Fees

Dealers weighing response to FXGO’s fee plans

Spread compression means costs will likely have to be passed on to clients, say banks

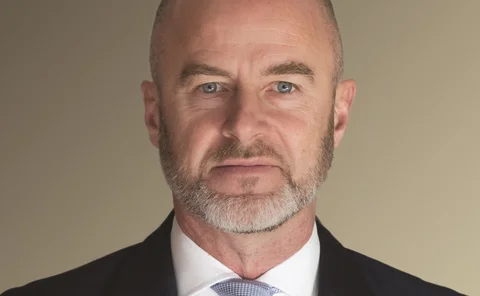

FXSpotStream looks to growth products beyond spot

New chief exec Jeff Ward highlights NDFs and FX swaps as next boom area for the venue

New trading platform costs weigh on FX dealers

As roughly 75 platforms vie for business, LPs complain of struggle to keep up with connectivity costs

Dealers look to cut SDP prices amid platform fee battle

JP Morgan offers different pricing for single and multi-dealer venues; Barclays mulls same approach

Digital Vega aims to slash FX options fees with new Clob

Traders hope platform can loosen grip of voice brokers, despite concerns over market fragmentation

Fee standoff intensifies as FX spreads compress

As spread squeeze continues, brokers refuse to budge on trading fees

Societe Generale links FX algo fees to ESG targets

Clients face penalties if they fail to meet sustainability criteria during algo rental period

Digital Vega, Spark deal hints at wider shake-up for platforms

Two trading tech firms seek point of difference as dealers cull vendor relationships in cost-cutting drive

Benchmark rigging scandal: a remake in the making

Regulators should act now to prevent any repeat of the fixing scandal of 2013

How low can you go: falling cost of FX fix sparks concern

Algorithms are reducing fixing fees, but some dealers are willing to go even lower – perhaps dangerously so

Swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

Banks struggle to keep trade flows in-house during volatility

Directional markets in March tested dealers’ ability to internalise risk

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

FX HedgePool goes live with three buy-side firms

Two US buy-siders trade with European firm on peer-to-peer utility created for them to source liquidity from each other

Johnson seeks rehearing, argues lower fraud bar threatens markets

Former trader’s attorney says that in affirming his conviction, the panel has set a low bar for fraud

Court considers ‘Wild West’ practices in HSBC frontrunning case

Seeking to overturn Mark Johnson’s conviction, his attorneys argue he violated no laws or industry norms when trading on behalf of Cairn

Industry pushes back on Citi’s FXPB cost claims

Rivals question apex brokerage’s calls for executing brokers to make up mispricing shortfalls caused by incoming rules

Traiana boosts risk controls for FXPBs

Providers can be more specific about the risks they are willing to take

ParFX takes first step for moving into NDFs

Trading platform has snapped up an MIC code as it explores building a platform for the growing FX segment

Johnson’s counsels press DoJ to clearly explain his crime

Lawyers plan to argue the US’s “ever-shifting” theories show prosecutors are unclear what crime he committed

Asia: the new frontier for global payments

With regulatory barriers lowered, the region is ripe for new entrants