Japanese Yen

Buy side scales back on yen positions as volume dips

Market participants report a significant decline in investor and corporate appetite for the yen, following the rush to the currency in the first quarter

FX markets in mid-year lull as yen volatility dries up

The yen has become more range-bound following its dramatic fall earlier in the year, creating a lull in FX market activity during the western summer weeks

Yen volatility drives record turnover, central bank surveys reveal

Volume was up across forex products in the UK and US in April 2013, with just over $1 trillion traded daily in the US and more than $2.5 trillion in the UK

Yen and Swissie weakness will continue, says UniCredit

A strong US dollar performance against the traditional safe-haven currencies pushes UniCredit to the top of the one-month table

Crédit Agricole wins with moderate stance on yen

French bank weathers volatile yen conditions and tops three-month rankings with conservative view on yen weakness

Yen correction will be short-lived, says Wells Fargo

The US bank forecast the yen to retrace some of its fall, landing it at the top of the one-month rankings, but it still expects USD/JPY to rise further

Belief in euro keeps Bank of Montreal on top

The Canadian bank outlines its long-term forecasting strategy as maintains its place at the top of the 12-month tables

CMC Markets triumphs by backing the greenback

CMC Markets tops this week's three-month currency forecast rankings with expectations of yen and euro weakness

Diversified portfolios exposed to correlation risk, experts warn

Politics is a greater driver of G-4 currencies than traditional economic fundamentals, say panellists at CME event

Barclays rises as BoJ sends yen plummeting

UK bank wins in FX Week's one-month rankings after forecasting continued yen weakness in April

Sharp drop in yen will destabalise markets, warn traders

Observers concerned over potential impact of rapid yen depreciation. However, others say effect will be limited to currencies in Asia

Japan to drive 36% rise in retail foreign exchange volumes in 2013

Yen volatility to drive $380 million a day in global retail FX and CFD market in 2013

Japan trade captivates macro hedge funds

Top hedge fund managers at the Salt conference in Las Vegas are brimming with enthusiasm for Japanese equities as Abeconomics helps weaken the yen and boost economic growth

Breakdown in correlations leads to forex discrimination

Risk aversion has returned, breaking down correlations between assets and leading to investor discrimination between currencies. Mitul Kotecha looks at who stands to gain from this shift in appetite

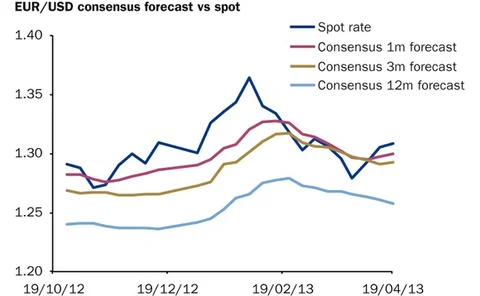

Eurodollar pullback lands Thomson Reuters top spot

Thomson Reuters - IFR Markets ranks number one in the three-month table after predicting a weakening euro

Return of currency trends a boon for macro managers, says Insight Investment

The strong currency trends in 2013 have been good news for the asset manager, which uses strategies aiming to generate alpha from currency positions

SEB tops one-month table with contrarian yen view

Swedish bank goes against consensus with prediction for a weaker yen based on expectations of greater BoJ intervention

Dollar strength boosts Standard Chartered to top

Standard Chartered's accurate short-term dollar view based on expectations the US economy would outperform other major centres

Market complacency over Korean won ‘staggering’

Traders have been slow to react to heightened tensions between North and South Korea

‘Easy’ stage of yen decline is over, says Jim O’Neill

Further weakening of the Japanese yen may be more gradual than in recent months, but the yen and the Swiss franc are the only G-10 currencies worth trading, says GSAM chairman

BMO in double win with accurate yen forecasts

USD/JPY could rise up to 100 in time, according to Bank of Montreal's Benjamin Reitzes, whose forecasts put the bank at the top of the 12- and one-month forecast rankings

Rabobank dominates 12-month rankings with weak dollar view

A contrarian long-term view that the euro would remain relatively strong has kept Rabobank at the top of the 12-month rankings for the past five weeks

Volatility is here to stay in FX as the currency war engages

Currency markets have jolted back to life in recent weeks, largely driven by the change of government and monetary policy in Japan. With competitive devaluation of currencies clearly now in play, John Hardy believes the volatility is here to stay

Japan institutional investors start unwinding dollar/yen hedge after steep yen drop

While foreign hedge funds have been driving down the value of the yen, now Japan insurers may strengthen the trend