Monetary Policy

CLS discusses renminbi inclusion with PBoC

The talks, which have been going on for several years, are still in the exploratory phase

Adopt code or face regulation, warn central bankers

Market participants should embrace the new principles on conduct, say the ECB's Schiavi and Debelle of the RBA and BIS at the 14th annual FX Week Europe conference

Best Banks Awards: Deutsche Bank scoops five wins

The bank triumphs in spot FX, structured products, the eurozone, EUR/USD and EUR/JPY

Best Bank for Swiss Franc: UBS

Throughout 2015's difficult market conditions, UBS remained committed to providing clients with liquidity

Best Bank for Scandinavian Currencies: SEB

SEB scoops the prize for trading Scandinavian foreign exchange

Draghi stresses 'willingness to act' as ECB cuts inflation forecasts

The governing council holds policy as European Central Bank staff cut their inflation targets over the forecast horizon; Mario Draghi stresses quantitative easing could run beyond September 2016 if necessary

European currency-hedged funds set for inflows

But UK counterparts will continue to struggle to attract new money

RBI's Rajan says the euro is too strong - Central Banking

Rajan says the eurozone is suffering from the same problems as EM countries due to spillover effects

Perspectives on 2014: Axel Merk, Merk Investments

The timing of QE tapering will remain a dominant theme in the coming months as many currencies remain beholden to central bank decisions, while the eurozone crisis is still far from over, warns Axel Merk, president and chief investment officer of Merk…

Swiss franc floor will remain in place, says UBS FX chief

George Athanasopoulos shares currency predictions for 2014, including an expectation the Swiss National Bank will maintain the 1.20 floor on EUR/CHF

RBI's shift in monetary policy welcome, say traders

The central bank’s reduction in its marginal standing facility is positive for India’s growth, but the rupee is still exposed to external risks

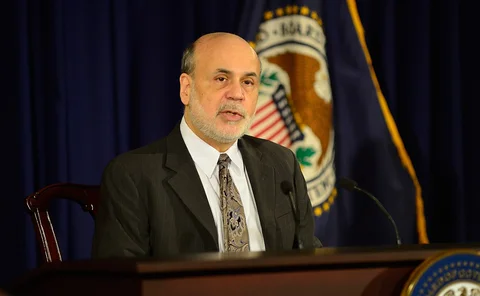

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Weaker franc leads to speculation over future of SNB floor

Volatility has picked up in EUR/CHF this year, but traders believe the franc needs to weaken a lot more before the Swiss National Bank would consider easing its policy

Traders surprised by Australian rate cut

Reserve Bank of Australia's decision to cut interest rate to 2.75% came earlier than traders expected

FX Invest North America: Central banks ‘getting away with murder’

Central banks are pursuing the wrong policies and will find it difficult to know when to tighten monetary policy, says Axel Merk at Merk Investments

BoJ's inflation target unattainable, says Nomura

Panellists at Bloomberg event yesterday debated whether the yen will continue to weaken as the Bank of Japan pursues an ambitious 2% inflation target

Currency war scenario ‘exaggerated’, warns senior Swiss economist

Central banks are pursuing domestic priorities and are not engaged in competitive devaluation, says keynote speaker at FX Invest conference

Aussie dollar remains strong after RBA rate cut

The Australian dollar rallied after the RBA rate cut on Tuesday and strategists expect interest rates to remain at 3% for the next six months, supporting further strength

Central banks are behaving irrationally, complain currency managers

The ECB's OMT programme fails to tackle growth and a third round of QE from the Fed would be irrational, according to speakers at FX Invest West Coast conference

SNB's continuing resolve drives creativity among Swissie traders

A year after the Swiss National Bank imposed a 1.20 floor on EUR/CHF to stem the appreciation of the Swiss franc, the minimum rate remains in place, driving traders to seek new ways to trade a currency afflicted by low volatility. Miriam Siers reports

Markets recoil as major central banks ease policies

Chinese, European and UK central banks take monetary policy action; moves leave no doubt about gloomy global economic picture as eurozone stock markets fail to rally

FX Invest July-August edition now live

Managing currency risk in markets dominated by central bank monetary policy

Euro crisis could cause full EU break-up, warns ex-BoE official

John Gieve, former deputy governor for financial stability at the Bank of England, warns of an "explosion" waiting to happen in the EU

Increase in Swissie floor still on the cards, say strategists

Currency analysts expect the EUR/CHF floor could rise 1.25 or 1.3 by the end of March