Opinion

Profiting from the Chinese yuan

With speculation rife on the revaluation of the Chinese yuan, James Davison of the global FX derivatives marketing team at ABN Amro in London, examines potential ways for derivatives traders to benefit

Why the US current account still matters

Is the market’s new-found obsession with portfolio flows data justified in assessing the US dollar? asks Adam Cole, senior FX strategist at Credit Agricole Indosuez in London

The zero-cost double KO/KI forward

A double knock-out/knock-in forward may provide a Mexican manufacturer with an effective zero-cost hedge, say Vincent Lee and Richard Stang, vice-presidents in FX sales at TD Securities in Toronto

Aussie hits a high

The Aussie dollar looks set to be the one of the main beneficiaries from continued central bank currency intervention in Asia, argues Robert Rennie (right), chief currency analyst at Westpac in Sydney

Are long-dated options correctly priced?

Options pricing is based on a flawed model of market efficiency. This is why market-makers and hedgers might see the same volatility as cheap or expensive, depending on their viewpoint, says Gilles Bransbourg, head of European FX sales at Bear Stearns in…

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Cancellable forward beats dollar pendulum

Cancellable forward contracts offer corporates a cheap way of protecting against volatile dollar receivables says Anders Kjaer Jensen, FX strategist at Nordea in Copenhagen

Portfolio flows and the dollar’s outlook

The pace of the dollar’s decline appears to have returned to more sustainable levels, says Michael Woolfolk, senior currency strategist at The Bank of New York

Falling rates spell kroner/krona opportunities

The Norwegian kroner is being supported by oil prices and carry-trade liquidation, but these factors will force the Norges Bank to slash rates. This provides the opportunity for short-term tactical trades against the Swedish krona, says Hans-Guenter…

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

Rotation in reflation trades

Inflation is driving the UK to raise interest rates while other nations are set to cut rates to drive growth. These rate differentials provide opportunities for return says Monica Fan, head of European FX strategy at RBC Capital Markets in London

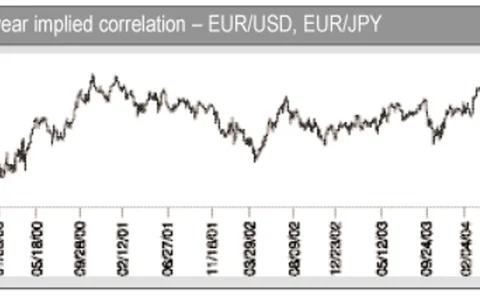

Correlation for hedging and speculation

One of the most surprising FX developments in the past year has been the re-emergence of the use of correlation products. Ade Odunsi, a director in Merrill Lynch’s FX risk advisory group in New York, suggests two such solutions for a hedging and a…

Hedging dollar dividends back to euro

A European company seeking to protect dividends received from a US subsidiary can benefit from the current inverted volatility term structure in the FX options market. UBS’s FX Solutions group explains how

Reflationary effects on dollar/yen

Strong cross-border portfolio inflows into Japan are unlikely to falter. Consider either Seagull or reverse knock-in option strategies to protect against further yen strength, say State Street Global Markets’ currency options and currency strategy teams

Time for Asia to flex FX

A week after the Boca Raton G7 communiqué, and the market is flexing its capital muscle, prompting a broad appreciation of Asian currencies, writes Claudio Piron, head of FX strategy at Standard Chartered Bank in Singapore

Accrual strategy counters euro/dollar vol

The next phase of dollar weakness is unlikely to be as monotonous as the previous one. Dollar sellers should therefore use an accrual strategy to exploit market volatility, says Bart Wong, senior FX structurer at Barclays Capital in London

End of the line for euro/dollar ascent?

The market may push euro/dollar higher to challenge the European Central Bank’s resolve, but economic fundamentals are stacking up against the euro, says Stephen Jen, currency economist at Morgan Stanley in London

Sterling -- a call for calm

The market has got so excited about sterling it has failed to recognise underlying economic problems in the UK. These problems will see sterling disappoint many in 2004, say David Bloom (left) and Mark Austin, currency strategists at HSBC in London

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

Using currency as an alpha source

The past three years have been disturbing for investors and managers. This investment climate is perfect for engaging in currency strategies to create alpha, say Paul Lambert, head of currency, and Mark Pursey, UK spokesperson at Deutsche Bank Asset…

Mission impossible

Japanese FX intervention is increasing, but even unlimited funds would fail to stop appreciation, says Simon Derrick (right), head of currency research at the Bank of New York in London

Kiwi ripe to strengthen

The New Zealand dollar’s recent performance is based on more than just US dollar weakness. Sue Trinh, currency strategist at the Bank of New Zealand in Wellington, looks at what will be driving the currency in 2004

Assessing the value of e-FX trading

Predicting future currency movements is not the only problem currency managers face. Finding the best method of dealing is also an issue, explains Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency…

The year ahead in Asia

US dollar weakness and regional equity market strength look set to remain the main drivers of Asian FX in 2004, according to Tim Condon, chief economist, Asia for ING Financial Markets in Hong Kong