll steps into currency overlay

NEW JERSEY -- Summit, New Jersey-based fund manager Plimsoll Capital is moving into currency overlay, and expects to secure its first clients this quarter, a senior official told FX Week .