Federal Reserve

Monex Europe on top with strong EUR/USD view

An accurate view on Fed tapering - or lack thereof - has leapfrogged Monex Europe to the top of the one-month rankings

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Asia is a focus for FX research, says Morgan Stanley's Redeker

Hans Redeker, global head of FX strategy at Morgan Stanley, talks to Miriam Siers about the objectives of his team and their expectations for the coming months

Currency managers caught out by dollar rise against EM currencies

Immediate future of emerging market currencies in the hands of the Federal Reserve amid QE tapering expectations

EM exodus continues ahead of imminent QE tapering

The Indian rupee and Indonesian rupiah have continued to fall this week as tapering of quantitative easing in the US looms in the coming months

Westpac wins with bet on sound pound

Westpac's head currency strategist says market has been overexcited over the prospect of tapering in the US, while sterling shows more promise

Traditional reserve currencies on the decline, says Pimco

Pimco's chief operating officer is bearish on major currencies, expressing the fund's preference for emerging markets, particularly the ruble and renminbi

Achievement award: Jeff Feig

Citi’s global head of G-10 FX wins the 2013 e-FX achievement award in recognition of the exceptional contribution he has made to Citi’s foreign exchange franchise and the broader industry over the past nine years

BTMU hires from Barclays in e-FX sales

Ericka Bratsiotis has joined Bank of Tokyo Mitsubishi UFJ; other staff changes at the Federal Reserve, Deutsche Bank and Goldman Sachs

Faith in euro recovery lands BAML on top

Bank of America Merrill Lynch forecast a long-term euro rally in mid-2012, putting it at the top of the 12-month rankings, but the bank expects the euro to weaken in the months ahead

Markets braced for dollar to rally post-FOMC

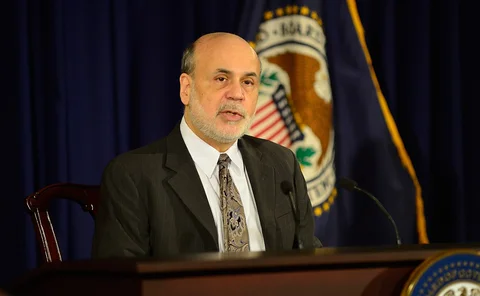

As Fed chairman Ben Bernanke is expected to confirm plans for tapering of bond purchases, FX traders say the dollar will rally in response

US dollar will continue to outperform, says StanChart

A prediction the US dollar would perform well against other major currencies during May lands Standard Chartered at the top of the one-month rankings

CMC Markets triumphs by backing the greenback

CMC Markets tops this week's three-month currency forecast rankings with expectations of yen and euro weakness

Danske Bank: Relative monetary policy pushes EUR/USD higher

Central bank policy pressures weigh on the euro, and Danske Bank expects eurodollar to continue trading in the low 1.30s over the coming month

Local factors will decide carry trade winners

Weaker US data, coupled with the Fed's quantitative easing, supports carry trades generally, but particularly where local factors are favourable

Breakdown in correlations leads to forex discrimination

Risk aversion has returned, breaking down correlations between assets and leading to investor discrimination between currencies. Mitul Kotecha looks at who stands to gain from this shift in appetite

FX Invest North America: Central banks ‘getting away with murder’

Central banks are pursuing the wrong policies and will find it difficult to know when to tighten monetary policy, says Axel Merk at Merk Investments

New York Fed demands better management of FX risks

Greater use of capital and collateral to mitigate all risks relating to FX trading is crucial, warns Jeanmarie Davis, head of financial market infrastructure at the NY Fed

Currency war scenario ‘exaggerated’, warns senior Swiss economist

Central banks are pursuing domestic priorities and are not engaged in competitive devaluation, says keynote speaker at FX Invest conference

CLS hires ex-New York Fed veteran to head regulation

Management changes at CLS continue with the appointment of Dino Kos, former head of FX at the New York Fed, as head of global regulatory affairs

Volatility to remain constrained by central banks, says Rabobank

An expectation that the US dollar and the yen would both weaken during 2012 has landed Rabobank at the top of the 12-month currency forecast rankings

FX Concepts’ Taylor turns bearish on US dollar

The head of $3 billion hedge fund FX Concepts says the Federal Reserve’s open ended quantitative easing programme will drive the US dollar lower in coming months.

QE3 sparks widespread dollar bearishness

The US dollar fell against most major currencies following the announcement of QE3 on September 13, but market participants are lukewarm on the likelihood of its success

Central banks are behaving irrationally, complain currency managers

The ECB's OMT programme fails to tackle growth and a third round of QE from the Fed would be irrational, according to speakers at FX Invest West Coast conference