United States (US)

Banks rent ready-made algos for FX trading

NatWest, XTX Markets and others develop new outsourcing model for tech

Filings reveal biggest FX forwards dealers

Counterparty Radar: Group of four banks executed 47% of sector’s trades during second quarter

Nomura targets US in FX rebuilding effort

Return of volatility sees Japanese bank rehire in New York and focus global business on Asian pairs and FX options

Boston Fed and MIT collaborate on digital currency research

Research results on software architecture will be released as open source

Swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

Lawyers divided on Johnson’s Supreme Court prospects

Ambiguity in wire fraud statutes may see court accept ex-HSBC trader’s appeal – but it’s a long shot, say attorneys

BLTs and glitchy Wi-Fi: lockdown life for FX execs

With traders transacting trillions from their living rooms, currency markets are adapting to new normal

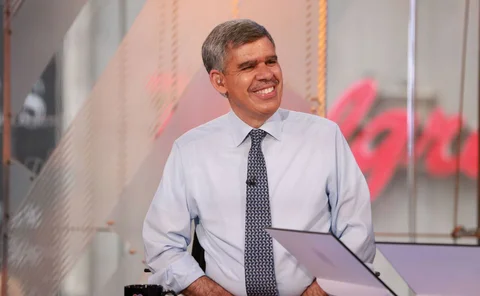

El-Erian on Covid-19 policy risks and ‘zombie’ markets

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

How carbon-cutting Drax manages currencies and credit

Interview: UK power giant uses option selling – and other tactics – to create hedging headroom

Fed extends dollar funding to more central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

Westpac: Johnson’s rhetoric over EU trade hits sterling

Cable has less upside than before the “go it alone” talk resumed after Brexit

FX HedgePool goes live with three buy-side firms

Two US buy-siders trade with European firm on peer-to-peer utility created for them to source liquidity from each other

CMC: fiscal stimulus holds potential for pound upside

Amid uncertainty around Brexit clearing, upcoming UK budget may add support to UK currency

Swissquote: US-China trade war to ease in election year

Trump will enter November’s presidential election “bragging about a historic trade deal with China”

Mike Harris leaves Campbell & Company

Former FX trader exits after working at the firm for almost 20 years

Johnson moves to Floating Point Group

Former FX trader worked in e-FX liquidity distribution at Tower Research Capital earlier in his career

EM forecaster of 2019: City Index

CNY could hit 7.5 in H2 2020 as trade doubts linger and time runs out for Trump

G10 forecaster of 2019: Rabobank

Sterling’s future is still very dependent on Brexit-related developments, the bank says

First Ibor versus SOFR cross-currency swaps trades

Westpac and Citi strike BBSW/SOFR trade in landmark moment for Australian market

Vanguard: automation is great until it doesn’t work

Andy Maack, head of FX trading, talks about the future of trading, algos and diversity

GFMA: expect new trade lifecycle technology to surface in 2020

FX industry will see more use cases for algos, AI, distributed ledger technology and order routing

JP Morgan: beating lower margins, flat volumes and the competition

Foresees collaboration with clients and technology providers on FX tech infrastructure, and working with regional players

FX HedgePool: move to clearing may be irresistible

Jay Moore says balance sheet pressures will redefine buy-side credit relationships