Australian dollar

BoJ inertia informs Westpac's chart-topping yen forecast

An accurate forecast on the direction of USD/JPY - based on the view that the Bank of Japan would remain behind the curve on intervention - lands Westpac at the top of the three-month rankings

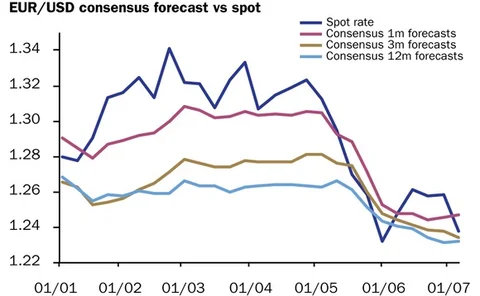

Euro set to fall further after period of stability, says UBS

An accurate forecast that eurodollar would remain steady at 1.24 lands UBS at the top of the one-month rankings, although the bank is more bearish on the currency in the longer term

Eurozone woes spreading to China, warns BAML

Bank of America Merrill Lynch has climbed to the top of the one-month forecast rankings after taking a negative view on the euro, but the bank expects it could rally towards year-end

Carry makes a muted comeback as investors hunt for yield

The carry trade showed some signs of resurgence during the second quarter but currency managers remain lukewarm about the strategy in an uncertain economic environment

VIDEO: Safe-havens in euro turbulence

Looking at the key risks to the Australian dollar, Swedish krona and sterling

Technical analysis of historical data puts GFT in 12-month lead

GFT looked back to market data from June 2010 to make its 12-month forecasts on the euro's dramatic fall

Investors seek alternative forex hedges for euro crisis

Australian dollar, renminbi and CE3 currencies touted as alternative macro hedges for European debt woes

Aussie banks join e-FX arms race

Ramping up single-dealer platforms and connectivity to multibank portals is a key priority for Australian banks, as they seek to ensure their forex business is not poached by global banks with superior technology

Moving up from down under

Following his recent appointment as global head of FX at Commonwealth Bank of Australia, Kieran Salter talks to Robert Mackenzie Smith about his mission to ensure the bank’s FX capabilities are globally recognised, and the major technology overhaul the…

Aussie demand surges following RBA rate cut

The Reserve Bank of Australia’s decision to cut interest rates on May 1 led to a sharp fall in the Australian dollar, but has also caused an uptick in demand for the currency, according to FX traders and strategists in the region

Yen will go from strength to strength, says ANZ

The Australian bank forecast a yen revival last month, landing it at the top of the one-month rankings – and it expects the Japanese currency will continue to gain ground this year

Reserve managers cling to the dollar but shun the euro, survey finds

Many central banks have reduced their holdings of euro reserves and looked to diversify into non-traditional currencies as a result of the ongoing eurozone crisis

CMC on top of ECB's 2011 rate hike reversal

CMC Markets accurately predicted the euro would rise and then fall as the ECB reversed its interest rate policy in 2011

Yield makes a comeback

Two months into 2012, Mitul Kotecha assesses the modest healing process that appears to have taken hold in currency markets after a period of marked risk aversion, and explains why yield is becoming a key factor influencing investor appetite

Aussie dollar is overvalued, says UBS Asset Management

Despite the strong performance of the Australian economy, the Aussie dollar is overvalued to "an extreme level", according to Jonathan Davies

BAML: economic uncertainty favours yen

Bank of America Merrill Lynch tops the one-month forecasts with the view that the yen will remain strong in 2012

ANZ holds top spot for Aussie dollar

The Australian bank has invested both in people and technology over the past year, with a focus on growing its operations in London

Eurozone deal brings relief in FX spot and options

Risk sentiment appeared to make a comeback in FX markets yesterday as options volatility fell from record highs and the euro rallied in response to the deal announced after the Euro Summit in Brussels

G-10 troubles fuel sell-off in EM currencies

Declining risk appetite and a flight to quality have driven a sell-off in some emerging market currencies and pushed up the cost of hedging, say participants

FX Invest: US dollar's time as world's reserve currency draws to a close

With the European sovereign debt crisis grabbing headlines, markets might be forgiven for overlooking the nearing end of a second round of quantitative easing in the US. Debate over its success raises deeper questions about the role of the US dollar as…

More upside in the Aussie dollar

Paul Bednarczyk, head of currency strategy at 4Cast in London, looks at the steady rise of the Australian dollar since 2008 and explains why it might yet appreciate further

Eurodollar rise has run its course, says Standard Chartered

Asian bank saw signs of potential dollar strength in late May, landing it at the top of the one-month forecast rankings

Crunch time for the US dollar, says Barclays Capital

US economic issues overshadowed by the eurozone crisis will return to the fore in Q3 and push US dollar depreciation, according to quarterly report

Reality check on CAD and AUD assumptions

Jeremy Stretch, head of FX strategy at CIBC in London, asks whether the Canadian or the Australian dollar is a better buy in an environment in which both appear attractive alternatives to struggling traditional currencies