Trading

European corporates wary of RMB settlement

UK government pushing for London to become a centre of offshore renminbi trading, say conference speakers

Banks monitor FX options trading following Thomson Reuters withdrawal

Market-makers continue to focus on emergence of new multi-bank options platforms that will enable them to comply with new regulations

Thomson Reuters to quit FX options matching business

Resources will be diverted to Eikon platform upgrade, with new trade capabilities to be offered in FX options

Deutsche Bank launches DXY ETNs

Now listed on NYSE Arca as UUPT and UDNT

Gain Capital targets mid-tier investors with prime-brokerage offering

Online FX broker steps into prime brokerage with GTX Direct platform

Trading platforms prepare for Sef arms race

As the CFTC prepares to close the consultation period on its Sef rulemaking next week, it is still unclear exactly what changes FX trading platforms might need to make to comply with the Sef criteria. How are the potential Sefs preparing? Chiara Albanese…

FX spot volumes drop back to normal

Thomson Reuters and Icap report more normal volumes in April after a spike in March

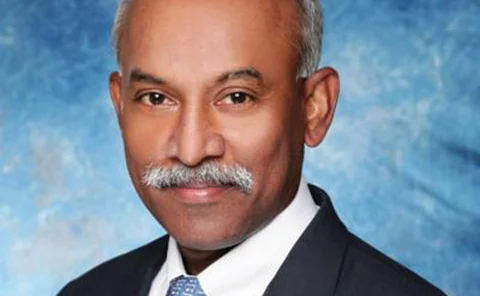

Spotlight on: Phil Weisberg, FXall

The chief executive of institutional FX platform FXall talks to Miriam Siers about FXall's plans to register as a swap execution facility and how he believes regulation is likely to affect the foreign exchange market in the long term

Deutsche and Barclays sweep into CNH derivatives

Banks both now offer offshore renminbi trading in spot, forwards and swaps on their FX platforms after new launches over the past fortnight

Testing the limits

Thomson Reuters Spot Matching suffered a major outage last month, with trading unavailable on any currency pairs for four hours. Chiara Albanese speaks to FX trading platforms to assess how they test their technology to prevent such outages

Isda raises concerns over Russian netting laws

But despite the challenges involved, banks and brokers are excited by the progress being made to open up the Russian market

Icap updates rules for EBS Spot Ai customers

Interdealer broker limits top-of-book quote interrupts to 200 per institution per day

Social media finds a foothold in FX

Banks are evaluating the value that can be delivered to the foreign exchange business by investing in social media. What are the potential benefits and challenges of using such tools? Chiara Albanese reports

EBS decimals move has divided the spot market, admits Icap

Interdealer broker tells conference delegates it has made both friends and enemies by introducing decimalised pricing on major currency pairs

FX Invest North America: Beware of EM risks, buy side warns

The danger of not being able to unwind a position in an illiquid currency during a crisis could outweigh the possible returns in many cases, according to conference delegates

FX swaps and forwards headed for exemption, argues former bank clearing head

John Wilson, who left RBS earlier this year, expects FX to be exempted from clearing but expresses concern about outstanding issues in US and EU derivatives legislation

CBA completes first phase of FX systems overhaul

Commonwealth Bank of Australia's Baxter e-FX platform set to go live this week

LCH.Clearnet confirms FX options clearing for 2011

Annual results confirm significant investment in developing clearing services for FX options

Multi-bank options platforms: the vision versus the reality

New platforms offering multi-bank FX options trading are finding it tough to manage the manual pricing processes of banks and the complex close-out arrangements inherent in options. Farah Khalique reports

BNP Paribas goes mobile with e-commerce platform

French bank invests in electronic and social media strategy

Traiana rolls out forex clearing connectivity service

Citi and CME Clearing become the first to join the network as the market prepares for the advent of FX clearing

Icap mulls bank-only alternative to Pure FX

Discussions progress about new functionality on Icap's platform that could eliminate the threat of Pure FX

Pure FX: Market or mirage?

Pure FX has been the subject of plenty of speculation since it was first mooted last year, but there is still little clarity over whether the project will come to fruition. Some banks and trading platforms say there is no need for the venture

SGX to clear FX forwards despite possible Treasury exemption

SGX to add new currencies and asset classes, including FX forwards, to OTC clearing service