Regulation

Seven leave Dresdner in FX flight

LONDON -- Dresdner Kleinwort Wasserstein in London is facing an exodus of staff from foreign exchange, with at least seven leaving the bank in London and New York in the past month.

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Asian regulators ease restrictions

HONG KONG -- Banks in Northeast Asia are rushing to apply for licences to enable them to transact non-renminbi derivatives in China, following a relaxation of the rules from March 1.

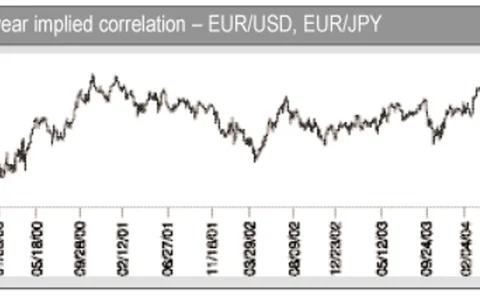

Correlation for hedging and speculation

One of the most surprising FX developments in the past year has been the re-emergence of the use of correlation products. Ade Odunsi, a director in Merrill Lynch’s FX risk advisory group in New York, suggests two such solutions for a hedging and a…

Near-term ringgit peg change unlikely

KUALA LUMPUR -- Despite recent reported comments from Malaysia’s second finance minister, Tan Sri Nor Mohamed Yakcop, Malaysia is unlikely to change the ringgit’s current peg to the US dollar -- at least until the country’s general election is over.

IASB set to launch Euro advisory group

LONDON -- IASB, the International Standards Board, has invited senior officials to form a European consultative group to advise on issues related to the application of accounting standards.

Politics overshadows economics for zloty

WARSAW -- The resignation of the Polish prime minister from the leadership of the ruling Democratic Left Alliance (SLD) Party will lead to continued volatility in the zloty, which is already close to record lows, analysts said last week.

NAB report to reveal ‘control breakdowns’

MELBOURNE -- Pricewaterhouse- Coopers’ (PWC) report on the forex options trading scandal that has shaken National Australia Bank (NAB) in recent weeks is expected to expose a number of risk control problems at the bank, Graham Kraehe, NAB’s new chairman,…

FXCM hits back at CFTC charge

NEW YORK -- Online trading firm Forex Capital Markets (FXCM) hit back at the Commodity Futures Trading Commission (CFTC) last week, after the regulator charged it with liability for an allegedly fraudulent trading firm.

Reflationary effects on dollar/yen

Strong cross-border portfolio inflows into Japan are unlikely to falter. Consider either Seagull or reverse knock-in option strategies to protect against further yen strength, say State Street Global Markets’ currency options and currency strategy teams

Market to test central banks post-G7

LONDON -- The G7 communiqué released after the Boca Raton meeting on February 7 will lead to the market testing the resolve of central banks to limit FX moves, analysts agreed last week.

New accounting rules put focus on training

LONDON -- New accounting regulations and recent instances of suspected fraud in the forex markets should make training financial markets staff a top priority, said officials at online training firm Intuition in London.

IASB to create advisory group

LONDON -- IASB, the International Accounting Standards Board, is investigating the establishment of an advisory forum, following comments from euro official Frits Bolkestein last month that standards for the treatment of derivatives are still unsuitable…

ACI reaffirms manager liability for fraud

LONDON -- Ultimate responsibility for misdemeanours on the trading floor rests with senior management, forex industry body ACI reminded market participants last week, in a letter prompted by recent reports of "alleged fraud or malpractice" in the…

Firms race for North American retail investors

NEW YORK -- Trading firms and exchanges are building FX products targeting the retail market, as retail investor interest in foreign exchange soars in North America.

NAB ‘rogue trading’ dates from 2002

MELBOURNE -- Alleged rogue trading in forex options at National Australia Bank (NAB) had been going on for at least a year before the bank’s original estimate, an NAB official said last week, as the bank revised its final estimate for losses up to A$360…

Spotlight on ‘points’ post FBI inquiry

NEW YORK -- The New York FX Committee is likely to revise its guidelines on FX trading and operational risk management this year, when it concludes a review into issues arising from the FBI’s arrests of 47 currency traders last November.

NAB chief admits weaknesses

MELBOURNE -- National Australia Bank chief executive Frank Cicutto last week admitted that weak internal processes had enabled the four traders it suspended on January 13 to carry out a suspected fraud.

IAS 39 still unacceptable says Euro official

BRUSSELS -- Frits Bolkestein, European commissioner for the internal market, taxation and customs union, said last week that standards for the treatment of derivatives are still not suitable for adoption, despite recent concessions by the International…

SPECIAL REPORT: CHINA Opportunity China: banks reveal plans

SHANGHAI -- Top forex banks are stepping up their strategies to win lucrative FX business in China as it gradually liberalises its economy. Major international players are taking steps such as increasing staffing levels in the Asia-Pacific, or carrying…

Clearview charged by CFTC

NEW YORK -- The Commodity Futures Trading Commission (CFTC) has charged Clearview Capital Management and its head trader James Weiss for misrepresentation, and is seeking an injunction to suspend the firm.

‘Illegal trading’ costs NAB $140m

MELBOURNE -- Australia’s largest bank, National Australia Bank (NAB), became the latest victim of alleged rogue forex trading last week. The bank said on Tuesday (January 13) that it had uncovered losses of up to A$180 million (US$140 million) from…

Five-year-old euro comes of age

FRANKFURT -- When the euro was first introduced, many were sceptical about its potential for success and concerned about its impact on the FX market as a whole. But as it celebrated its five-year anniversary this month, the euro’s status is gradually…

EBS outage sparks BoJ rumours

LONDON -- Dealers acting on behalf of the Bank of Japan (BoJ) may have been among the customers frustrated by momentary lapses in spot broking platform EBS’s dealable rates last week.