Sterling

Premier League pays 10% more for players due to FX

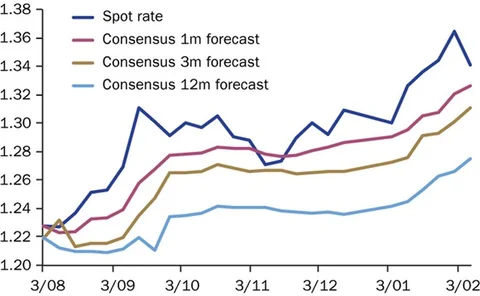

The euro's rise against the pound forces UK football clubs to overpay

Connery's James Bond gained more sterling for his buck

He enjoyed more Martinis per pound than any of his successors

Azimo launches euro money transfers to Scotland

New service will be in place before independence referendum

US corporates prepare for Scottish vote

US corporates appear more active than their UK peers in mitigating FX market risk in case of a Yes vote in the September 18 Scottish referendum

Sterling set for instant 5% fall if Scotland votes Yes

Market still sees independence as unlikely, but participants buying sterling protection

Spot-on dollar view puts CIBC top

CIBC continues to view cable as overvalued as its bearish view helps it top the one-month rankings

Salmond hammered over lack of ‘Plan B’ for Scottish currency

Yes campaign leader criticised over currency stance in live TV debate on August 5

Euro resilience helps Monex top rankings

A bullish euro view has propelled Monex Europe to top spot in the three-month rankings

Corporates defend macro-hedging strategies

UK corporates defend their risk management strategies, unconcerned by the prospect of a Scottish currency affecting their UK portfolios

Sterling strength cuts £3.5 billion off UK dividend payments

Rises in sterling against the US dollar and the euro have wiped billions off UK investors' dividend payments from some of the largest companies

Independent Scotland must cede some sovereignty to keep sterling

Bank of England governor Mark Carney warns of tough choices ahead for Scotland if it goes ahead with independence but looks to keep the pound

Barclays keeps the lead in London and sterling crosses

UK bank remains best bank for FX in London, as well as GBP/USD and EUR/GBP, in this year's survey

City Index tops table with bullish sterling view

New to the FX Week forecasts index, City Index has topped this week's one-month table for the first time thanks to a correct call on sterling strength

Westpac wins with bet on sound pound

Westpac's head currency strategist says market has been overexcited over the prospect of tapering in the US, while sterling shows more promise

Upward sterling view puts Gain Capital on top

The retail broker accurately forecast cable to strengthen from 1.53 to 1.57 during the course of late May and early June

Diversified portfolios exposed to correlation risk, experts warn

Politics is a greater driver of G-4 currencies than traditional economic fundamentals, say panellists at CME event

Bullish dollar view pays off for TMS Brokers

The Polish brokerage firm has leapfrogged Thomson Reuters in the three-month rankings to top the table this week

SEB tops one-month table with contrarian yen view

Swedish bank goes against consensus with prediction for a weaker yen based on expectations of greater BoJ intervention

Weakening euro lands RBS on top

Royal Bank of Scotland forecast in mid-February that the euro would continue its weakening trend, landing the bank at the top of the one-month rankings

Danske in double win after betting on sterling weakness

An accurate long-term view on the downward trend of the pound lands Danske Bank at the top of the three- and 12-month rankings

Tempered euro bet lands CIBC on top

The Canadian bank accurately forecast the euro would rise and then fall in its one-month forecasts submitted on January 18

Barclays wins with forecast of yen weakness

A forecast that the yen would weaken during November ahead of forthcoming Japanese elections lands Barclays at the top of this week's one-month currency forecast rankings

Informa tops the pile with cautious dollar gain forecast

Informa Global Markets has stormed from 26th place to top of this week's one-month forecast rankings with an accurate all-round forecast

Record spots dislocation in covered interest rate parity

Record Currency Management is looking to help its clients profit from a dislocation in the covered interest rate parity between several currencies