Central counterparty

Indonesian CCP seeks thumbs-up from US, UK and Japan

Growing foreign bank interest pushes IDClear to pursue regulatory approval overseas

Clearing members fear CFTC bending rules for crypto

Critics warn new framework for Bitnomial and LedgerX could undermine clearing integrity

How risk managers can stop the FTX infection from spreading

Segregation and transparency can save investors from imploding crypto trading venues

Late EU clearing house recognition spooks dealers

Bank capital requirements on exposures to affected foreign CCPs could jump after June 28 deadline

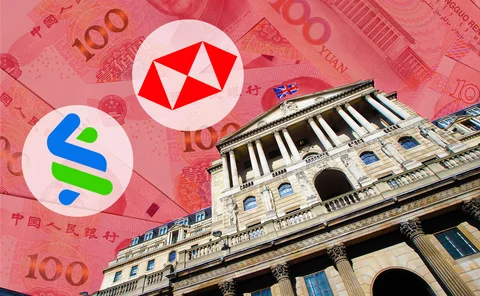

HSBC, StanChart face capital hit on cleared renminbi trades

Lack of UK recognition for Shanghai Clearing House could prompt banks to reduce exposures

Futures aim to put a dent in FX swaps supremacy

Advent of margin rules sharpens appeal of exchange-traded instruments for buy-siders

CFTC rule change sparks dealer-client margin scuffle

FCMs fear “race to the bottom” as funds lobby dealers for lower margin status

SA-CCR switch clouded by confusion over netting sets

An effort by US regulators to incentivise the switch to SA-CCR may be having the opposite effect

Indonesia eyes netting changes to enable derivatives CCP

Central bank says legal amendments will pave way for locally cleared NDFs and interest rate swaps

LCH to launch non-deliverable options clearing

Clearing service will go live in Q4 for nine currency pairs

Big banks reproach CCP risk panels as resentment surfaces

Emotions simmer as major banks insist committees listen harder to clearing members, in wake of green light for bitcoin futures

Nasdaq default came at time of mass margin breaches

CCP's clearing members incurred 49 margin breaches as of end-September

LCH shakes up compression vendor fee structure

Proposals follow criticism that the current regime favours TriOptima

Evia: rising capital costs to encourage mergers in 2019

Trend of mergers and acquisitions in FX industry set to continue, says Alex McDonald

Day one of a no-deal Brexit: swaps and chaperones

Banks, platforms and repositories tee up EU entities – and dread the repapering crunch that would follow

SGX is launching FX futures solution

New feature lets market participants trade customisable FX futures contracts in an OTC fashion

CME FX Link to go live on March 25

CME is launching a new central limit order book allowing participants to trade OTC spot and FX futures via a single spread trade

Shift towards futures inevitable, says Greenwich

To address the cost pressures associated with regulation, both buy- and sell-side participants have started analysing the impact of adopting futures in their trading habits

Nex optimises post-trade OTC FX with direct clearing connectivity

By removing secondary matching, Nex optimises post-trade workflow and maximises benefits of clearing

CME to go live with triangulation and monthly FX futures

Triangulation will link futures, and both volatility- and premium-quoted options markets on February 27

EU and US reach CCP recognition deal

US counterparties will be able to continue providing services to European market participants