smartTrade is observing a significant trend among its clients and prospects: banks are increasingly enhancing their sell-side front office offerings by incorporating more sophisticated products such as FX options into their end-client solutions

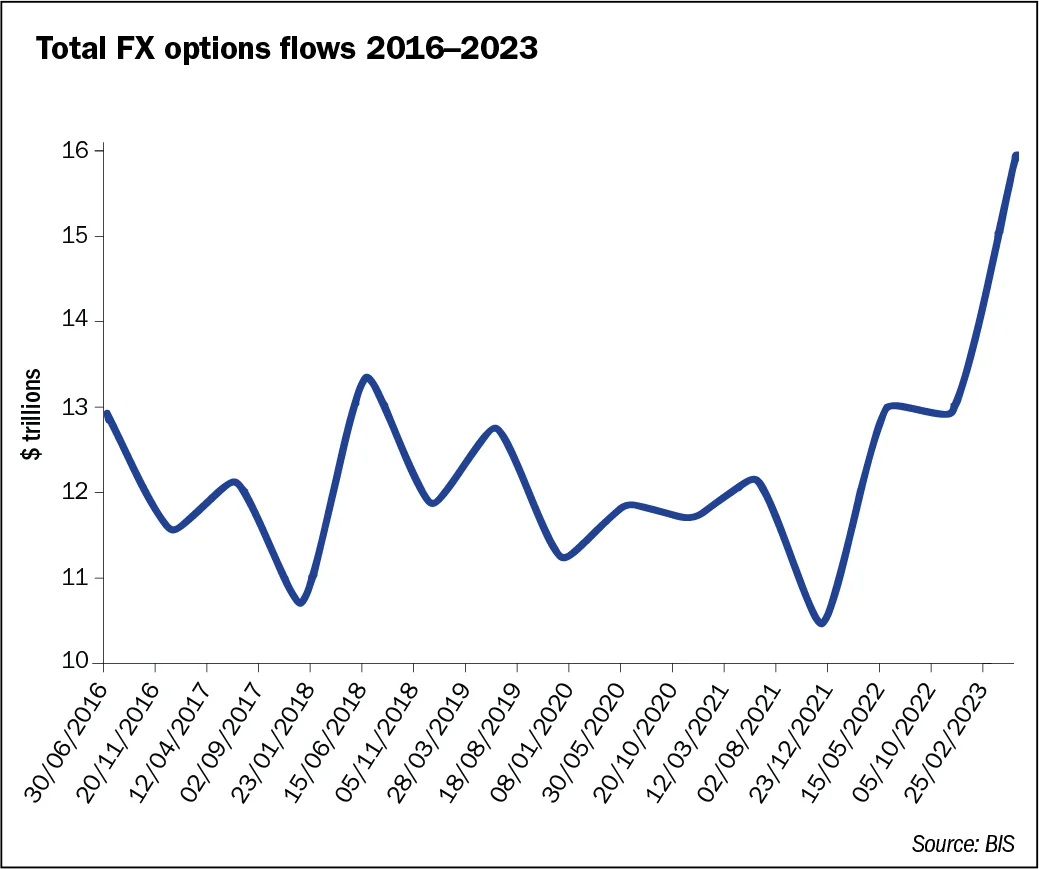

According to data from the Bank for International Settlements (BIS) OTC derivatives statistics report, FX derivatives volumes grew 12% in the first half of 2023 to reach $120 trillion. Within this, FX options volume has increased significantly over the past five years, and it is expected to grow further.

This shift is driven by the dual forces of client demand for more sophisticated hedging tools and the need to diversify revenue streams as more established products become more commoditised. As banks adapt to these evolving market dynamics, it is essential to understand the factors at play and the strategies being employed to stay ahead of the curve.

Client demand and revenue diversification

Clients are seeking flexible and cost-effective solutions for managing FX risks. Traditional hedging tools, such as forwards and swaps, are being supplemented by options because of their inherent advantages in flexibility and potential cost savings. The appeal of options lies in their ability to provide tailored risk management strategies that can better align with the varying risk profiles and market views of corporates.

Banks are recognising the need to diversify their sources of revenue as spot FX spreads tighten. Options, particularly those embedded in structured products, offer higher margins compared to more commoditised instruments. This profitability, coupled with growing client interest, is compelling banks to expand their options offerings.

From voice trading to electronification

Historically, options trading was managed primarily through voice trading, involving manual processes that were time-consuming and prone to errors. However, the landscape is rapidly changing as banks move towards electronification of their FX options workflows. For forward-thinking institutions, the shift to electronic trading is not just a matter of operational efficiency, but also a strategic necessity to remain competitive.

Electronification enables banks to streamline their trading processes, reduce operational risks and offer faster, more reliable services to their clients. It also provides the infrastructure to support more complex and high-volume trading activities, which are essential in today’s fast-paced market environment.

Expanding options offerings

Previously, offering robust options support was seen as the preserve of larger, more sophisticated banks. However, advances made by smartTrade’s research and development have levelled the playing field. Today, banks of all sizes can offer not just vanilla options, but also more complex exotic options, and soon even structured products. This development allows smaller and regional banks to compete more effectively and provide comprehensive solutions to their clients.

Strategies for integration

Banks are adopting various strategies to integrate options into their front-office offerings. Some are leveraging third-party options pricing engines, combining these with distribution frameworks, such as those provided by smartTrade, to enhance their in-house capabilities. This approach allows banks to maintain control over their pricing strategies while benefiting from advanced technology solutions.

Others are opting to outsource the entire pricing and risk management functions, aggregating options liquidity from multiple sources to offer competitive pricing to their clients. This direct market access model, developed by smartTrade in partnership with a number of global banks, is particularly attractive for smaller and regional banks, which may lack the resources to develop comprehensive in-house solutions but still wish to provide a full spectrum of services to their clients.

smartTrade’s comprehensive trading platform

smartTrade is unique in its ability to offer a trading platform that allows banks to distribute such a wide range of instruments and product types. The platform already supports FX spot, forwards, swaps, money markets, non-deliverable forwards, non-deliverable swaps, precious and physical metals, cryptos, futures and now additional option types. This comprehensive coverage ensures banks can meet the diverse needs of their clients and operate efficiently across multiple markets.

smartTrade’s role in navigating trends

As a market leader in the electronic trading solutions space, smartTrade is uniquely positioned to assist banks in navigating these trends, given its track record and rich offering, with many clients already distributing FX options alongside other instruments. smartTrade’s technology enables banks to integrate options into their front offices seamlessly, whether through in-house development or outsourced solutions. smartTrade provides the tools necessary for banks to enhance their electronic trading capabilities, ensuring they can meet client demands while maximising profitability.

smartTrade’s solutions offer robust and flexible frameworks for options trading, allowing banks to scale their operations and adapt to market changes efficiently. By partnering with smartTrade, banks can leverage cutting-edge technology to stay ahead of the competition and deliver superior value to their clients.

Conclusion

The integration of options into banks’ sell-side front-office offerings is a clear response to market demand and a strategic move to broaden revenue generation as commoditised product margins compress. The shift from manual, voice-based trading to electronic trading represents a significant transformation in the industry, driven by the need for efficiency and accuracy. At smartTrade, we are ready to support banks in this journey, providing the expertise and technology required to thrive in the evolving financial landscape.

As banks continue to innovate and adapt, those that embrace these changes and leverage advanced technology solutions will be best positioned to meet the demands of their clients and achieve sustainable growth.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com