Quantitative easing

Inequality and deflation will be key trends in 2014, Saxo predicts

Danish bank publishes its 10 'outrageous' predictions for 2014, mooting the possibility that five fragile EM currencies could fall by as much as 25% against the dollar

Perspectives on 2014: Axel Merk, Merk Investments

The timing of QE tapering will remain a dominant theme in the coming months as many currencies remain beholden to central bank decisions, while the eurozone crisis is still far from over, warns Axel Merk, president and chief investment officer of Merk…

FX Week Europe: Fed is in ‘La La Land’ on monetary policy

SG CIB's chief currency strategist hits out at Federal Reserve's failure to appreciate the implications of its QE and interest rate policies

Lynn Challenger talks to FX Invest

Michael Watt asks Lynn Challenger, managing director of global trading at Mellon Capital Management, about the ups and downs of 2013, the merits and demerits of FX trading styles, and his outlook for 2014

FX Week Forum: Citi tops Best Banks survey

Joel Clark interviews Anil Prasad, Citi's global head of foreign exchange and local markets, after Citi was voted top in FX Week's annual market survey

Deutsche retains eight awards, despite low interest in eurozone FX

Slipping into second place this year, Deutsche Bank nonetheless retains eight awards, including in new categories such as best bank for FX for investors

Systematic strategies will bounce back, say managers

Despite the recent bankruptcy of FX Concepts, some currency managers believe systematic investment strategies could soon make a comeback

Buy side prepares for fixed-income storm

Artificially low volatility leaves firms nervous about the future – and looking for fixed-income alternatives

Reserve managers seek alternatives to USD and EUR

Following the IMF’s publication of its FX reserves data for the second quarter, Steven Saywell assesses why reserve growth has slowed and central banks are looking to diversify

Monex Europe on top with strong EUR/USD view

An accurate view on Fed tapering - or lack thereof - has leapfrogged Monex Europe to the top of the one-month rankings

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Westpac wins with bet on sound pound

Westpac's head currency strategist says market has been overexcited over the prospect of tapering in the US, while sterling shows more promise

Yen and Swissie weakness will continue, says UniCredit

A strong US dollar performance against the traditional safe-haven currencies pushes UniCredit to the top of the one-month table

Traditional reserve currencies on the decline, says Pimco

Pimco's chief operating officer is bearish on major currencies, expressing the fund's preference for emerging markets, particularly the ruble and renminbi

Market conditions point to uneven global recovery, says Treasury official

Speaking at FX Week USA conference, Daleep Singh acknowledges the improvement in economic conditions in the US but calls for a more balanced global recovery

Markets braced for dollar to rally post-FOMC

As Fed chairman Ben Bernanke is expected to confirm plans for tapering of bond purchases, FX traders say the dollar will rally in response

Barclays rises as BoJ sends yen plummeting

UK bank wins in FX Week's one-month rankings after forecasting continued yen weakness in April

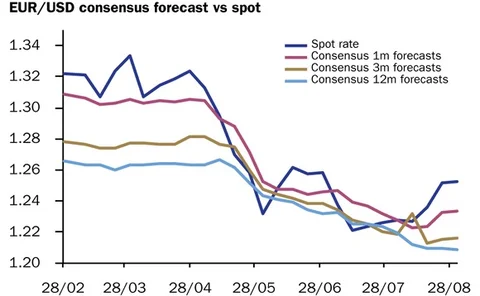

Danske Bank: Relative monetary policy pushes EUR/USD higher

Central bank policy pressures weigh on the euro, and Danske Bank expects eurodollar to continue trading in the low 1.30s over the coming month

Identifying the winners from Bank of Japan easing moves

Japanese investors will diversify overseas as the BoJ steps up its quantitative easing. Adam Cole follows the capital outflow to identify the currencies most likely to benefit

FX Invest North America: Central banks ‘getting away with murder’

Central banks are pursuing the wrong policies and will find it difficult to know when to tighten monetary policy, says Axel Merk at Merk Investments

A reality check for emerging markets

Are things a little too good to be true in emerging markets? SLJ Partners’ Stephen Jen thinks so, and warns that healthy GDP figures are not telling the whole story of what lies beneath. Saima Farooqi reports

Yen will continue to weaken under BoJ pressure, says Nomura

An accurate prediction that the yen would weaken as a result of the Bank of Japan's monetary policy lands Nomura at the top of the one-month forecast rankings

Central bank intervention weighs on investor sentiment

FX strategists expect continued uncertainty for major currencies in the fourth quarter as a result of central bank intervention

Euro will continue to strengthen, says BNP Paribas

BNP Paribas anticipated in early August that short-term dollar weakness would support the euro, landing the French bank at the top of the one-month currency forecast rankings