OTC derivatives

Icap's Spencer: 'not a prayer' of UK agreeing to FTT

Proposed EU trading tax would be vetoed by UK, says Icap's Spencer - if not, the broker will move its London HQ to New York

CME gives green light to Traiana for FX clearing

Traiana's clients will now be able to clear FX derivatives directly through its Harmony CCP Connect network

G14 dealer group adds two members

Nomura joined the group at the end of August, while Crédit Agricole is expected to join in the first quarter next year - in part a response to regulator criticisms that the group had become too exclusive

Battle for clearing supremacy

Singapore Exchange (SGX) became the first of the major clearers to launch an OTC Asian FX forwards clearing business in October. But with bank-backed LCH.Clearnet and the CME hot on its heels with a non-deliverable forwards offering, can SGX maintain its…

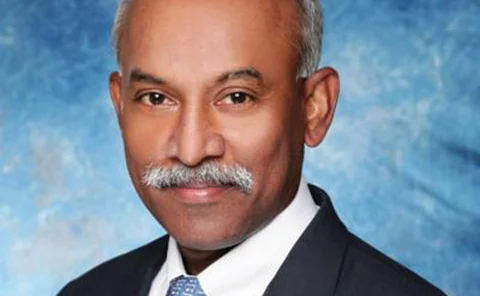

Profile: CLS Bank's Bozian on regulatory co-ops and CCP settlement risk

Regulators are struggling to ensure they have oversight of over-the-counter market infrastructure without losing the benefits of centralisation. CLS Bank’s council of supervisors could be the precedent they follow. By Michael Watt

LCH.Clearnet eyes November launch for NDF clearing

London-based CCP is set to launch clearing for NDFs in six currencies in mid-November, having shelved plans for options clearing while banks discuss settlement-related issues with regulators

Isda to review close-out value definitions

Absence of a standard approach is stifling attempts to value termination clauses, dealers complain

Taking stock of 2011: the buy side

Central bank intervention, volatile markets and forthcoming regulation – hedgers and investors in the FX market continue to face some real challenges. Chiara Albanese and Miriam Siers hear their views

SwapClear may assist OIS development

London-based clearing house might consider helping to build OIS markets in minor currencies, as it continues to move its interest rate swap portfolio to OIS discounting

New standard CSA could be rolled out in Q2 2012

An implementation plan for the new standard CSA is set to be reviewed by the Isda board in September, with a first-phase rollout expected as early as the second quarter of 2012

FX Week USA: Regulation both good and bad for the end-investor

Panellists agree mandated use of CCPs and exchanges could attract investors but will also raise costs

FX Invest: EIB signs Citi for collateral management

Citi gains key client for third-party collateral management service

FX Invest: Overlay Asset Management sticks with emerging markets

Overlay Asset Management’s Helie D’Hautefort talks to FX Invest about his firm's emerging markets strategies

Australian regulators suggest clearing exemption for FX

Reserve Bank of Australia discussion paper commits to harmonising rules with US and Europe

JSE to launch exotic can-do currency options

Move follows the successful launch of any-day expiry options in February

US Fed’s Tarullo stresses importance of robust CCPs

Well-managed central counterparties (CCPs) are key to handling counterparty credit risk, according to Daniel Tarullo, a governor at the Federal Reserve Board in Washington, DC.

Securities regulators at odds over OTC shift to trading platforms

Iosco members fail to agree on whether organised trading platforms for derivatives should source liquidity from multiple institutions.

Proof of exposure required before Indian companies can trade FX derivatives

New regulations in India will require companies to prove they have an exposure that needs to be hedged.

Asia to follow US on CCPs amid fears about hedging costs for exporters

Banks in Asia say there is no easy formula to decide whether moving over-the-counter foreign exchange instruments onto central counterparty (CCP) clearing would represent a lower-cost solution for their corporate clients, or whether they are better off…

Goldman Sachs appoints Lubke as chief regulatory reform officer

Theo Lubke calls time on 15-year stint with New York Fed to join Goldman Sachs.

Global FX Division establishes FXPB

The Global FX Division (GFXD) of AFME/SIFMA/ASIFMA announced the formation of a working group to focus specifically on the challenges and issues surrounding global FX prime brokerage (FXPB) and to implement over-the-counter FX clearing for clients.

First offshore renminbi swaption accomplished in Hong Kong

The first offshore renminbi OTC swap option was carried out this week between BNP Paribas and HSBC in Hong Kong, brokered by Icap.