Reserves

Asia shies away from dollar bloc

Basel – Asian currencies are not trading as a dollar bloc, said the Bank for International Settlements (BIS) in its quarterly review last week.

A broader view than the yuan

While much attention is focused on a likely shift in the value of China’s currency, Ashish Advani (right), director of risk solutions at Travelex in Toronto, points to a way of hedging against the more imminent risk of free-floating Asian currency…

Asian ERM debate returns to the fore

HONG KONG -- Calls for an Asian currency regime mirroring the European exchange rate mechanism (ERM) are coming to the fore, as the region’s authorities face mounting pressure to alter their exchange rate policies.

Euro role grows, says ECB

The euro is increasingly being used as an international currency and its place in the global markets is becoming ever more important, a European Central Bank (ECB) official told delegates at the FX Week congress in London last week.

Concerted intervention ruled out

FRANKFURT – Despite increasingly vigorous comments from European politicians arguing in favour of stemming the onward rise of the euro, concerted intervention from Europe and the US is extremely unlikely.

Bush win prompts dollar sell-off

NEW YORK – The re-election of President George W. Bush last week prompted a dollar sell-off, sending the euro to an all-time high just below 1.30 by close of trading on Friday (November 5).

China rate hikes boost FX volatility

CHINA – Volatility in global FX has surged amid speculation that the first rate hike by the People's Bank of China (PBOC) in almost a decade could spark a sooner-than-expected yuan revaluation, according to analysts.

Chinese currency to rise by 25% against dollar

LONDON – China's currency is up to one quarter below its true value and a significant adjustment on the forex market is inevitable.

Making the most of upcoming volatility

For the currency overlay manager looking to take advantage of a burst of market volatility at the start of the fourth quarter, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their…

Hedging when the market moves against you

A nine month sliding forward structure can help your company achieve attractive FX hedging rates when the market has moved substantially beyond your budget rates, says Adam Gilmour, head of FX options sales in Citigroup's emerging markets sales and…

Russian peg change to drive rouble trading

MOSCOW – A touted move from a dollar peg to a dollar-euro basket will be the key driver for trading in the rouble in coming months.

Banks draw EU25 battle plans

LONDON – Euro convergence may yet be years away for the 10 new member states joining the European Union (EU) this weekend, but far-sighted banks and brokers are already drawing up their FX battle plans for the new Europe.

MAS move could pre-empt peg changes

SINGAPORE -- The Monetary Authority of Singapore’s surprise move last week towards a "policy of modest and gradual appreciation" for the Singapore dollar may be a pre-emptive move to counter Asian peg revaluations.

Richmond launches currency fund for Asia

HONG KONG -- Richmond Asset Management is set to launch a new fund in Hong Kong this month, to capitalise on increased opportunities to profit from currency strengthening, officials said last week. The Bermuda-based Currency Optimiser fund will be…

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Near-term ringgit peg change unlikely

KUALA LUMPUR -- Despite recent reported comments from Malaysia’s second finance minister, Tan Sri Nor Mohamed Yakcop, Malaysia is unlikely to change the ringgit’s current peg to the US dollar -- at least until the country’s general election is over.

Market to test central banks post-G7

LONDON -- The G7 communiqué released after the Boca Raton meeting on February 7 will lead to the market testing the resolve of central banks to limit FX moves, analysts agreed last week.

SPECIAL REPORT: CHINA Opportunity China: banks reveal plans

SHANGHAI -- Top forex banks are stepping up their strategies to win lucrative FX business in China as it gradually liberalises its economy. Major international players are taking steps such as increasing staffing levels in the Asia-Pacific, or carrying…

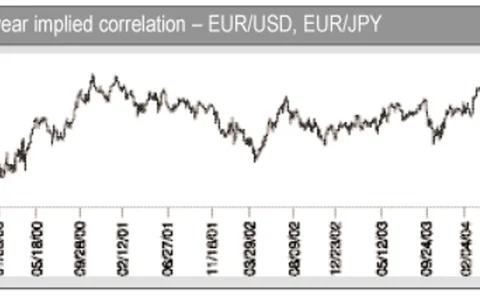

Five-year-old euro comes of age

FRANKFURT -- When the euro was first introduced, many were sceptical about its potential for success and concerned about its impact on the FX market as a whole. But as it celebrated its five-year anniversary this month, the euro’s status is gradually…

Market eyes fresh dollar falls

LONDON -- Forex market analysts and traders are predicting fresh falls for the dollar in the coming months after euro/dollar hit successive record highs last week.

Yuan’s US dollar peg to stay despite speculation

Beijing – Speculation that China may relax the yuan’s US dollar peg refuses to go away. Following media reports in June of US Treasury Secretary Jon Snow saying the Chinese government is considering widening the yuan’s trading band, the rumour mill is…

Dealing with yen downside risk

A collapse in the dollar/yen could offer significant trading benefits. How should an FX trader deal with the downside risk? By John Taylor, chairman of FX Concepts in New York

CME brings futures to CLS

CHICAGO – The Chicago Mercantile Exchange (CME) has become the first exchange to use the continuous linked settlement (CLS) service, extending use of CLS into a new market.