Monetary policy

Perspectives on 2014: Axel Merk, Merk Investments

The timing of QE tapering will remain a dominant theme in the coming months as many currencies remain beholden to central bank decisions, while the eurozone crisis is still far from over, warns Axel Merk, president and chief investment officer of Merk…

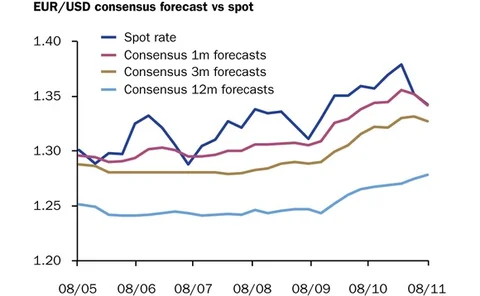

Monex Europe goes against the grain on EUR/USD

Currency broker Monex Europe climbs to first place in the three-month rankings after forecasting euro resilience against the dollar

FX Week Europe: Eurozone break-up ‘inevitable’, says ECU currency chief

Short-term policies have delayed the break-up of the eurozone, but a disorderly exit of debt-laden countries is inevitable, says chief investment officer Michael Petley

US dollar will outperform other majors, says BMO

Canadian bank tops one-month forecast rankings for the first time this year with a bullish take on the dollar

Crédit Agricole on the rise with bullish dollar view

A consistent view on US dollar strength sees Crédit Agricole soaring up through the one-month forecast rankings

Swiss franc floor will remain in place, says UBS FX chief

George Athanasopoulos shares currency predictions for 2014, including an expectation the Swiss National Bank will maintain the 1.20 floor on EUR/CHF

ECB speculation provides welcome diversion for investors

Currency investors are growing weary of QE tapering speculation and taking more of an interest in events in Europe, prompting big moves in the euro

Westpac tops table with pessimistic dollar view

Australian bank tops this week's three-month currency forecast rankings after predicting events in the US would weaken the dollar against the euro

Scepticism over tapering pays off for Westpac

Westpac tops this week's one-month currency forecast rankings with low expectations for the dollar and the yen

RBI's shift in monetary policy welcome, say traders

The central bank’s reduction in its marginal standing facility is positive for India’s growth, but the rupee is still exposed to external risks

Monex Europe on top with strong EUR/USD view

An accurate view on Fed tapering - or lack thereof - has leapfrogged Monex Europe to the top of the one-month rankings

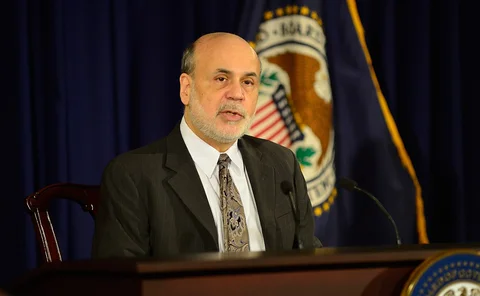

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

TMS Brokers tops table as euro falls

Polish broker tops one-month forecasts with expectations of a weaker euro

Weaker franc leads to speculation over future of SNB floor

Volatility has picked up in EUR/CHF this year, but traders believe the franc needs to weaken a lot more before the Swiss National Bank would consider easing its policy

Belief in euro keeps Bank of Montreal on top

The Canadian bank outlines its long-term forecasting strategy as maintains its place at the top of the 12-month tables

Barclays rises as BoJ sends yen plummeting

UK bank wins in FX Week's one-month rankings after forecasting continued yen weakness in April

Traders surprised by Australian rate cut

Reserve Bank of Australia's decision to cut interest rate to 2.75% came earlier than traders expected

FX Invest North America: Central banks ‘getting away with murder’

Central banks are pursuing the wrong policies and will find it difficult to know when to tighten monetary policy, says Axel Merk at Merk Investments

BoJ's inflation target unattainable, says Nomura

Panellists at Bloomberg event yesterday debated whether the yen will continue to weaken as the Bank of Japan pursues an ambitious 2% inflation target

Currency war scenario ‘exaggerated’, warns senior Swiss economist

Central banks are pursuing domestic priorities and are not engaged in competitive devaluation, says keynote speaker at FX Invest conference

Currency managers divided on net foreign assets as an indicator

Net foreign assets have a greater role to play in weighing up currency strength, says Stratton Street portfolio manager - but others disagree

Aussie dollar remains strong after RBA rate cut

The Australian dollar rallied after the RBA rate cut on Tuesday and strategists expect interest rates to remain at 3% for the next six months, supporting further strength

Saxo Bank on the yen's decline

John Hardy, global head of FX strategy at Saxo Bank shares his views on the G-3 currencies

The case for gold

Axel Merk and Kieran Osborne at Merk Investments believe recent financial shocks and ongoing turbulence provide major incentives for those considering gold, not just as a safe haven, but also as a protection against inflation