Volatility

Banks struggle to keep trade flows in-house during volatility

Directional markets in March tested dealers’ ability to internalise risk

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

Investors trade the drama out of the crisis

How LGIM, AXA, Manulife and other buy-siders tackled the toughest markets since 2008

Assessing execution quality and slippage in volatile times

Market participants must focus on how their evaluated execution costs vary in different market regimes, writes Tradefeedr’s Alexei Jiltsov

Market turmoil causes traders to pull back to vanilla strategies

Emerging markets spreads tighten but liquidity still patchy

NDF access will help tame rupee volatility, say dealers

Lifting of restrictions stopping Indian banks trading rupee NDFs allows RBI to intervene offshore

FX options, NDFs trading slows as Covid fears ease

Analysis of transaction data shows lower notional volumes and tighter spreads for most currency pairs

Buy side eyes outsourced trading amid Covid disruption

Pressure on trading continuity drives in-house desks to look outwards

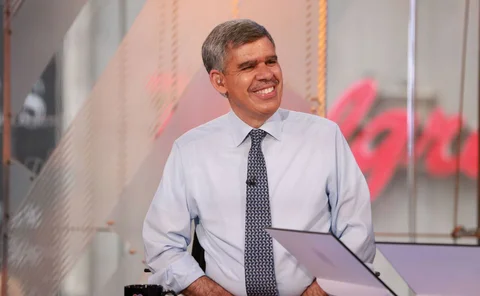

El-Erian on Covid-19 policy risks and ‘zombie’ markets

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Who revived FX volatility?

The reports of FX vol death were greatly exaggerated. For now, anyway

Algo choice: how to implement a market impact/volatility trade-off

Quantifying how macroeconomic announcements affect market reaction is key to deploying the right FX algo, writes Alexei Jiltsov of Tradefeedr

CLS data scientists try to decode FX volatility

New team has flood of info to work on, after Covid-19 trading surge pushes March volumes up 27%

FX vol revived by Covid-19 – but for how long?

Traders split on whether virus impact or central bank responses will prove most powerful

In choppy FX markets, algos buck expectations

Goldman, Nomura and others report increased volumes, although some clients revert to principal quotes

Coronavirus jolts FX options market

Analysis of transaction data shows record notional volumes for some G10 pairs

For FX dealers, virus brings volumes

Mixed feelings for sell-side traders as Covid-19 spurs wave of speculation and hedging

Dealers turn to mid-cap and EM deal-contingent trades

Premiums of more than 25% are attractive to banks battling low vol and increasing competition

For FX vol, think globally, but act locally

Country-specific stories are where to look for volatility, writes Fenics

FX options see record volumes as yen goes off-script

Coronavirus outbreak and recession fears trigger frenzied trading in USD/JPY options

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Algos: choosing the right horse for the right course

Liquidity and volatility regimes play big role in performance, BestX quants show

Morgan Stanley FX loss leaves ill-feeling, questions in wake

Options traders saw odd quotes by US bank months before losses were publicised

LMAX: bitcoin to break $30,000 in 2020

Exchange head David Mercer foresees more transparent market, freed of “pariah” of last look

JP Morgan: beating lower margins, flat volumes and the competition

Foresees collaboration with clients and technology providers on FX tech infrastructure, and working with regional players