China

Isda set to draft China netting opinion

Banks could be in a position to turn on close-out netting in China by third quarter

HSBC, StanChart face capital hit on cleared renminbi trades

Lack of UK recognition for Shanghai Clearing House could prompt banks to reduce exposures

China netting: industry raises concerns on cross-border trades

Filing requirement of new netting law could unfairly penalise trades from foreign banks

After FTSE inclusion, China bonds still face CNY hedge hurdles

Lack of pricing competition and costly hedges top buy-side hurdles to investing in China, says ChinaFICC CEO

China outlaws all crypto transactions and bans mining

PBoC, cyber watchdog and central economic planner act in a joint crackdown on crypto

Renminbi splurge lifts BNPP, MSIM in Q1 options data

Counterparty Radar: Morgan Stanley IM is largest options user, following series of huge renminbi calls

China netting law drives interest in CSAs

Steady growth in contracts with CSAs suggests confidence that clean netting is near

Chinese exporters urged to ramp up US dollar hedges

Dealers join China’s Safe in sounding alarm at mounting unhedged FX exposures

Tighter RMB rates basis brings new hedging opportunities

Increasing alignment between CNH and CNY benchmarks opens door to more cross-currency hedging by foreign lenders

BIS and central banks partner to create CBDC ‘bridge’

Cross-border project will link up digital currencies of China, Hong Kong, Thailand and the UAE

China tightens regulations on non-bank payment firms

Central bank will scrutinise payments more closely and fine firms for rejecting cash

PBoC eases cross-border yuan settlement policy

Central bank promotes use of yuan in cross-border settlement and financing

Investors eager for next round of China financial reforms

Bond futures and credit default swaps the missing pieces

MAS unveils renminbi funding for banks in Singapore

New funding scheme of up to 25 billion yuan replaces overnight funding facility

Asia’s FX markets step to the algorithm

Buy-side use of automated trading programs builds, albeit from a low base

Public policy lines blur: implications for reserve managers

Crisis-fighting has pushed central banks into new forms of risk-taking, and this is now spilling into reserve management, says Jennifer Johnson-Calari

FX Markets Asia Awards 2020: The winners

Citi lands four wins in this year’s awards

China derivatives appetite set to grow as PBoC lifts deposit rule

Central bank rule change could cut hedging costs by up to 100bp, traders say

FX swap volumes set to rise on China govvies index inclusion

Traders expect greater use of FX derivatives if FTSE Russell adds bonds to the WGBI this week as expected

RMB hedging comes onshore as regulators liberalise FX market

Foreign investors turn to CNY for bond hedges as rule changes spur more competition

Banks trade first USD/CNY cross-currency swap versus SOFR

Risk-free rate sets new milestone with Crédit Agricole and Bank of China’s $10m trade

Is there a dollar funding squeeze in China?

China could benefit from joining the Fed’s dollar swaps network but political obstacles bar the way

Fed extends dollar funding to more central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

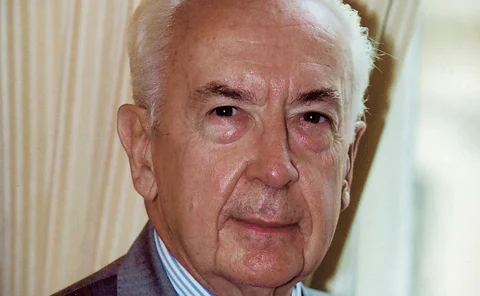

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies