Infrastructure

CLS pushing 'transformation' agenda, says Bozian

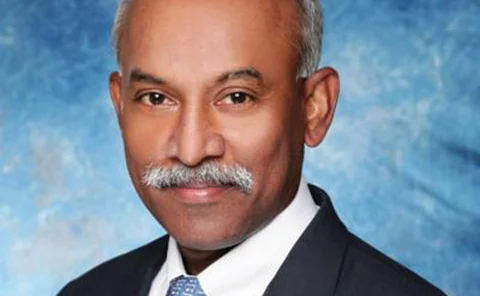

Central settlement utility is feeding greater resources into expanding its universe of currencies, according to chief executive Alan Bozian

Spotlight on: Alan Bozian, CLS

The chief executive of CLS talks to Joel Clark about the transformation agenda he has been pushing since taking the top role in 2010, as he seeks to position CLS as a more robust infrastructure with greater currency coverage and broader participation

DealHub launches proximity hosting for FX trading systems

Co-location in Equinix data centres has already gone live for customers in London, and will go live in New York in the coming weeks

Battle for clearing supremacy

Singapore Exchange (SGX) became the first of the major clearers to launch an OTC Asian FX forwards clearing business in October. But with bank-backed LCH.Clearnet and the CME hot on its heels with a non-deliverable forwards offering, can SGX maintain its…

ADS Securities to provide liquidity through Integral

Start-up brokerage has connected its API to Integral and expects to execute first trade with an Australian client within days

CFTC urged to rethink rules that threaten cross-margining

In a world where central clearing and bilateral collateral posting are mandatory, margin efficiency will be a big draw, and one obvious way to achieve it is through cross-product margining. Unfortunately, it is difficult to achieve – and Commodity…

CME vows to expand NDF clearing by year-end

Expansion of the exchange’s nascent NDF clearing platform to include a broader range of NDFs is set to begin within weeks, according to Roger Rutherford

Eurobase debuts Evo single-bank platform

New single-bank platform will have enhanced user experience and the flexibility to trade asset classes other than just FX and money markets, officials at Eurobase tell FX Week

Spotlight on: Simon Jones, Citi

Citi's head of G-10 spot trading for North America and global head of foreign exchange electronic trading talks to Miriam Siers about the growth of the bank's e-trading capabilities in recent years, and how his team has navigated the recent period of…

Profile: CLS Bank's Bozian on regulatory co-ops and CCP settlement risk

Regulators are struggling to ensure they have oversight of over-the-counter market infrastructure without losing the benefits of centralisation. CLS Bank’s council of supervisors could be the precedent they follow. By Michael Watt

Banks continue to invest in FXPB, despite tough hiring climate

Widespread cost-saving initiatives and hiring freezes have led to a wave of high-profile redundancies in the foreign exchange market, but forex prime brokerage remains an area for investment because of the focus on clearing, say banks and recruitment…

Singapore Exchange preps FX clearing launch

SGX president says NDF clearing will begin shortly, following the successful launch of a clearing platform for interest rate swaps in November 2010

FX Week Asia: Options clearing on hold, prime brokers confirm

FX clearing will be restricted to non-deliverable forwards as US authorities discuss whether settlement risk can be properly managed for cleared FX options, according to speakers at the FX Week Asia conference in Singapore

Emerging markets focus to boost NDFs despite clearing costs

The growth of the non-deliverable forwards market will not be hit by impending clearing laws

Spotlight on: Tony Dalton, Bank of America Merrill Lynch

Bank of America Merrill Lynch’s global head of foreign exchange prime brokerage talks to Joel Clark about the growth of the bank’s FXPB offering since the 2009 merger and the challenges of preparing for clearing of FX options and non-deliverable forwards

Clearing of Chilean NDFs hampered by netting uncertainty

The Central Bank of Chile has the authority to stop financial institutions netting down their transactions, which participants fear might prevent central counterparties from being able to clear contracts denominated in the Chilean peso

Morgan Stanley multi-manager platform goes head-to-head with Deutsche and Citi

FX Gateway, launched this week, will leverage Morgan Stanley’s prime-brokerage and distribution capabilities and give institutional investors direct access to up to 20 currency managers

Buy-side firms await regulatory clarity

Many buy-side firms are still holding back on introducing systems and processes for central clearing – but time might be running out

LCH.Clearnet eyes November launch for NDF clearing

London-based CCP is set to launch clearing for NDFs in six currencies in mid-November, having shelved plans for options clearing while banks discuss settlement-related issues with regulators

Spotlight on: Jon Hitchon, Deutsche Bank

The newly promoted head of Deutsche Bank Markets Clearing talks to Farah Khalique about the bank’s cross-asset clearing business and how it will compete with the derivatives clearing offerings of other top-tier banks

Regulation will reshape FX liquidity, says Rule Financial

Uncertainty about regulatory changes could hurt liquidity in the first instance, but the advent of Sefs might cause trade volumes to rise, according to consultants

Electronic FX trading in Asia may switch to multi-dealer platforms

The Asian FX derivatives business is expanding rapidly, driven by increased participation from financial institutions and hedge funds. While single-dealer platforms have increased market share over the past few years, incoming regulation could force FX…

Academic opposition to FX exemption debated at Isda’s Europe conference

Speaking in London on September 20, Craig Pirrong supports the unpopular position of fellow academic Darrell Duffie that FX swaps and forwards should not necessarily be exempt from the mandatory clearing requirements of the Dodd-Frank Act, as recommended…

Spotlight on: Stewart Macbeth, DTCC

Following the selection of the Depository Trust & Clearing Corporation and Swift to develop a trade repository for the FX market, the DTCC’s general manager for the global repository business talks to Chiara Albanese about its preparations to launch the…