Joe Parsons

Deputy editor – Markets

Joe Parsons is deputy editor on the Markets desk. Joe was formerly deputy editor at Global Custodian, and prior to that he was at The Trade.

Follow Joe

Articles by Joe Parsons

Bank ALM crisis leaves FX hedgers with steeper roll costs

Spreads on EUR/USD forwards jumped more than fourfold in past two weeks

Mutual funds dump two-thirds of FX options positions in Q4

Counterparty Radar: Morgan Stanley Investment Management leads fall in volumes with big cuts to RMB trades

Tales from the crypto prompt calls for FX-style market structures

Demands for interdealers and prime brokers to be brought into crypto market in wake of FTX debacle

Pimco nearly halves FX forwards book in Q4

Counterparty Radar: West Coast manager’s 45% cuts send Morgan Stanley to fifth place in dealer rankings

Refinitiv’s FXall launches automated forward fixing tool

New service offers asset managers automatic competitive pricing for a benchmark trade’s forward points

Fenics’ Kace launches FX options OMS

The system will help regional banks tap white-labelled liquidity from a single access point

Liquidity drops 80% on dealer balance sheet constraints – BIS

Study finds top-tier banks are more likely to pull back when leverage and funding costs spike

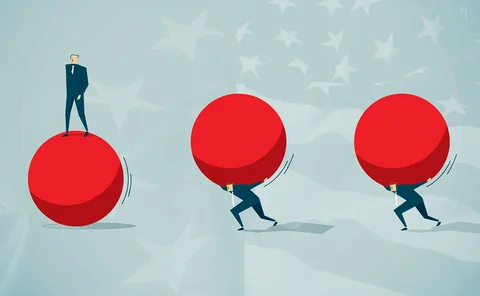

P2P platforms look to bring banks into the fold

The USP of peer-to-peer FX matching venues is that they cut out the middleman. So why are they now inviting them in?

Dealers eye benefits of ‘on-chain’ FX

Automated market-makers are already used for EUR/USD trades – now can they tackle settlement risk?

EBS ventures into crypto market with upcoming NDF

The move could be a big step forward for mainstream adoption of crypto NDF trading

Living with SA-CCR, one year on

Collateral agreements and FX futures may be some of the ways to tackle increased capital costs

Credit Suisse shakes up top line in new-look FX division

Swiss bank draws on electronic macro business for FX leadership roles

Hedge funds push yen options bets to next BoJ meeting

Target shifts as vol punts on change to rates policy fall flat

New buy-side tools seek to break grip of bank FX algos

Proprietary algorithms come of age to provide alternatives for the buy side

ANZ defies ‘white label’ trend with algo expansion

Instead of relying on large LPs, Australian bank aims to offer six new FX algos of its own by February

SA-CCR gives RBC a chance to prove its worth

RBC attempts to entice buy-side clients with aggressive FX forwards pricing strategy

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move

Former StanChart FXPB head emerges at StoneX

Prime services co-head leaves for StoneX EMEA expansion role

Senior FX exec for buy-side sales departs Citi

Caryn Freiberger most recently led North America FX sales for real money clients

FX primary venues seek reversal of fortunes

EBS and Refinitiv fight to restore market share – but bilateral trading may be too entrenched, dealers say

CME eyes retail growth with new weekly FX options

Exchange hopes to capture massive demand from the sector

Should RMB be treated as a G10 currency?

As it becomes the fifth most-traded currency, dealers weigh pricing and risk managing RMB like a G10 equivalent

European corporates scramble for alternative credit sources

Credit lines with traditional bank counterparties exhausted since dollar rally against euro