Foreign exchange

US investment banks’ revenues soar on back of investor demand

NEW YORK -- Strong investor demand is driving US investment banks’ fixed-income and forex revenues sky-high, according to first-half results released last week.

Rabo loses global FX head

LONDON -- Dutch Bank Rabobank is currently without a global head of foreign exchange following the departure of Gary Kaye from the London office last Monday (June 16), a spokesperson for the bank in Utrecht told FX Week .

Investors boost forex fund returns

NEW YORK -- Market trends and a surge in interest from investors is creating a bumper year for investment managers specialising in FX.

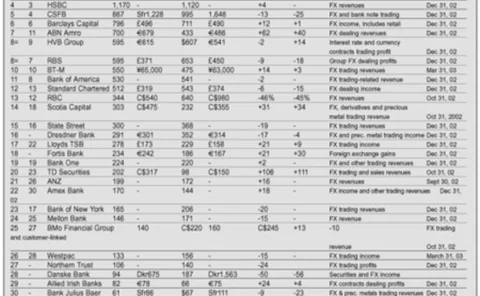

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Banks counter IAS39 threat

LONDON -- Banks are developing new structuring models for corporate clients to ensure the IAS39 accounting standards do not result in a reduction of complex FX hedging activity.

Reduced capital requirements boost brokerage prospects in Hong Kong

HONG KONG -- Companies offering leveraged forex brokerage services in Hong Kong should brace themselves for an influx of competition. New players are being enticed into the market by reduced capital requirements for firms wishing to offer leveraged…

US dealers revise op risk standards

NEW YORK -- The Foreign Exchange Committee, a 20-dealer industry liaison group to the New York Federal Reserve Bank, has made new recommendations for the exercise of in-the-money FX options in a revision of its 1996 forex op risk best practices document…

GFI targets corporates for options pricing

LONDON -- New York-based interdealer broker GFI Group today (June 16) launches a new online FX option pricing service targeting corporate firms and lower-volume FX users.

Reduced capital requirements boost brokerage prospects in Hong Kong

HONG KONG -- Companies offering leveraged forex brokerage services in Hong Kong should brace themselves for an influx of competition. New players are being enticed into the market by reduced capital requirements for firms wishing to offer leveraged…

UK top tier to survive euro

LONDON -- The UK government outlined its view on euro entry last week, but the potential death of the sterling market would be unlikely to dent the top UK banks in FX.

Cheap volatility brings yen opportunities

Japanese economic growth has outstripped many western economies over the past year, and the next currency breakout in the FX markets could be yen strength. Alex Schumann and Trevor Nathan, of Commonwealth Bank of Australia in Sydney, show how investors…

Huge profits for German auto hedges

MUNICH -- The euro’s continued rise against the US dollar has turned forex hedges into a huge money-maker for German auto manufacturers, according to research made public last week.

ACI/ICA link-up welcomed

BEIRUT -- Forex vendors last week welcomed the decision by ACI -- The Financial Markets Association to combine its global forex congress with the InterArab Cambist Association (ICA) congress in Beirut, Lebanon.

ACI/ICA link-up welcomed

BEIRUT -- Forex vendors last week welcomed the decision by ACI -- The Financial Markets Association to combine its global forex congress with the InterArab Cambist Association (ICA) congress in Beirut, Lebanon.

Sars leaves FX untouched

HONG KONG/TORONTO -- Despite fears that the Sars outbreak would affect volumes and markets globally, the forex industry escaped the crisis unscathed.

Hedge optimisation under IAS39

All European Union listed companies must implement IAS 39 by the end of this year. Raymond Franzi, head of structuring, and Emmanuel Burot, head of structuring and accounting at Dresdner Kleinwort Wasserstein in London, outline how a European firm should…

ETrade enters FX with Saxo Bank

LONDON -- Online bond and equity retail trader ETrade has made its first foray into FX by becoming a white-label partner of Danish FX dealer and technology provider Saxo Bank.

BTM top in Japanese FX

TOKYO -- Bank of Tokyo-Mitsubishi (BTM) has cemented its position as the top Japanese forex provider, reporting a 3% rise in yen terms in revenues for the full-year 2002.

Prop desks reap rewards of heightened FX volatility

LONDON -- Banks could be reaping rewards from their proprietary FX trading desks, as swift intra-day market moves continue, dealers have told FX Week .

Icap thrives on market volatility

LONDON -- UK Inter-dealer broker Icap has seen "another outstanding year" on the back of market volatility, especially in medium-term interest rate markets, said group chief executive Michael Spencer on the announcement of the firm's full-year results…

FX derivatives activity flat but healthy

BASEL -- FX derivatives volumes were relatively unchanged in the second half of 2002, the Bank for International Settlements reported last month.

Reuters FX under threat EBS-Bloomberg forex alliance prompts defiant response from UK firm

LONDON -- Reuters was last week fighting back to secure its position in FX, following the announcement of an alliance between two rivals.

Gulf currency by 2010, say Saudis

RIYADH -- A common currency for Persian Gulf countries could be a reality as early as 2010, according to officials from the Saudi Arabian Monetary Agency (SAMA).