News

CLS plans business continuity improvements

SINGAPORE -- Continuous Linked Settlement (CLS) Bank International intends to move one of its two operations sites from greater London, to provide more reliable business continuity in case of an interruption to business, Joseph De Feo, president and…

Merrill merges FX and rates

LONDON -- Merrill Lynch merged its global FX and global rates businesses under new co-heads Michael DeSa and Barry Wittlin in September, a spokesperson confirmed last week.

Euro needs more stability

BRUSSELS -- The EU Commission needs to solve the issues surrounding the EU stability pact for Eurozone countries before any new countries join either the currency or the European Union, analysts said last week. The consequences of allowing France and…

Reuters names new global head of risk

PARIS -- UK trading systems and market data vendor Reuters has made Sebastien Rousotte global head of risk -- a position that has been empty since the departure of Mike Whitaker earlier this summer ( FX Week , August 18).

Traiana goes live, adds brokers

NEW YORK -- The e-FX prime brokerage industry picked up momentum last week, as the first banks went live on Traiana’s automated FX prime brokerage software and two more key prime broker banks signed up for the system.

State Street hires options chiefs in Asia and Europe

BOSTON -- State Street has hired two regional FX options managers in newly created positions overseeing Asia and Europe.

Dollar weakness capped in short term

NEW YORK -- A short-term bounce in the US dollar was boosted by stronger US data last week, including better than expected Q3 corporate results, combined with more intervention from Asian central banks.

FX shock from fund upheaval

TOKYO -- Massive upheaval in the Japanese pension fund industry is set to have major implications for forex flows and relationships, as the process of daiko henjo -- the return of public funds to the government -- gets underway.

Trayport plans multi-portal screen

LONDON -- Software vendor Trayport is set to launch Exchange Gateway, an interface that allows traders to access multiple forex markets from one screen, in Q1, 2004.

Commerz to add staff for new long-dated options book

LONDON -- Commerzbank plans to hire two new options specialists in London over the coming months, to support a long-dated FX options book that is currently in development.

JP Morgan expands Treasury Services

LONDON -- JP Morgan Treasury Services has hired four staff in London across technology, liquidity management, consulting and trade services. The hires will help JP Morgan expand its business, said Steve Groppi, regional executive for Europe, the Middle…

Fimat merges US and UK FX

CHICAGO -- Fimat, the brokerage arm of French investment bank SG, has merged its US and UK FX businesses into a single global unit.

SuperDerivatives spices up Xerox Mexicana

MEXICO CITY -- US printing technology company Xerox Corporation has signed a deal with SuperDerivatives to use the UK-based forex technology firm’s FX option benchmark pricing system in Xerox Mexicana, its Mexican subsidiary.

China export tax changes will not satisfy US, Japan and EU

BEIJING -- The Chinese government plans to cut tax rebates for exporters in a bid to reduce international pressure for yuan revaluation, local media in Hong Kong and mainland China reported last week. However, market participants in Asia-Pacific said the…

Deutsche adds e-options

LONDON -- Deutsche Bank will go live with FX options on its autobahnFX trading platform in January, in response to client demand, a bank official told FX Week .

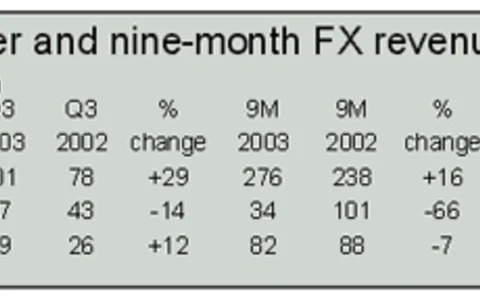

Merrill Lynch reports record quarter

NEW YORK -- Merrill Lynch’s drive to become a major force in the FX industry appears to be bearing fruit, according to its third-quarter results.

Asset manager technology hinders op risk management

LONDON -- Less than 40% of global asset managers believe they have the necessary technology to manage operational risk and automation issues effectively, according to a survey released last week.

FX shock from fund upheaval

TOKYO -- Massive upheaval in the Japanese pension fund industry is set to have major implications for forex flows and relationships, as the process of daiko henjo -- the return of public funds to the government -- gets underway.

China’s regulator publishes new derivatives guidelines

BEIJING -- The publication of China’s long-awaited derivatives regulations has moved a step closer, following the release of new draft guidelines by the country’s regulator, the China Banking Regulatory Commission (CBRC).