Trading

FX Week Forum: Central banks and FX reserves

In the latest in the FX Week Forum series, Joel Clark talks to Steven Saywell, global head of FX strategy at BNP Paribas, about trends in central bank reserve management and the IMF's latest set of reserves data

Reserve managers seek alternatives to USD and EUR

Following the IMF’s publication of its FX reserves data for the second quarter, Steven Saywell assesses why reserve growth has slowed and central banks are looking to diversify

Future of agency FX depends on size, says Chapdelaine chief

Douglas Borthwick, FX manager at Tullett Prebon's Chapdelaine agency desk, believes recent regulatory challenges show that size will be the key factor for agency intermediaries

New chief executive brings multi-asset focus to ECU

ECU Group offers clients access to its high-powered investment committee as it moves into the global macro advisory space

Swiss regulator investigates FX rate manipulation

Switzerland's Finma this morning announced it is investigating manipulation of exchange rates, while UBS is reported to have dismissed its spot-trading heads

Lack of Esma clarity delays progress on FX trade reporting

Questions raised by Isda concerning trade reporting workflows have not yet been answered, delaying preparations for the start of mandatory trade reporting early next year

US government shutdown impacts on dollar expectations

The timetable for tapering of quantitative easing and the performance of the US dollar could both be impacted if the shutdown continues, say strategists

UBS aims for full FX launch on Neo in Q1

Following the recent launch of the UBS Neo cross-asset platform, FX e-trading head Chris Purves talks to Miriam Siers about the bank’s electronic strategy, both on its own platform and other venues

FX Concepts teeters as clients exit and AUM plummets

Assets under management at FX Concepts have continued to fall and the fund's chief strategist confirms the board's ideas haven't worked so far

Citi to donate a dollar per million of platform volume to charity

E for Education initiative will see a proportion of revenue from Velocity in the fourth quarter handed over to six charities globally

Deconstructing the Sef ‘car crash'

With days to go until approved swap execution facilities are set to open for business, the CFTC would do well to heed some of the warnings it is hearing from the industry

Political risk biggest challenge for Mena investors

Unable to predict the outcome of current turmoil in Syria and Egypt, investors have mixed outlooks for the Mena region over the coming months

Oanda acquires Currensee copy trading platform

FX copy trading platform will strengthen Oanda's product offering

High-frequency firm AienTech shuts up shop

Technology-focused hedge fund made its mark in FX as a top provider of volume to bank platforms

CLS same-day settlement 'positive' for CAD market, says FX committee chair

Canadian FX committee chair Donna Howard welcomes launch of same-day settlement through CLS for USD/CAD, but acknowledges associated challenges

CFDs gain reprieve from CVA threat

The reports of CFDs’ demise were greatly exaggerated, writes Michael Watt. Far from being killed off by the CVA charge, they have probably been saved by one of the clauses in the new rule

FX structurers take advantage of high-cost hedging in other asset classes

FX structurers are trying to tempt clients away from high-cost asset classes such as rates and credit by replicating the hedges on offer there through proxy instruments, but will buy-side participants trust the correlations to hold up when the worst…

State Street's Collin Crownover talks to FX Invest

State Street Global Advisors’ head of currency management talks to Michael Watt about his view of 2013 so far, the future of central bank involvement in the direction of major global currencies, and the impact of new regulation on the FX market

Volcker rule curtailing FX liquidity, say buy-side participants.

Investors say foreign exchange market-makers are already trimming risk appetite ahead of the Volcker rule ban on proprietary trading in the US. But, while liquidity in emerging market and frontier currencies has suffered, other market participants…

FXCM buys majority stake in Faros Trading

FXCM continues its aggressive expansion as it acquires a 50.1% stake in FX agency firm Faros Trading, four years after it was established by Ray Kamrath

Aviva chooses collared options to hedge balance sheet

Tom Moore, head of group treasury management at Aviva, talks about the challenges of managing currency risk while meeting capital requirements, and outlines the firm's hedging strategies

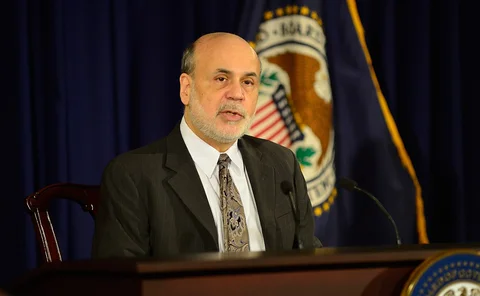

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Citadel pushes fixed-income expansion into FX

Fixed-income business heads Derek Kaufman and Richard Mazzella explain their strategy in expanding Citadel's growing fixed-income business into foreign exchange. Robert Mackenzie Smith reports