Trading

The average rate fadeout forward

An average rate fadeout forward may help a European corporate lock in protection on its US earnings, says Federico Gilly, executive director, FX strategies at Goldman Sachs in London

Mid-tier clients pile into rupee options

MUMBAI -- FX options use in India is extending to more mid-market customers, nine months on from the liberalisation of rupee options, local market participants told FX Week .

Japan: on the move

Japan’s economic rebound looks more and more like the long-awaited self-sustaining recovery that would put an end to the post-bubble era. But there are still big risks, says Anne Mills, head of foreign exchange research at Brown Brothers Harriman in New…

Profiting from the Chinese yuan

With speculation rife on the revaluation of the Chinese yuan, James Davison of the global FX derivatives marketing team at ABN Amro in London, examines potential ways for derivatives traders to benefit

Richmond launches currency fund for Asia

HONG KONG -- Richmond Asset Management is set to launch a new fund in Hong Kong this month, to capitalise on increased opportunities to profit from currency strengthening, officials said last week. The Bermuda-based Currency Optimiser fund will be…

Traders active on MoF retreat

TOKYO -- Traders are set for heavy action in the coming weeks after the Ministry of Finance’s (MoF) withdrawal from yen intervention last week, ending its massive $360 billion spending spree of the past 12 months.

Why the US current account still matters

Is the market’s new-found obsession with portfolio flows data justified in assessing the US dollar? asks Adam Cole, senior FX strategist at Credit Agricole Indosuez in London

No ringgit peg change

KUALA LUMPUR -- New FX regulations introduced in Malaysia on April 1 may herald further economic liberalisation, but that does not mean the ringgit’s peg to the US dollar will be relaxed soon, analysts in Asia told FX Week .

The zero-cost double KO/KI forward

A double knock-out/knock-in forward may provide a Mexican manufacturer with an effective zero-cost hedge, say Vincent Lee and Richard Stang, vice-presidents in FX sales at TD Securities in Toronto

NZ ups reserves as "insurance"

WELLINGTON -- The Reserve Bank of New Zealand (RBNZ) is proposing to enhance its capacity to intervene in FX markets. The central bank wants to increase the amount of foreign currency reserves it holds as "insurance" against a non-convertible Kiwi dollar…

Watchdog savages NAB

MELBOURNE -- National Australia Bank’s currency options desk will remain closed until it has satisfied requirements issued by its regulator in a damning report released last week.

Aussie hits a high

The Aussie dollar looks set to be the one of the main beneficiaries from continued central bank currency intervention in Asia, argues Robert Rennie (right), chief currency analyst at Westpac in Sydney

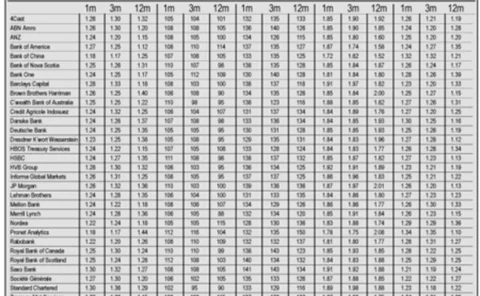

Investment banks break records

NEW YORK -- This year looks set to be a record-breaker for banks' FX earnings, if the commercial banks follow the lead set by the US investment houses.

EBS sees fruit of 'sustained effort on sterling'

LONDON -- Spot broker EBS last week quantified the success of its initiative to build sterling volumes on its platform.

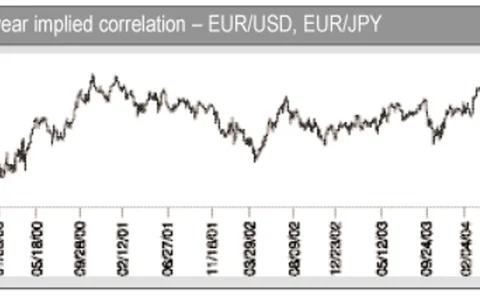

Are long-dated options correctly priced?

Options pricing is based on a flawed model of market efficiency. This is why market-makers and hedgers might see the same volatility as cheap or expensive, depending on their viewpoint, says Gilles Bransbourg, head of European FX sales at Bear Stearns in…

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London