Foreign exchange

EBS sees fruit of 'sustained effort on sterling'

LONDON -- Spot broker EBS last week quantified the success of its initiative to build sterling volumes on its platform.

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

NAB report: managers axed

FX head and three executives leave NAB in wake of report on forex losses MELBOURNE -- National Australia Bank (NAB) sacked head of FX Gary Dillon on Friday (March 12) after he was criticised by PricewaterhouseCoopers’ independent report into the bank’s A…

FX is platform for growth at Merrill

NEW YORK -- Merrill Lynch’s investment in foreign exchange will form a platform for growth for the US investment bank, said chairman and chief executive Stanley O’Neal last week.

800 expected at ACI London event in May

LONDON -- Forex industry body ACI is expecting up to 800 FX officials to descend on London in May for its seventh European Congress, hosted by ACI UK.

Asian regulators ease restrictions

HONG KONG -- Banks in Northeast Asia are rushing to apply for licences to enable them to transact non-renminbi derivatives in China, following a relaxation of the rules from March 1.

Loewy exits on a high note

HSBC’s FX chief retires as the bank makes highest-ever forex profits LONDON -- Rob Loewy, head of FX at HSBC for the past 15 years, retired last Monday (March 1) as the bank announced its highest-ever dealing profits for foreign exchange.

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

Gartmore leads new hedge fund launches

LONDON -- Gartmore Investment Management has added to the recent explosion in currency funds with the launch of a new hedge fund. The fund, available to institutional investors around the world, builds on the firm’s 16-year track record in currency…

Busy start to year sets records on EBS

LONDON -- The start of 2004 has proved to be the busiest in the past 10 years, according to spot broker EBS.

HBOS profits up 10% on corporate growth

EDINBURGH -- HBOS Treasury Services had a successful year in forex, with FX profits rising by about 10% year-on-year for 2003, a senior official told FX Week .

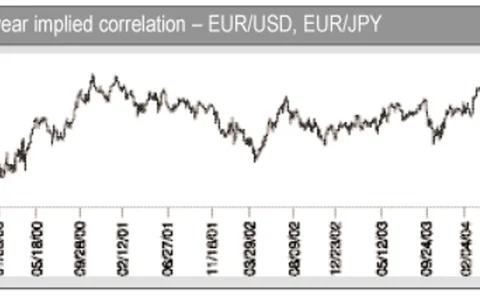

Correlation for hedging and speculation

One of the most surprising FX developments in the past year has been the re-emergence of the use of correlation products. Ade Odunsi, a director in Merrill Lynch’s FX risk advisory group in New York, suggests two such solutions for a hedging and a…

FXI launches managed trading for institutions

FARMINGVILLE, NY -- Online currency trading firm FXI Corporation is launching an Institutional Trading Services (ITS) division in response to growing demand for managed trading accounts from hedge funds and asset managers, an official said last week.

Emerging FX takes off online

LONDON -- Increasing demand from both corporate and hedge fund clients for the ability to trade emerging markets (EM) currencies online is leading banks to boost their e-trading offerings in this area, senior officials told FX Week .

Reuters to launch FX swaps

LONDON -- Reuters is to expand its foreign exchange product range by launching FX swaps on its Reuters Dealing 3000 matching platform next month, a senior official said last week.

NAB report to reveal ‘control breakdowns’

MELBOURNE -- Pricewaterhouse- Coopers’ (PWC) report on the forex options trading scandal that has shaken National Australia Bank (NAB) in recent weeks is expected to expose a number of risk control problems at the bank, Graham Kraehe, NAB’s new chairman,…

RBS leading UK FX race

LONDON -- Royal Bank of Scotland (RBS) reported a 24% increase in foreign exchange revenues for 2003, the largest year-on-year rise among UK banks reporting their results last week.

FXCM hits back at CFTC charge

NEW YORK -- Online trading firm Forex Capital Markets (FXCM) hit back at the Commodity Futures Trading Commission (CFTC) last week, after the regulator charged it with liability for an allegedly fraudulent trading firm.

UBS and CSFB to grow prime brokerage

ZURICH -- Swiss banks UBS and Credit Suisse both nominated prime brokerage as key areas of growth for their financial markets businesses, in their annual results reports published last week.

Ex-MMS team sets up new analysis firm

NEW YORK -- Three managers from the former MMS International, the currency analysis firm bought by publishing group Informa, have set up a new real-time technical analysis service for spot FX.

Tradition takes 10% stake in IFX Group

LAUSANNE -- Swiss broker Compagnie Financière Tradition has taken a 10% stake in UK online trading firm IFX Group, the firm announced last week.

CME slashes fees

CHICAGO -- The Chicago Mercantile Exchange will slash Asian and North American trading fees from March for new members, as it seeks to widen its client base after the launch of Eurex US.

Changes afoot at Merrill Lynch

NEW YORK -- A major restructuring of Merrill Lynch’s FX management is underway, according to sources close to the bank in New York.

Deutsche closing gap on Citi?

FRANKFURT -- Deutsche Bank could be about to close the forex-earnings gap with rival Citigroup, if FX figures match the 33% dollar-terms improvement in its debt group, announced last week.