Risk management

Watchdog savages NAB

MELBOURNE -- National Australia Bank’s currency options desk will remain closed until it has satisfied requirements issued by its regulator in a damning report released last week.

Calyon names regional managers

PARIS -- Calyon, the group to be formed from the merger of Crédit Agricole Indosuez (CAI) and Crédit Lyonnais (CL) on April 30, has agreed the structure of its global spot FX business and appointed regional heads, a senior official said last week.

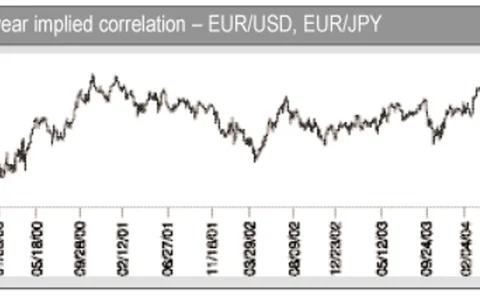

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Banks add NDFs to e-trading tools

LONDON -- Royal Bank of Scotland, Barclays Capital and Standard Chartered are planning to launch electronic trading of non-deliverable forwards (NDFs) this year, chasing market leaders in the field such as Dresdner Kleinwort Wasserstein and Deutsche Bank.

NAB report: managers axed

FX head and three executives leave NAB in wake of report on forex losses MELBOURNE -- National Australia Bank (NAB) sacked head of FX Gary Dillon on Friday (March 12) after he was criticised by PricewaterhouseCoopers’ independent report into the bank’s A…

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

Gartmore leads new hedge fund launches

LONDON -- Gartmore Investment Management has added to the recent explosion in currency funds with the launch of a new hedge fund. The fund, available to institutional investors around the world, builds on the firm’s 16-year track record in currency…

Benchmarking against competitive exchange rates

The dollar decline has led to competitive divergences between those currencies that tag the dollar and those that have suffered. This is likely to bring increased FX volatility, says Peter Luxton, economic adviser at Informa Global Markets in London

Market to test central banks post-G7

LONDON -- The G7 communiqué released after the Boca Raton meeting on February 7 will lead to the market testing the resolve of central banks to limit FX moves, analysts agreed last week.

Banks hire for Euro corporates

LONDON -- BNP Paribas, Deutsche Bank SEB and SG Corporate & Investment Bank are among the banks building European corporate FX sales teams, as clients step-up activity in response to volatile markets.

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

More banks put money on research

LONDON -- ABN Amro and Barclays Capital are among the increasing number of banks putting money on their trade recommendations for FX. Both have allocated money to start trading on model portfolios this year, joining CSFB, Citigroup and JP Morgan Chase as…

Using currency as an alpha source

The past three years have been disturbing for investors and managers. This investment climate is perfect for engaging in currency strategies to create alpha, say Paul Lambert, head of currency, and Mark Pursey, UK spokesperson at Deutsche Bank Asset…

Korean regulations to keep won stable

SEOUL -- Analysts are forecasting more near-term stability for the Korean won, after the South Korean Ministry of Finance and Economics (Mofe) last week introduced regulations aimed at limiting activity in the non-deliverable forwards (NDF) market by…

Sentiment indexes gain importance

LONDON -- Traders and investors are increasingly looking to new market sentiment indexes to help them manage their positions in the currency markets.

‘Illegal trading’ costs NAB $140m

MELBOURNE -- Australia’s largest bank, National Australia Bank (NAB), became the latest victim of alleged rogue forex trading last week. The bank said on Tuesday (January 13) that it had uncovered losses of up to A$180 million (US$140 million) from…

September - Quote unquote

"We jointly decided that the best move would be to increase its FX expertise" -- Jim Brown , managing director of TH Lee Global Internet Managers, on the departure of Currenex chief executive Lori Mirek in January

May - Banks’ operational risk lapse exposed

A special investigation by FX Week in May revealed a lapse in operational risk management at banks that do not separate risk management budgets from business lines.

JPMorgan Fleming to launch FX fund

LONDON -- JPMorgan Fleming will launch a fund in February based on research produced by parent group JP Morgan Chase.

Scandinavian banks look east

STOCKHOLM -- Scandinavian banks are expanding emerging markets teams in Europe and Asia as they seek to upgrade non-Scandi forex in preparation for the anticipated disappearance of the Swedish and Danish crowns.

Market eyes fresh dollar falls

LONDON -- Forex market analysts and traders are predicting fresh falls for the dollar in the coming months after euro/dollar hit successive record highs last week.

Dollar trend drives fund profits

STAMFORD -- The success of models in capturing early trend moves in the dollar drove 57% of currency fund managers in the Parker FX Index to achieve gains in October. But gains were limited, as the index was up only 0.6%.