European Central Bank (ECB)

RMB convertibility will be catalyst to offshore trading, say bankers

Buy-side firms will remain reticent in using renminbi until it becomes a fully convertible currency, despite the progress that has been made in recent months

FX benchmark manipulation: a buy-side perspective

Banks have been caught at the centre of the regulatory probe into manipulation of benchmark exchange rates in recent months, but the scandal could also affect buy-side firms that rely on benchmark fixes. Kathy Alys talks to Patrick Fleur, head of trading…

FX Week Europe: Currency managers need to react to short-term trends

Buy-side speakers at the conference divided on prospects for the euro, but all agree investment needs to adapt to short-term trends in currencies

Industry in discussions to change FX benchmark calculation, says ECB official

Senior market participants have suggested widening the time window in which benchmark exchange rates are set in FX, following allegations of manipulation

Lynn Challenger talks to FX Invest

Michael Watt asks Lynn Challenger, managing director of global trading at Mellon Capital Management, about the ups and downs of 2013, the merits and demerits of FX trading styles, and his outlook for 2014

Crédit Agricole on the rise with bullish dollar view

A consistent view on US dollar strength sees Crédit Agricole soaring up through the one-month forecast rankings

ECB speculation provides welcome diversion for investors

Currency investors are growing weary of QE tapering speculation and taking more of an interest in events in Europe, prompting big moves in the euro

Westpac tops table with pessimistic dollar view

Australian bank tops this week's three-month currency forecast rankings after predicting events in the US would weaken the dollar against the euro

Progress of RMB internationalisation ‘spectacular’, says SFC official

Speaking at the FX Week Asia conference, deputy chief executive of Hong Kong regulator highlights the importance of continuing to internationalise China's currency

TMS Brokers tops table as euro falls

Polish broker tops one-month forecasts with expectations of a weaker euro

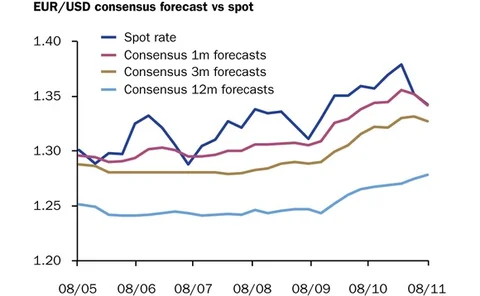

Bet on euro's long-term strength puts NAB on top

National Australia Bank tops the 12-month rankings, having taken a contrarian bullish stance on EUR/USD in August 2012

No CVA exemptions in US Basel III rules

Europe isolated as US regulators opt for broad counterparty risk charge

Danske Bank: Relative monetary policy pushes EUR/USD higher

Central bank policy pressures weigh on the euro, and Danske Bank expects eurodollar to continue trading in the low 1.30s over the coming month

Local factors will decide carry trade winners

Weaker US data, coupled with the Fed's quantitative easing, supports carry trades generally, but particularly where local factors are favourable

Breakdown in correlations leads to forex discrimination

Risk aversion has returned, breaking down correlations between assets and leading to investor discrimination between currencies. Mitul Kotecha looks at who stands to gain from this shift in appetite

France leads eurozone in Chinese renminbi payments

Aims to promote Paris as an international hub for the renminbi are paying off, as France sees a 249% increase in yuan-denominated transactions

Euro bearishness reawakened post-Cyprus

Long euro positions have been unwound following the bailout of Cyprus and many participants now foresee further trouble ahead for the eurozone

Depositors will trust EU guarantee despite Cyprus, says BdF official

Policy-makers have incentive to accelerate deposit guarantee plans, says Sylvie Matherat of the Banque de France

BMO in double win with accurate yen forecasts

USD/JPY could rise up to 100 in time, according to Bank of Montreal's Benjamin Reitzes, whose forecasts put the bank at the top of the 12- and one-month forecast rankings

Tempered euro bet lands CIBC on top

The Canadian bank accurately forecast the euro would rise and then fall in its one-month forecasts submitted on January 18

Mifid transparency rules must be properly calibrated, warns ECB board member

Central banks will have to deal with liquidity shocks in financial markets, so must ensure post-trade transparency rules are well calibrated, says Peter Praet

Volatility is here to stay in FX as the currency war engages

Currency markets have jolted back to life in recent weeks, largely driven by the change of government and monetary policy in Japan. With competitive devaluation of currencies clearly now in play, John Hardy believes the volatility is here to stay

Euro outlook 'unpredictable' after recent strength

Despite the resurgence of confidence in the euro since the turn of the year, participants appear to be following the caution expressed by Mario Draghi yesterday over whether the trend is sustainable

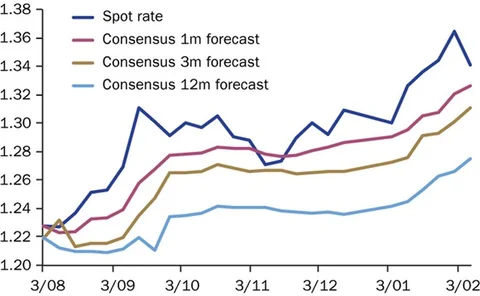

Dollar will outperform euro in the near term, says Barclays

An accurate forecast that the euro would strengthen at the end of 2012 has landed Barclays at the top of the three-month rankings, but the bank believes the dollar now has the edge