Vikram Srinivasan, head of spot product at 360T, argues that using technology to reverse the trend of liquidity fragmentation in FX will ultimately benefit market participants.

One of the unique things about FX as an asset class is the range of participants it attracts and the diversity of their trading intentions.

Unlike equities, for example – where assets are generally bought and held in the expectation that their value will increase – participants approach the FX market for a wide variety of reasons: to meet payrolls outside of their domestic jurisdictions, hedge existing international exposures, facilitate investment in foreign assets, diversify portfolios with non-correlated assets, speculate on geopolitical events. The list is extensive.

Such diversity of intentions also means there is an equally wide array of expected outcomes to be catered for, such as transparent execution, the prevention of information dissemination, low-market footprint, passive execution, private negotiation, and so on.

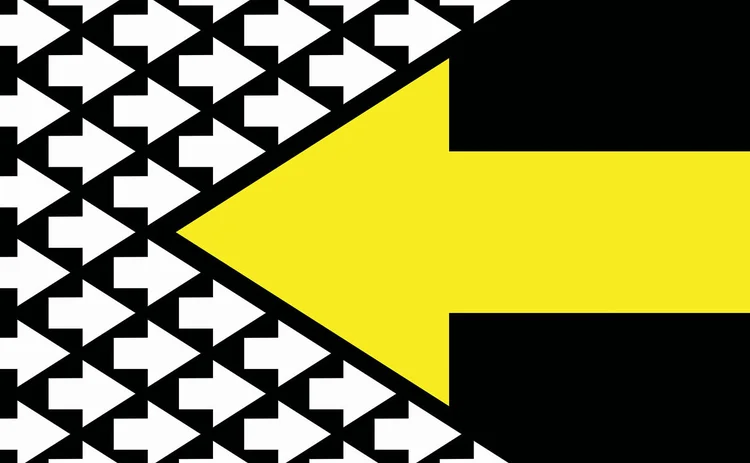

To accommodate this, FX venues have traditionally created distinct market models specifically designed to suit the varied intentions and expected outcomes of different types of trading activity. And, while this approach makes sense, because this diversity creates a genuine need for different market models, the problem lies in the implementation of these different models having effectively walled off the liquidity within each model.

These artificial barriers to access and participation are compounded by more fundamental constraints around credit, and the result of this is that liquidity has become more fragmented, which is clearly not optimal for facilitating efficient risk exchange.

Bridging liquidity pools

There is a sense that the FX market has tolerated this trade-off, but clearly a better solution would be to enable this liquidity to interact without compromising expected outcomes or affecting trading styles.

Fortunately, just as technology has fragmented liquidity pools, it can also be used to bridge them. Today we see an opportunity for technology to be used to consolidate and enhance liquidity, by preserving and standardising the access that fostered such unique liquidity within each market model. Efficient utilisation of credit further enhances the potential benefits to liquidity.

For example, imagine a lit book that offers transparent executions also offering discreet offset among large dark risk at the mid of the lit book without impacting the print. Imagine further that the large risk preserves the queue position and opportunity for passive execution through safe and controlled display of interest within the lit book. This is just one possibility that such a technology consolidation could enable.

But, in reality, this is more than just a technology proposition.

Understanding the value proposition

For starters, there needs to be a significant amount of unique liquidity and a wide variety of market participants with uncorrelated order flow available to make the endeavour worthwhile. There is a clear and important difference between a franchise that already offers a value proposition for a range of different client types that are executing through anonymous and disclosed channels, and a historically anonymous venue that is now leveraging its pipes to offer a point-to-point utility service between its few existing, and largely similar, participants.

The real value lies in bringing together the participants that have historically driven much of the spot FX trading on the active market venues and electronic communications networks with the buy-side franchises that typically do not trade on these platforms. To this end, there has been some debate in the FX industry around whether disclosed trading volumes have grown at the expense of anonymous trading. But perhaps this is the wrong lens through which to view this market. Rather than thinking of it as a zero-sum game, imagine if these liquidity pools could safely and effectively interact with each other, creating symbiotic growth.

While the first step is to begin linking pools of spot liquidity, the goal must be to integrate other products as well. FX futures and non-deliverable forwards are the most obvious candidates, given the relevance they have for price discovery and hedging within the FX market. A consolidated technology vehicle can allow liquidity to seamlessly float between these markets through synthetic instruments, for example.

As an industry, we have spent years building out these siloed pools of liquidity that cater to the specific needs of different market participants, becoming ever-more proficient at catering to their specific execution demands. The next stage of evolution is to stitch these fragmented pools together through unified, high-performance technology that protects the different interests of these market participants, creating a marketplace that will add more value than the sum of its constituents.

And this evolution has already begun.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com