Regulation

TriOptima unveils UTI pairing service for Emir reporting

Icap-owned technology provider seeks to tackle the dual reporting challenge for paper-confirmed trades and FX trades without a common ID

FX benchmark probe gathers pace as chief dealers placed on leave

Senior spot traders at JP Morgan, Citi and Standard Chartered have all been placed on leave, while Barclays, Deutsche Bank and UBS confirm they are conducting internal reviews in connection with alleged manipulation of FX benchmarks

EU bonus cap threatens the future of London FX

The UK last month launched a legal challenge against the EU's planned bonus cap - it will need to be successful if London is to retain the best FX sales and trading personnel

Expiry of Sef confirmation relief causes unrest among dealers

Swap execution facilities have only until October 30 before they have to issue legal confirmations for trades, but dealers remain uneasy about their ability to do so

Standardisation needed in Sef reporting conventions

Sefs agree a lack of clarity on reporting requirements has created an inconsistent and fragmented view of trading activity

Footnote 88 prompts BlackRock to abandon NDF platforms

Asset manager returns to phone trading for non-deliverable forwards after controversial footnote in Sef rules makes trading on Sefs an unattractive option for users

Clearing of physical FX in China and India a concern, says GFXD’s Ngai

Global FX division managing director David Ngai warns of the challenges associated with centrally clearing physically delivered FX products

Euro-denominated FX reserves rise again

After several quarters of declining central bank holdings in euro, recent data from the IMF suggests reserve managers have started to increase holdings in the currency again, albeit by a very small amount, says Thomas Stolper

RBI's shift in monetary policy welcome, say traders

The central bank’s reduction in its marginal standing facility is positive for India’s growth, but the rupee is still exposed to external risks

Progress of RMB internationalisation ‘spectacular’, says SFC official

Speaking at the FX Week Asia conference, deputy chief executive of Hong Kong regulator highlights the importance of continuing to internationalise China's currency

FX Week Forum: Central banks and FX reserves

In the latest in the FX Week Forum series, Joel Clark talks to Steven Saywell, global head of FX strategy at BNP Paribas, about trends in central bank reserve management and the IMF's latest set of reserves data

Reserve managers seek alternatives to USD and EUR

Following the IMF’s publication of its FX reserves data for the second quarter, Steven Saywell assesses why reserve growth has slowed and central banks are looking to diversify

Lack of Esma clarity delays progress on FX trade reporting

Questions raised by Isda concerning trade reporting workflows have not yet been answered, delaying preparations for the start of mandatory trade reporting early next year

CFTC shutdown leaves Sefs lacking clarity

Sefs and their clients question scope of no-action letters, but US government shutdown means no-one is able to provide guidance

CFTC relief welcomed but concerns remain as Sef rules begin

A string of no-action relief letters issued ahead of today's deadline have been welcomed, but some participants believe they still don't go far enough

Deconstructing the Sef ‘car crash'

With days to go until approved swap execution facilities are set to open for business, the CFTC would do well to heed some of the warnings it is hearing from the industry

Sefs struggle with CFTC reporting rules

A lack of clarity over reporting obligations has left would-be Sefs struggling to adapt processes and workflows

Options platforms will miss Sef application deadline

Digital Vega and SurfacExchange do not expect to meet the CFTC's October 2 deadline to register as Sefs

FXCM buys majority stake in Faros Trading

FXCM continues its aggressive expansion as it acquires a 50.1% stake in FX agency firm Faros Trading, four years after it was established by Ray Kamrath

Industry forced to rethink reporting after Esma rejects GFMA proposal

FX participants must reconsider their approach to dual reporting under Emir, possibly at considerable cost to those already building towards the proposed model

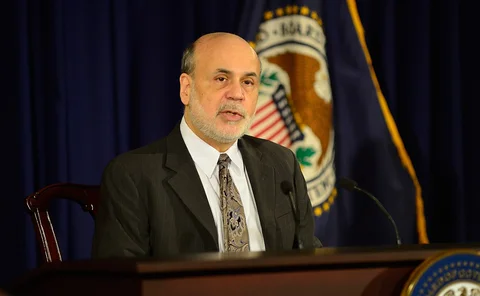

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Gensler not ruling out targeted Sef relief

CFTC chairman recognises difficulty in meeting October 2 Sef deadline, but says platforms need to be targeted in requests

Sefs questioned on plans for erroneous trades

Swap execution facilities have been rushing to meet an October 2 deadline for registration, but more thought is needed on how platforms will deal with trade failures, say conference participants

Pressure mounts on CFTC for relief on Sef rules

CFTC is being lobbied to grant relief on the contentious Footnote 88, which requires platforms to register as Sefs even if the products they offer are not yet made available to trade