Trading

A strengthening yen is no barrier to Japan's exporters

A stronger yen isn't proving to be the disaster for Japanese exporters that many predicted. Tohru Sasaki, chief FX strategist at JP Morgan Chase Bank in Tokyo, looks at why a strengthening Japanese currency doesn't necessarily mean decreasing revenues…

Hedging Taiwan dollar risk

Exporters exposed to movements in the Taiwan dollar must hedge by using the non-deliverable forwards market. Michael Image, FX options structurer for northeast Asia at Standard Chartered Bank in Hong Kong, suggests a zero upfront premium solution, which…

Managing sterling risks

Trading cable or euro/sterling off fundamentals is fraught with risk because they are primarily driven by trends in euro/dollar, says Steven Englander, Barclays Capital’s New York-based chief FX strategist for the Americas. But a properly constructed…

New era dawns for FX data

NEW YORK -- A new era in FX data is on its way, as the continuous-linked settlement service (CLS) for forex prepares to sell its market data back to users early next year.

Ringgit peg set to hold firm

KUALA LUMPUR -- Malaysia’s new prime minister, Abdullah Badawi, is set to maintain the ringgit’s peg to the US dollar for at least 12 months, according to market participants in the Asia-Pacific. Badawi assumed leadership of the Malaysian government in…

Yukos storm hits rouble

MOSCOW -- The arrest of Mikhail Khodorkovsky, chairman of oil company Yukos, and the freeze on his 44% stake in the firm will lead to rouble volatility -- despite the central bank’s current efforts to smooth fluctuations in the exchange rate, analysts…

US abandons strong dollar policy -- but will Asia?

The G-7 communiqué at the IMF/World Bank annual meetings in Dubai marked the end of the US administration’s ‘strong dollar’ policy. But does it also signal a change in Asia’s preference for a strong dollar?

Risk management for Kiwi wine exporters

With the booming popularity of New Zealand wines in the US, the threat of Kiwi dollar appreciation looms large over the New Zealand wine-making industry. Wes Price in ANZ Investment Bank’s consultative risk management group in Melbourne, describes a…

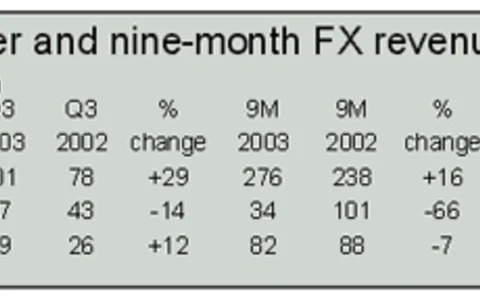

IMF fuelled record trading

NEW YORK -- US banks’ financial results last week added to the evidence that the third quarter witnessed exceptionally high FX trading revenues, chiefly as a result of explosive moves following the International Monetary Fund’s meeting in September.

‘Discount forward’ for hedging euro/sterling

With euro/sterling forecast to strengthen next year, Danny Goldblum, from HSBC’s global FX structuring team in London, proposes a solution to give a UK corporate that imports from Europe the protection of a forward contract at an improved rate

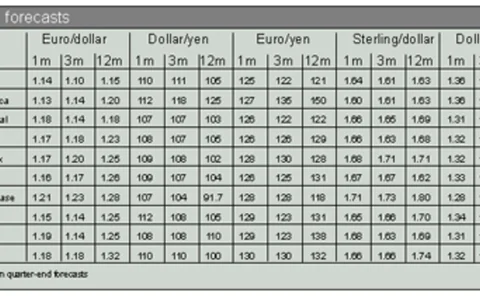

Seasonal yen patterns

Dollar/yen’s statistically significant seasonal pattern bottoms in mid-October and rises through mid-January. Greg Anderson, senior FX strategist at ABN Amro in Chicago, recommends looking for a spike in the flat period to come and selling into it

Traiana goes live, adds brokers

NEW YORK -- The e-FX prime brokerage industry picked up momentum last week, as the first banks went live on Traiana’s automated FX prime brokerage software and two more key prime broker banks signed up for the system.

Changing fortunes

September’s G-7 communiqué was a departure from its usual bland messages, and Asian currencies have reacted accordingly. Jimmy Koh (right), head of economics treasury research at United Overseas Bank in Singapore, explores some of the likely future…

SuperDerivatives spices up Xerox Mexicana

MEXICO CITY -- US printing technology company Xerox Corporation has signed a deal with SuperDerivatives to use the UK-based forex technology firm’s FX option benchmark pricing system in Xerox Mexicana, its Mexican subsidiary.

Merrill Lynch reports record quarter

NEW YORK -- Merrill Lynch’s drive to become a major force in the FX industry appears to be bearing fruit, according to its third-quarter results.

Alternative hedging for European exporters

European exporters could use major currencies’ volatility and liquidity to manage euro appreciation against emerging markets currencies, says Christine Lefort, global head of the structuring and marketing desk at Credit Agricole Indosuez in Paris