Trading

Meet the Sefs

The weeks leading up to the October 2 deadline for registration as a swap execution facility (Sef) under the US Dodd-Frank Act have seen a wave of new platforms receive approval from the Commodity Futures Trading Commission (CFTC). Robert Mackenzie Smith…

Deconstructing the Sef ‘car crash'

With days to go until approved swap execution facilities are set to open for business, the CFTC would do well to heed some of the warnings it is hearing from the industry

Political risk biggest challenge for Mena investors

Unable to predict the outcome of current turmoil in Syria and Egypt, investors have mixed outlooks for the Mena region over the coming months

High-frequency firm AienTech shuts up shop

Technology-focused hedge fund made its mark in FX as a top provider of volume to bank platforms

FX structurers take advantage of high-cost hedging in other asset classes

FX structurers are trying to tempt clients away from high-cost asset classes such as rates and credit by replicating the hedges on offer there through proxy instruments, but will buy-side participants trust the correlations to hold up when the worst…

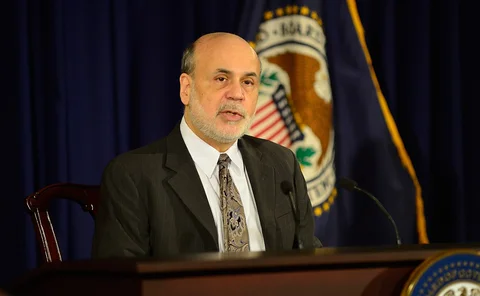

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Asia is a focus for FX research, says Morgan Stanley's Redeker

Hans Redeker, global head of FX strategy at Morgan Stanley, talks to Miriam Siers about the objectives of his team and their expectations for the coming months

United Overseas Bank eyes Asia clients for single-dealer platform

Singapore-based bank is ramping up its e-FX capabilities using FlexTrade technology as it seeks to poach clients from multibank platforms

FX market will be 70% electronic by year-end, says Aite Group

New research estimates 60% of FX is electronic today, rising to 70% by year-end but there will still be a place for voice trading

Currency managers caught out by dollar rise against EM currencies

Immediate future of emerging market currencies in the hands of the Federal Reserve amid QE tapering expectations

FX now a $5.3 trillion per day market, says BIS

The latest BIS triennial survey shows the UK has strengthened its grip on the FX market, while USD/JPY has seen a strong increase in trading activity

'Good v. bad' is overplayed in EM currencies, indicates BNPP quant model

BNP Paribas has recently extended its quantitative fair value model from G-10 to EM currencies - and it has found some assumptions about strong and weak currencies may be unfounded

Saxo Bank to publish monthly volume data

Danish firm aims to promote greater transparency by going public with its volume figures on a monthly basis

EM stress prompts investors to turn to options

As the crisis in Syria continues, the Turkish lira this week became the latest victim of the emerging market sell-off, leading to an increased interest in options

Striking a balance on pricing

FX platform pricing models have come under fire, with calls to reduce or abandon fixed costs, but how should platforms seek to get the balance right?

EM exodus continues ahead of imminent QE tapering

The Indian rupee and Indonesian rupiah have continued to fall this week as tapering of quantitative easing in the US looms in the coming months

Buy side scales back on yen positions as volume dips

Market participants report a significant decline in investor and corporate appetite for the yen, following the rush to the currency in the first quarter

Rupee sell-off continues, despite repeated RBI efforts

Efforts by the Reserve Bank of India to stabilise the currency's depreciation have failed, as the rupee falls to a record low

FX platforms encouraged to consider liquidity enhancing pricing models

A proposal made to the FX Joint Standing Committee in July 2012 for a per-order fee that is rebated in proportion to actual executed volume has garnered support among market participants

Legal & General's FX trading head tasked to grow derivatives

Newly appointed to head FX trading at Legal & General Investment Management, options trader Virginie Queval is looking at ways to grow the firm's small FX business

Russia's ruble expected to become major currency by 2015

Market participants are bullish about the ability of the ruble to quickly penetrate the group of top global currencies, but settlement issues remain the biggest obstacle

FX markets in mid-year lull as yen volatility dries up

The yen has become more range-bound following its dramatic fall earlier in the year, creating a lull in FX market activity during the western summer weeks

Thomson Reuters reduces price granularity in three currencies

Mexican peso, South African rand and Russian ruble are now priced at a minimum tick size of five pips rather than single pips, taking Thomson Reuters Matching a step further away from decimalisation

Future of e-FX will be cross-product, says Citi’s Bibbey

Richard Bibbey, Citi's new head of e-FX trading, believes the landscape is changing and successful banks will be those that can leverage technology across products and asset classes