Infrastructure

CLS to include Korean won

NEW YORK -- CLS Bank, which operates the continuous-linked settlement service for FX, will today announce its plans to include the Korean won as a CLS-eligible currency.

Online retail forex in Asia set to grow

TOKYO -- Online retail FX business in Asia is set to grow, as dealers increasingly move into the sector, market participants in the region told FX Week .

Uncertainty eases for AIG Trading

GREENWICH, CT -- The tension surrounding the upcoming merger of AIG Trading and AIG Financial Products has eased following the release of an internal statement earlier this month, a source at the firm told FX Week .

Basel may advise banks on outsourcing

BASEL -- The Basel Committee on Banking Supervision may investigate the risks associated with outsourcing trading systems to third parties, a senior Bank for International Settlement (BIS) official told FX Week .

Third-party CLS take-up slows

LONDON -- Take-up of the continuous linked settlement (CLS) service by third-party banks is slowing as a result of time-consuming back-office changes and a waning sense of urgency, CLS project managers have told FX Week .

Analysts cautious on US reflation

NEW YORK -- Federal Reserve chairman Alan Greenspan’s increased optimism in his testimony last Tuesday (July 15) prompted expectations that the US economy may finally begin the reflation process, but analysts advised caution last week.

Reuters sues Bloomberg

Trading technology rivals’ battle heats up over forex patent claims NEW YORK -- US trading technology firm Bloomberg could be forced to stop using parts of its FX matching and conversational dealing technology, if its UK rival Reuters succeeds in a…

Reuters sues Bloomberg

Trading technology rivals’ battle heats up over forex patent claims NEW YORK -- US trading technology firm Bloomberg could be forced to stop using parts of its FX matching and conversational dealing technology, if its UK rival Reuters succeeds in a…

ING to merge central European back offices

BUDAPEST – ING plans to set up a central European processing centre in Budapest by the second half of 2003, the bank announced last week. The move is part of a global strategy to reduce costs and increase efficiency by consolidating back-office functions…

CME brings futures to CLS

CHICAGO – The Chicago Mercantile Exchange (CME) has become the first exchange to use the continuous linked settlement (CLS) service, extending use of CLS into a new market.

CME brings futures to CLS

CHICAGO – The Chicago Mercantile Exchange (CME) has become the first exchange to use the continuous linked settlement (CLS) service, extending use of CLS into a new market.

Fimat forex launch in Poland

LONDON – Fimat Group, the brokerage arm of French investment bank SG, is developing new exchange-related FX futures contracts in eastern Europe in a bid to widen the currency product portfolio for its institutional client base, a senior official told FX…

FXall reaches profitability

New York – Multi-bank portal FXall now earns more than it outlays on a monthly basis, it said last week, over two years after its May 2001 launch.

Rupee options launch today

MUMBAI – Banks in India can start trading rupee/foreign currency options today, following the lifting of restrictions from the Reserve Bank of India (RBI).

Dollar still top currency for central banks

LONDON – Market speculation that central banks began rebalancing their reserves away from the dollar last year was misled, according to the Bank for International Settlements’ (BIS) annual report released last week.

Rupee options launch today

MUMBAI – Banks in India can start trading rupee/foreign currency options today, following the lifting of restrictions from the Reserve Bank of India (RBI).

Fed cut boosts dollar, but doubts remain

WASHINGTON, DC -- The Federal Reserve’s 25 basis point interest rate cut last week did little to excite the FX markets, and analysts said the US currency could be entering a period of consolidation.

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto

Politics mars eastern European FX process

BUDAPEST -- Political interference in Hungary’s monetary policy decisions could ultimately damage regional currencies and derail the accession process to the eurozone, analysts told FX Week .

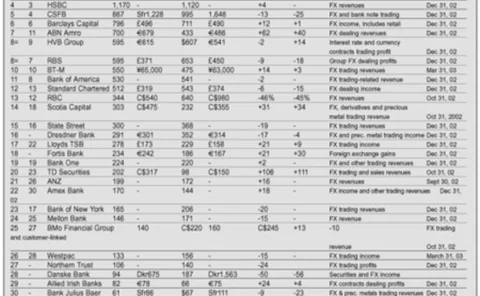

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Top three make biggest gains

LONDON -- FX traders are used to hearing about the growing dominance of the top five or 10 banks in foreign exchange. But according to FX Week ’s exclusive yearly round-up of banks’ forex revenues, the process of consolidation is accelerating much more…

Yen drives fund gains

STAMFORD, CT -- Movements in Japanese yen helped nearly 75% of currency managers on the Parker FX Index to record positive returns in April, while the index itself was up 0.9%.

Cashflow control for pension portfolio hedges

Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency Management, offers a solution to an FX-related problem facing a UK pension fund