Wholesale

Merrill Lynch reports record quarter

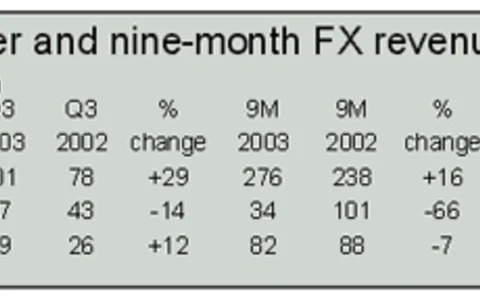

NEW YORK -- Merrill Lynch’s drive to become a major force in the FX industry appears to be bearing fruit, according to its third-quarter results.

FX shock from fund upheaval

TOKYO -- Massive upheaval in the Japanese pension fund industry is set to have major implications for forex flows and relationships, as the process of daiko henjo -- the return of public funds to the government -- gets underway.

China’s regulator publishes new derivatives guidelines

BEIJING -- The publication of China’s long-awaited derivatives regulations has moved a step closer, following the release of new draft guidelines by the country’s regulator, the China Banking Regulatory Commission (CBRC).

FSA warns of treasury management flaws

LONDON -- The Financial Services Authority, the UK regulatory body, has highlighted key areas of weakness in UK treasury management following a survey of banks and building societies.

ABN Amro’s new strategy products

SINGAPORE -- ABN Amro launched a new global FX research publication in Singapore last week.

NFA suspends California FX firm

CHICAGO -- Regulatory body National Futures Association (NFA) suspended California-based futures commission merchant FX First, effective September 26.

Nike, Refco make CLS choices

NEW YORK -- Top buy-side players Nike, the US training shoe manufacturer, and Refco, the Chicago-based futures broker have selected their partner banks for continuous-linked settlement.

Hantec’s online platform turns Japanese

HONG KONG -- Hong Kong trading firm Hantec International has gone live with a Japanese version of its online FX brokerage platform. "It’s very important for people to be able to use the platform in their native language," said Nelson Ho, project co…

Forex TV live with Saxo and MNI content

NEW YORK -- Forex Television, a joint venture between RDC Bancorp and eTV-Media, has integrated automated FX news and analysis feeds from Saxo Bank in Copenhagen and Market News International (MNI) in New York, officials at eTV-Media told FX Week .

CMC expects major growth in Asia-Pacific FX business

SYDNEY -- Online foreign exchange service provider Currency Management Corporation (CMC) expects to double the number of customers for its FX trading services in the Asia-Pacific by June 2004, according to a senior official at the firm.

Structurer/dealer link deepens

LONDON -- The relationship between structurers and FX sales dealers is becoming increasingly close, officials told FX Week , as banks seek to further improve their client service levels.

New fund taps computational trade models

MASSACHUSETTS -- US-based online futures commission merchant FX Solutions is set to launch a managed currency fund next week based on newly developed computational trading models, senior officials told FX Week .

Portals see record FX volumes

LONDON -- Heightened volatility last Tuesday (September 30) created one of the busiest days in years for FX trading, senior officials told FX Week . Electronic portals proved their worth, with many managing record spot volumes.

COESfx takes SEB’s FX pricing

NEW YORK -- Electronic currency network COESfx will go live with FX prices from the London-based merchant banking division of Swedish bank SEB next month.

Dealers raise thousands for children’s charity

LONDON -- City dealers and New York institutions raised $240,000 for London-based charity Children in Crisis (CIC) on September 18 through the charity’s inaugural Dealing for Donation day.

CLS adds new data link

NEW YORK -- CLS Bank will announce the launch of a new settlements directory for users of the continuous-linked settlement service (CLS) today (September 29). The new data is designed to aid straight-through processing rates and reduce operational risk,…

Deutsche merges Benelux FX

AMSTERDAM -- Deutsche Bank began a move to relocate its Benelux FX sales coverage to Amsterdam earlier this month, as part of its strategy to grow FX business across all client sectors, sources close to the bank told FX Week .

IASB favours banks, says Treasury Association Group

LUXEMBOURG -- The International Accounting Standards Board (IASB) is favouring the demands of banks and insurance companies over the interests of corporations, the International Group of Treasury Associations (IGTA) said last week.

Italians step up FX use

ROME -- Italian corporates have increased their derivatives use over the past 12 months as companies have honed their risk management skills to battle against currency volatility.

Cashflow considerations in currency overlay

Active currency overlay can reduce the risk of adverse cashflow arising from a strategic hedge, say Andrew Davies, director of capital market research, and Damhnait Ni Chinneide, portfolio manager at Lee Overlay Partners in Dublin

Banks offer capital intro to hedge funds

LONDON -- Investment banks are stepping into a new role by offering a capital introduction service to hedge fund clients in order to increase their business with them, officials told FX Week .

Appraising a decade of EBS

Forex market reflects on 10 years of the electronic broking duopoly LONDON -- On the tenth anniversary of the launch of EBS onto traders’ screens, the FX market has altered almost unrecognisably.

Middle East lures FX firms

BEIRUT -- The potential for growing business in the Middle East has this year brought two new firms to industry body ACI’s annual congress, which was held in Beirut last week.

Jobs to go in MMS/MCM merger

LONDON -- Job cuts at forex market commentary providers MMS International and MCM are "inevitable" as a result of UK publishing group Informa’s $37 million acquisition of MMS International last week, officials told FX Week .