Central Banks

RBI's shift in monetary policy welcome, say traders

The central bank’s reduction in its marginal standing facility is positive for India’s growth, but the rupee is still exposed to external risks

Progress of RMB internationalisation ‘spectacular’, says SFC official

Speaking at the FX Week Asia conference, deputy chief executive of Hong Kong regulator highlights the importance of continuing to internationalise China's currency

FX Week Forum: Central banks and FX reserves

In the latest in the FX Week Forum series, Joel Clark talks to Steven Saywell, global head of FX strategy at BNP Paribas, about trends in central bank reserve management and the IMF's latest set of reserves data

Reserve managers seek alternatives to USD and EUR

Following the IMF’s publication of its FX reserves data for the second quarter, Steven Saywell assesses why reserve growth has slowed and central banks are looking to diversify

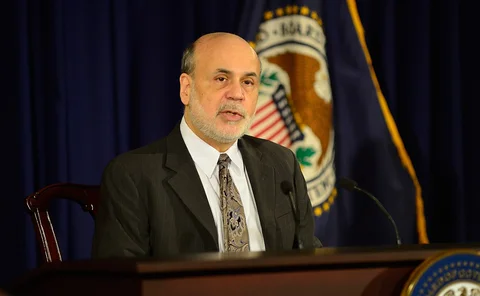

Dovish FOMC risks losing market trust

Federal Reserve's communication over tapering adds to market's growing mistrust of central bank information

Rupee sell-off continues, despite repeated RBI efforts

Efforts by the Reserve Bank of India to stabilise the currency's depreciation have failed, as the rupee falls to a record low

Weaker franc leads to speculation over future of SNB floor

Volatility has picked up in EUR/CHF this year, but traders believe the franc needs to weaken a lot more before the Swiss National Bank would consider easing its policy

Renminbi swap line expected to boost CNH liquidity

The recent agreement on a swap line between the UK and China will be a positive step for the nascent offshore renminbi market, although questions remain over how it will work

IMF gives its verdict on Abenomics

Article IV statement gives ringing endorsement to QQE in Japan; says ‘spillovers' may have adverse near-term effect on neighbours, but will be offset by benefits of economic strength in Japan

Traders surprised by Australian rate cut

Reserve Bank of Australia's decision to cut interest rate to 2.75% came earlier than traders expected

France leads eurozone in Chinese renminbi payments

Aims to promote Paris as an international hub for the renminbi are paying off, as France sees a 249% increase in yuan-denominated transactions

FX Invest North America: Central banks ‘getting away with murder’

Central banks are pursuing the wrong policies and will find it difficult to know when to tighten monetary policy, says Axel Merk at Merk Investments

Reserve managers avoid Bric currencies despite increase in risk appetite

Central banks look to diversify reserves in search of higher yield, but still consider emerging market currencies too risky

Depositors will trust EU guarantee despite Cyprus, says BdF official

Policy-makers have incentive to accelerate deposit guarantee plans, says Sylvie Matherat of the Banque de France

Nalm 2013: Debate rages over how to manage expanding reserves

Central banks enter into new asset classes and alternative currencies but Bank of Israel’s Andrew Abir rejects value of renminbi as a reserve currency

Central banks grapple with risks arising from FX reserves

Holdings of foreign exchange reserves at central banks has increased since the crisis, and market participants believe diversification into new currencies could now pick up

BoJ's inflation target unattainable, says Nomura

Panellists at Bloomberg event yesterday debated whether the yen will continue to weaken as the Bank of Japan pursues an ambitious 2% inflation target

Bank of England swap line expected to fuel RMB growth

The creation of a swap line with the People's Bank of China should lead to greater confidence in the offshore renminbi market, according to traders and strategists

Perception of EM risk reduced by central bank safety net - investors

Large foreign exchange reserves held by emerging market central banks makes investing in those countries attractive, say panellists at FX Invest Europe

Currency war scenario ‘exaggerated’, warns senior Swiss economist

Central banks are pursuing domestic priorities and are not engaged in competitive devaluation, says keynote speaker at FX Invest conference

Bank of England to establish RMB swap line

Ten months after the UK government launched an initiative to make London a centre for offshore renminbi business, the Bank of England has started much-anticipated discussions over a renminbi swap line

SNB to open Singapore branch to support FX activity

Swiss central bank has diversified its reserves into a number of Asian currencies in recent years and will open an office in Singapore by mid-year

Aussie dollar remains strong after RBA rate cut

The Australian dollar rallied after the RBA rate cut on Tuesday and strategists expect interest rates to remain at 3% for the next six months, supporting further strength