Clearing and settlement

Traiana paves the way to client clearing with six top banks

Harmony CCP Connect service will enable top prime brokers to offer client clearing for NDFs later this year

Ice throws down FX clearing gauntlet to competitors

Competition in forex clearing intensifies as LCH receives regulatory approval and Ice explains how its rival offering will differentiate itself

CCPs need to provide margin efficiency, says industry panel

Central clearing will place a huge burden on end-users, forcing CCPs to consider how best to create operational and margin efficiencies

Esma under pressure to opine on asset-class specifics in Emir

A public hearing on Emir draft technical standards earlier this week leaves market participants with ongoing concerns over asset-class specifics and implementation timeframe

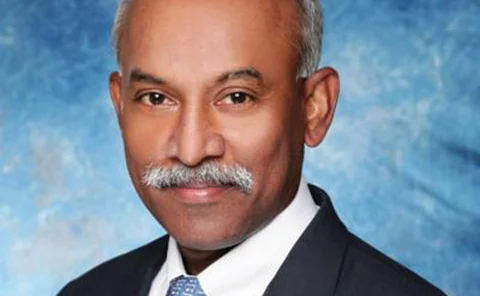

FSA: facing up to cross-jurisdiction conflicts

David Lawton, head of market infrastructure and policy at the UK’s Financial Services Authority, talks to Michael Watt

MarkitServ unveils middleware connectivity service for FX clearing

New middleware tool is launched today after MarkitServ won competitive tender process with the top banks and was certified by three FX clearers

The perils of one-size-fits-all

Regulators need to come up with a calibrated approach to calculating collateral requirements for uncleared derivatives, writes Joel Clark

FX Invest Europe: Investors back away from complex trades to avoid regulation

Some buy-side participants are moving away from complex FX options due to the uncertainty of forthcoming clearing and exchange trading regulations in the US and Europe, according to conference speakers

LCH’s ForexClear awaits regulatory approval

FX clearing platform for NDFs is ready for launch, pending regulatory approval, LCH.Clearnet confirmed in its annual report today

Emir clearing rules agreed, but calls grow for extension to Esma deadlines

Delays in the adoption of Europe's new clearing rules have eaten into the time Esma has to meet its June 30 rule-writing deadline

Afme liquidity conference: Costs of FX clearing will be punitive for all

The cost of implementing FX clearing and reporting services will be too high for more than a handful of top-tier banks to do it effectively, creating the possibility that demand might not be matched by supply, FX bankers warn

Greatest risk of regulatory arbitrage is for non-cleared FX, says Esma's chair

Bilateral collateralisation might not be applied to FX swaps and forwards under the Dodd-Frank Act, but will be applied in the European Union, says Steven Maijoor

FX clearing - the opportunity that never was?

Clearing of non-deliverable forwards has yet to get off the ground, despite clearers having switched their focus to the product during the course of last year

CME gives green light to Traiana for FX clearing

Traiana's clients will now be able to clear FX derivatives directly through its Harmony CCP Connect network

FX Week Europe: FX clearing has taken an illogical course, panellists warn

Non-deliverable forwards are the current focus for FX CCPs and banks, but panellists point out the risk in those products is negligible

Rationale for clearing all FX products is evident, say CCPs

Speakers at a conference in London discuss the exemption of FX swaps and forwards from mandatory clearing requirements

Battle for clearing supremacy

Singapore Exchange (SGX) became the first of the major clearers to launch an OTC Asian FX forwards clearing business in October. But with bank-backed LCH.Clearnet and the CME hot on its heels with a non-deliverable forwards offering, can SGX maintain its…

CFTC urged to rethink rules that threaten cross-margining

In a world where central clearing and bilateral collateral posting are mandatory, margin efficiency will be a big draw, and one obvious way to achieve it is through cross-product margining. Unfortunately, it is difficult to achieve – and Commodity…

CME vows to expand NDF clearing by year-end

Expansion of the exchange’s nascent NDF clearing platform to include a broader range of NDFs is set to begin within weeks, according to Roger Rutherford

Singapore Exchange preps FX clearing launch

SGX president says NDF clearing will begin shortly, following the successful launch of a clearing platform for interest rate swaps in November 2010

FX Week Asia: Options clearing on hold, prime brokers confirm

FX clearing will be restricted to non-deliverable forwards as US authorities discuss whether settlement risk can be properly managed for cleared FX options, according to speakers at the FX Week Asia conference in Singapore

Emerging markets focus to boost NDFs despite clearing costs

The growth of the non-deliverable forwards market will not be hit by impending clearing laws

Clearing of Chilean NDFs hampered by netting uncertainty

The Central Bank of Chile has the authority to stop financial institutions netting down their transactions, which participants fear might prevent central counterparties from being able to clear contracts denominated in the Chilean peso

Buy-side firms await regulatory clarity

Many buy-side firms are still holding back on introducing systems and processes for central clearing – but time might be running out