Canadian dollar

London retains top spot for offshore renminbi trading

The capital continues to dominate, despite the Chinese currency's overall share of payments shrinking, Swift says

Renminbi's share of global payments slides

China's currency holds sixth place globally, but its overall share continues to shrink, Swift says

BMO to build on Canadian success with ambitions in China

BMO Capital Markets has been voted Best Bank for the Canadian Dollar for the sixth year running

Renminbi's global share of payments slides

China's currency holds fifth place globally, but overall share shrinks again, Swift says

Global renminbi adoption slows in June

Decline continues in the internationalisation of China's currency, overtaken by the Canadian dollar in payments by value

Dollar may weaken as Fed stays less hawkish

The softness of the US currency may only be near term, as ongoing policy divergence could lead to some gains later

CME readies for Bloomberg Index futures launch

CME Bloomberg Dollar Spot Index futures will track a basket of 10 developed and emerging market currencies

Aggressive HFT stable in major currencies

High-frequency trading in FX remains below the levels seen in equities, according to research from AbleMarkets

BMO Capital Markets triumphs again in CAD

Bank of Montreal Capital Markets cements its position as the best bank for the Canadian dollar with its fourth win in a row

BMO retains Canadian dollar award for a third year

A focus on growing its international presence as interest in the Canadian dollar comes from multiple geographies keeps Bank of Montreal in top place

Bank of Montreal's strategy team awaits the taper tantrum

The imminent tapering of US quantitative easing will cause further weakness in the Canadian dollar in 2014, says Greg Anderson, BMO's new head of FX strategy

CLS launches settlement for same-day USD/CAD trades

Settlement risk mitigation firm is due to launch a new settlement session this week for the trades settled on a same-day basis

Belief in euro keeps Bank of Montreal on top

The Canadian bank outlines its long-term forecasting strategy as maintains its place at the top of the 12-month tables

Reserve managers avoid Bric currencies despite increase in risk appetite

Central banks look to diversify reserves in search of higher yield, but still consider emerging market currencies too risky

BMO in double win with accurate yen forecasts

USD/JPY could rise up to 100 in time, according to Bank of Montreal's Benjamin Reitzes, whose forecasts put the bank at the top of the 12- and one-month forecast rankings

Euro caution pays off for TD Securities

TD Securities forecast at the start of January that the euro would strengthen only moderately in the short term, landing the bank at the top of the one-month rankings

Anticipation of yen weakness lands Scotiabank on top

The Canadian bank forecast in December 2011 that the yen would weaken against the dollar – a trend it expects will continue throughout 2013

Yen set for further weakness, says Bank of Montreal

The Canadian bank accurately forecast in December 2011 that the yen would begin to weaken during 2012, landing it at the top of the 12-month rankings

BMO holds Canadian dollar award for second year running

Bank of Montreal has been at the forefront of efforts to capitalise on the rising international interest in the Canadian dollar

Saxo Bank on the US elections

As the US presidential elections get underway, John Hardy, chief forex strategist at Saxo Bank discusses the market impact of an Obama or Romney victory

Euro will fall to 1.18 by early next year, says TD Securities

A long-term prediction of euro weakness lands the Canadian bank at the top of this week's 12-month forecast rankings - and its chief strategist sees further weakness ahead

VIDEO: Saxo Bank G-10 Currency Market Outlook

An overview of currency markets into the fourth quarter and new year

FX futures and options volumes soar on CME

While volumes are down year-on-year, September has seen a number of record days on CME Group, particularly in currencies such as the Canadian and Australian dollars and the Mexican peso

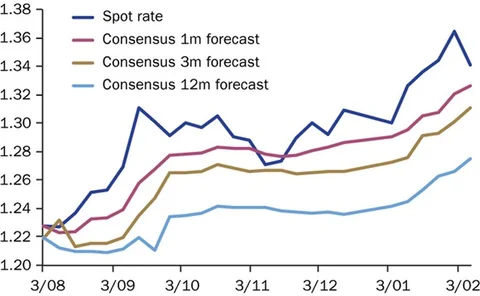

CIBC bets on gradual upward curve for US dollar

A set of forecasts based on the view that the US dollar would remain stagnant before rising later this year lands CIBC at the top of the three-month rankings