News

BAML hires FX options head from Goldman Sachs

Bank of America Merrill Lynch makes another FX trading hire from Goldman Sachs as it continues its FX expansion

Asia sales head exits UBS

Louis Curran has left UBS in Singapore after less than 18 months in the role

FXCM buys majority stake in Faros Trading

FXCM continues its aggressive expansion as it acquires a 50.1% stake in FX agency firm Faros Trading, four years after it was established by Ray Kamrath

CLS launches settlement for same-day USD/CAD trades

Settlement risk mitigation firm is due to launch a new settlement session this week for the trades settled on a same-day basis

Gain Capital appoints chief financial officer

KCG's Jason Emerson moves to Gain, while Price Markets hires a new head of FX sales

Industry forced to rethink reporting after Esma rejects GFMA proposal

FX participants must reconsider their approach to dual reporting under Emir, possibly at considerable cost to those already building towards the proposed model

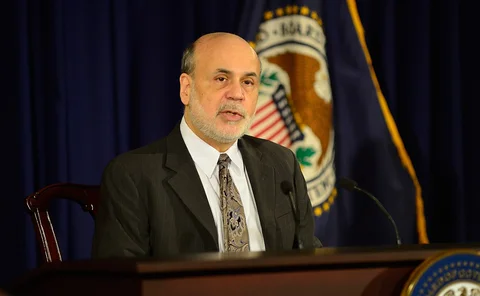

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Gensler not ruling out targeted Sef relief

CFTC chairman recognises difficulty in meeting October 2 Sef deadline, but says platforms need to be targeted in requests

Molten Markets appoints COO from State Street

John Vause ends more than 13 years at State Street to head operations at the new vendor

LMAX Exchange hires two in sales

Two new senior salespeople will focus on driving growth for LMAX's Interbank offering

FX options head exits Santander

Simon Manwaring has left Santander after a two-year stint and is expected to join a rival bank in a similar role

RBS reshuffles Emea FX sales management

Toby Cole and Robert Godber are promoted to head institutional FX sales in Emea, following recent departures

Sefs questioned on plans for erroneous trades

Swap execution facilities have been rushing to meet an October 2 deadline for registration, but more thought is needed on how platforms will deal with trade failures, say conference participants

FX options clearing a 'big challenge', warns NY Fed official

Speaking at the FX Invest West Coast conference, the New York Fed's Jeanmarie Davis addressed the challenges associated with clearing and settlement of FX options

Mako FX hires Simon Jones to drive platform growth

Citi's former e-FX trading chief has joined spot platform Mako FX as managing partner, with a mandate to focus on innovation and volume growth

FastMatch signs with TMX Atrium for low-latency connectivity

Start-up spot FX platform joins network to lower transatlantic latency and leverage global coverage

Pressure mounts on CFTC for relief on Sef rules

CFTC is being lobbied to grant relief on the contentious Footnote 88, which requires platforms to register as Sefs even if the products they offer are not yet made available to trade

Goldman Sachs hires ex-Citi salesman

New hire in FX sales at Goldman Sachs; other moves at Barclays, RBS, UBS and Credit Suisse

Nasdaq OMX awaits regulatory approval for FX clearing

The exchange's Nordic central counterparty has connected to MarkitServ and is awaiting the green light from regulators to clear G-10 and EM non-deliverable forwards and options

Trade reporting is driving FX options out of the US, say dealers

FX options traders looking to avoid Dodd-Frank legislation have been deliberately changing their trading habits to avoid reporting regulation

BNP Paribas restructures fixed-income management

Changes see global head of fixed-income trading, Guillaume Amblard, become head of the new foreign exchange and local markets group

BAML loses co-head of Ficc trading

Gerhard Seebacher departs, leaving David Sobotka as sole head of the Ficc trading business

Host Capital taps Citi index for retail-focussed currency fund

New UK-regulated fund will invest in Citi's Carry & Value index to provide exposure to G-10 and emerging market currencies

Faulkner exits Integral

EBS veteran David Faulkner has left Integral just four months after joining as global segment head for banks