Euro

VIDEO: Saxo Bank G-10 Currency Market Outlook

An overview of currency markets into the fourth quarter and new year

CIBC on top with stable yen forecast

Canadian Imperial Bank of Commerce forecast in September 2011 that the yen would hold steady against the euro and the US dollar, landing the bank at the top of the 12-month currency forecast rankings

Are currency managers adding value?

Latest edition of FX Invest now available

Euro will continue to rise, says HSBC

HSBC's bullish view on the euro - which it continues to hold in its current forecasts - lands the bank at the top of the one-month forecast rankings

FX futures and options volumes soar on CME

While volumes are down year-on-year, September has seen a number of record days on CME Group, particularly in currencies such as the Canadian and Australian dollars and the Mexican peso

FX Concepts’ Taylor turns bearish on US dollar

The head of $3 billion hedge fund FX Concepts says the Federal Reserve’s open ended quantitative easing programme will drive the US dollar lower in coming months.

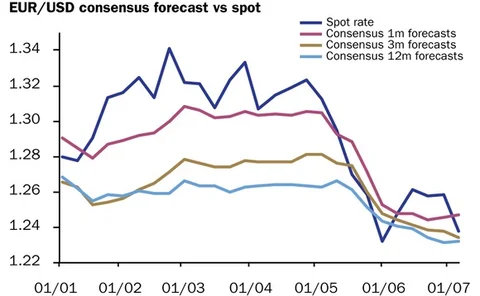

NAB on top after post-ECB euro rally

National Australia Bank forecast in mid-June that EUR/USD would rise to 1.28, landing it at the top of the three-month currency forecast rankings

QE3 sparks widespread dollar bearishness

The US dollar fell against most major currencies following the announcement of QE3 on September 13, but market participants are lukewarm on the likelihood of its success

Central banks are behaving irrationally, complain currency managers

The ECB's OMT programme fails to tackle growth and a third round of QE from the Fed would be irrational, according to speakers at FX Invest West Coast conference

Euro will continue to strengthen, says BNP Paribas

BNP Paribas anticipated in early August that short-term dollar weakness would support the euro, landing the French bank at the top of the one-month currency forecast rankings

EBS ditches decimals as part of platform overhaul

Full-pip and half-pip pricing will return to major currency pairs on EBS from September 17, as platform's new management team recognises flaws in decimalised pricing

RBC on top with August stagnation forecast

The Canadian bank tops the one-month currency forecast rankings and warns of uncertain forecasting conditions over the next three months

Likelihood of Grexit diminishes ahead of troika review

As European authorities head to Greece to inspect the country's finances, strategists believe it is increasingly unlikely authorities will allow the country to leave the euro

Countries will leave the euro by 2014, says ACI UK poll

The vast majority of respondents believe at least one country will leave the euro by 2014, but expect the single currency to survive

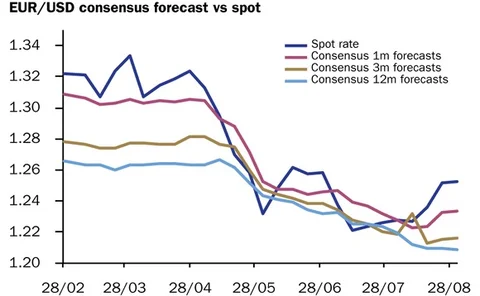

Euro set to fall further after period of stability, says UBS

An accurate forecast that eurodollar would remain steady at 1.24 lands UBS at the top of the one-month rankings, although the bank is more bearish on the currency in the longer term

Lloyds hits Olympic gold with forecasting triumph

Lloyds Banking Group’s focus on core fundamentals lands the bank at the top of the one- and three-month forecast rankings

Spotlight on: Nick Beecroft, Saxo Bank

Saxo’s newly appointed UK chairman and FX industry veteran Nick Beecroft talks to Robert Mackenzie Smith about his priorities in seeking to grow the Danish bank’s presence in the UK, as well as the challenges facing the FX market

Decline in spot volume driven by low volatility and HFT controls

The fall in FX spot volumes revealed in this week’s semi-annual survey data has been driven by low volatility and new controls on HFT behaviour, according to members of the FX JSC

Eurozone woes spreading to China, warns BAML

Bank of America Merrill Lynch has climbed to the top of the one-month forecast rankings after taking a negative view on the euro, but the bank expects it could rally towards year-end

Lloyds spot-on with bearish euro forecast

An accurate prediction in mid-April that the euro would fall to 1.22 within three months lands Lloyds Banking Group at the top of the forecast rankings

VIDEO: Safe-havens in euro turbulence

Looking at the key risks to the Australian dollar, Swedish krona and sterling

Technical analysis of historical data puts GFT in 12-month lead

GFT looked back to market data from June 2010 to make its 12-month forecasts on the euro's dramatic fall

Tail risk cheap, but few takers

Market dislocation has created attractive tail risk hedging opportunities, but demand is failing to take off, writes Joti Mangat

Eurozone tension expected to cross the Atlantic

Attention of FX market participants is beginning to shift to the effects of the US presidential election and the impending "fiscal cliff"