Regulation

DoJ fears FX civil suit may compromise criminal cases

It moves for judge to stay staff depositions at seven banks for fear of witness intimidation

FCA grants APA approval to Abide Financial

Authorisation allows Nex Regulatory Reporting, powered by Abide, to provide enhanced services ahead of Mifid II

CLS commits to FX Global Code, sets up public register

The settlement firm says it has aligned its activities with the principles of the Code

Nex Optimisation boosts Harmony as Mifid II deadline approaches

Traiana’s Harmony has been extended to enable participants to exchange additional information to assist with meeting a number of regulatory obligations under Mifid II

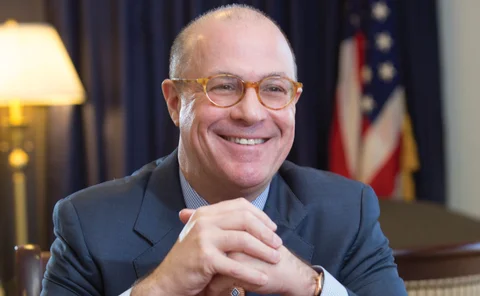

Giancarlo confirmed as CFTC chairman

US Senate also confirms two commissioners

Currenex and EBS mull venue-hosted last look

Platforms consider becoming third-party operators of last look to separate the function from liquidity providers

Investors must sue outside US to recoup FX losses, urge lawyers

Lawyers say the extent of collusion is clear, following recent settlements by five banks

Thomson Reuters completes Mifid II desktop enhancements

The firm starts onboarding clients to its improved multilateral trading facility

Deadline for compensation claims in FX benchmark settlement nears

“You will not simply receive a cheque in the mail, even if the actions of the banks harmed you,” says Battea chairman

Nasdaq boosts surveillance offer with Sybenetix acquisition

This will significantly expand the US stock exchange’s monitoring solutions for the buy side

ECB outlines approach to implementing FX Global Code

Adherence to the code of conduct will be a prerequisite for membership of the ECB’s Foreign Exchange Contact Group

Last look claims will happen on a case-by-case basis

Alpari’s last look claims against six banks are unlikely to be the last, lawyers say

BNP Paribas fined by Fed over FX manipulation

The French bank is to pay $246 million to settle an investigation into misconduct

Malaysian central bank strengthens onshore hedging

Bank Negara is complementing last year's NDF restrictions with a more open onshore market

CFTC to boost resources to study HFT impact

Acting CFTC chief hopes to get better analytics to discover the effects of high-frequency trading on the market

Asia strongly supportive of Global Code of Conduct – GFMA

Backing from local central banks for the principles will filter down to participants, says John Ball

Mifid II is a chance for reinvention – FX Connect’s O’Malley

“We’ve had more interaction with our customers in the past six months than in any individual point in our 20-year history,” says FX Connect’s Emea head

Platform operators step up surveillance after FX Global Code

FX Week-hosted webinar focusing on surveillance finds the Code’s message is filtering through

Commission should have power to order CCPs to relocate to EU – Cœuré

The power would be one among many, says ECB executive board member

Curex introduces microsecond time-stamping

New capability goes beyond the non-HFT millisecond requirement called for by Mifid II

Saxo signs up to FX Global Code

The Danish bank is the second firm to commit after Barclays

UK clearing houses could be moved to European Union

European Commission proposal comes days before divorce negotiations are set to begin between UK and EU

Platforms voice support for Code, but shy away from policing clients

While venues overwhelmingly say they will adhere to the Global Code, they won't turn away clients who don't

Hardwiring best practice into spot FX trading venues

The BIS FX Global Code of Conduct is compelling participants to take a hard look at established electronic spot FX platforms