Corporates

Banks scrutinised for offloading deal contingent risks on to funds

Critics say practice could lead to disclosure of sensitive client data

FX HedgePool launches all-to-all FX swaps matching

P2P platform starts daily matching and opens up to banks, hedge funds and ECNs

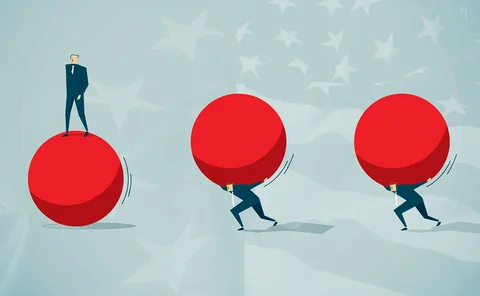

How corporates are tooling up for FX risk

Unstable markets have forced corporate treasurers to adopt whizzier methods for managing currency exposures

Corporate-focused banks see boom in FX trading volumes in H1

US banks report higher FX swaps and forwards volumes from corporates as SA-CCR effect wanes, BCG research shows

Corporates’ tech stacks face pressure from rising FX volatility

Treasurers and CFOs are worried about how their FX tech will cope with a potential increase in hedging activity

Citi’s FX unit taps Hewson for new global sales division

Bank combines sales teams focused on hedge funds and asset managers with those for corporate FX

Citi promotes top corporate sales exec to global FX role

The 35-year veteran takes over from Stuart Staley who led the business for two years

Chinese corporates step up FX hedging after reopening

Exporters eye hedges as RMB strengthens, but negative forwards points are a turn-off for some

P2P platforms look to bring banks into the fold

The USP of peer-to-peer FX matching venues is that they cut out the middleman. So why are they now inviting them in?

Living with SA-CCR, one year on

Collateral agreements and FX futures may be some of the ways to tackle increased capital costs

It’s not easy being green: why the FX market is lagging on ESG

And what’s being done to fix it

PBoC deposit requirement hits FX hedging, again

Reinstated rule hikes forwards costs and dents volumes, but volatility sees corporate demand persist

European corporates scramble for alternative credit sources

Credit lines with traditional bank counterparties exhausted since dollar rally against euro

Corporates rush to hedge emerging market currency risks

Falling forward points have reduced cost of hedging further drops in Chinese renminbi

SA-CCR hit on US banks could hinder year-end dollar funding

Potential lighter presence of US banks in swaps market may affect buy side’s ability to roll hedges

CVA exposures to UK corporates jump ‘hundreds of millions’

Dash for credit protection triggered a doom loop in the CDSs of cross-currency swap counterparties

Return of volatility revs up FX options market

Macro disruption hikes volatility for eager dealers, however liquidity and spread compression remain a concern

HSBC-Finastra aim to centralise white labelling

Proponents say connecting via central hub can streamline the often-bespoke process

Corporates boost FX hedges as US dollar surges

Banks see more business, but also rising exposures, from corporates’ FX decision-making

Russian invasion stirs up ‘perfect storm’ for XVA desks

Declining credit quality of Russian companies and spike in inflation threaten CVA and FVA double-whammy for banks

Product innovations push deal contingents beyond M&A

Banks entice new users with hedges related to IPOs and bankruptcy procedures

FX Markets Best Banks Awards 2021: Best bank for regional/domestic banks – BBVA

An unwavering committment to providing liquidity to smaller banks at competitive rates and allowing them to extend the liquidity to clients digitally garnered BBVA its win at the FX Markets Best Banks Awards

Fears over strong dollar put Asia’s hedgers on edge

Local corporates look to manage US dollar exposures in response to inflation and Fed tapering concerns

Segmenting your client franchise for profit

Ludovic Blanquet, chief product and strategic planning officer at smartTrade, investigates the complex dynamics of profitable e‑FX franchises, the importance of building and consolidating client trust, and how a technology partner such as smartTrade can…