Investment

Advanced IRB Basel II approach delayed

BASEL – The Basel Committee on Banking Supervision has said that implementation of the advanced internal ratings-based approach (IRB) for credit risk and the advanced measurement approach (AMA) for operational risk will be delayed until the end of 2007…

BIS reports FX options surge

BASEL – FX options business increased by a massive 77% year-on-year in the second half of last year, according to Bank for International Settlements (BIS) statistics released last week.

Solving investment problems with forex

An asset manager may look to euro/Swiss franc and euro/sterling structures to take advantage of investor uncertainty, says David Durrant, chief currency strategist at Julius Baer Asset Management International in New York

An average rate option to protect the budget

As euro/dollar continues its descent, Rabobank’s corporate sales desk in Utrecht suggests one way for European corporates to profit from the move

China hints strongly at yuan peg change

BEIJING – China last week gave its strongest hint yet that the yuan’s peg to the US dollar could be altered sooner rather than later.

Time is right for early barrier forwards

The high level of volatility in the market makes this an opportune time for corporates to use early barrier forwards to hedge cable risk, says Barclays Capital’s senior FX structurer in London, James Edwards

MAS move could pre-empt peg changes

SINGAPORE -- The Monetary Authority of Singapore’s surprise move last week towards a "policy of modest and gradual appreciation" for the Singapore dollar may be a pre-emptive move to counter Asian peg revaluations.

JPMC fund trio make £55m

LONDON -- Three FX and fixed-income specialists who left JP Morgan Chase to set up a hedge fund have made profits of more than £55 million ($100 million) in their first year.

JPMC fund trio make £55m

LONDON -- Three FX and fixed-income specialists who left JP Morgan Chase to set up a hedge fund have made profits of more than £55 million ($100 million) in their first year.

Profiting from the Chinese yuan

With speculation rife on the revaluation of the Chinese yuan, James Davison of the global FX derivatives marketing team at ABN Amro in London, examines potential ways for derivatives traders to benefit

The zero-cost double KO/KI forward

A double knock-out/knock-in forward may provide a Mexican manufacturer with an effective zero-cost hedge, say Vincent Lee and Richard Stang, vice-presidents in FX sales at TD Securities in Toronto

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Cancellable forward beats dollar pendulum

Cancellable forward contracts offer corporates a cheap way of protecting against volatile dollar receivables says Anders Kjaer Jensen, FX strategist at Nordea in Copenhagen

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

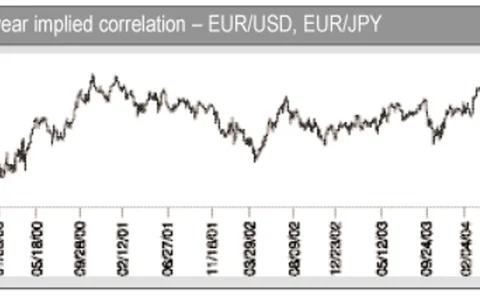

Correlation for hedging and speculation

One of the most surprising FX developments in the past year has been the re-emergence of the use of correlation products. Ade Odunsi, a director in Merrill Lynch’s FX risk advisory group in New York, suggests two such solutions for a hedging and a…

Hedging dollar dividends back to euro

A European company seeking to protect dividends received from a US subsidiary can benefit from the current inverted volatility term structure in the FX options market. UBS’s FX Solutions group explains how

Reflationary effects on dollar/yen

Strong cross-border portfolio inflows into Japan are unlikely to falter. Consider either Seagull or reverse knock-in option strategies to protect against further yen strength, say State Street Global Markets’ currency options and currency strategy teams

Changes afoot at Merrill Lynch

NEW YORK -- A major restructuring of Merrill Lynch’s FX management is underway, according to sources close to the bank in New York.

Saxo’s FX volume growth builds profits

COPENHAGEN -- Saxo Bank had its most active trading month ever in January, with over $93 billion worth of forex trading on its platform, officials said last week. The volumes represent an increase of over 200% since January 2003, when volumes were $28.5…

CAI, CL chiefs share top posts

PARIS -- Crédit Agricole Indosuez (CAI) and Crédit Lyonnais (CL) executives will share the management of foreign exchange after the two banks’ merger on April 30, it emerged last week.

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

More banks put money on research

LONDON -- ABN Amro and Barclays Capital are among the increasing number of banks putting money on their trade recommendations for FX. Both have allocated money to start trading on model portfolios this year, joining CSFB, Citigroup and JP Morgan Chase as…

Using currency as an alpha source

The past three years have been disturbing for investors and managers. This investment climate is perfect for engaging in currency strategies to create alpha, say Paul Lambert, head of currency, and Mark Pursey, UK spokesperson at Deutsche Bank Asset…