Coronavirus

FX hedge ratios fall across top 10 US managers

Counterparty Radar: Proportion of forwards to assets has been sliding since Q3 2020, but some firms buck trend

CFTC urged to take lead on CCP margin models

Advisory committee unable to agree steps on margin period of risk, model transparency

Regulators voice concerns over cloud risk

Risk USA: failure of big cloud service provider could cause “a very large shock”, says NY Fed exec

Mifid best execution relief for buy side hangs by a thread

Largest grouping in European Parliament faces uphill battle to suspend RTS 28 reporting

How Shell integrated FX algos into its corporate treasury mix

Interview: oil giant puts up to 50% of spot flows through algos, explains FX head Michael Dawson

MUFG: Covid response could spur e-FX shift in Japan

FX head says operational agility during pandemic could lead to greater electronification

How Covid-19 exposed the fragility of FX options liquidity

Simon Nursey at Digital Vega digs into the data to reveal the lessons of the March shock

FX research bounces back amid volatility

Dealers report sharp rise in client demand for research

Appetite for renewed Fed dollar swap lines in doubt

With up to $300bn of positions nearing expiry, some say FX swap market can meet banks’ funding needs

Navigating uncharted markets with FX algos

BNP Paribas's Asif Razaq describes traversing Covid-troubled waters with execution algorithms

Turkey turmoil opens door to offshore NDF market

Emta openly discussing documentation for offshore lira

BLTs and glitchy Wi-Fi: lockdown life for FX execs

With traders transacting trillions from their living rooms, currency markets are adapting to new normal

A gradual return from shorts to suits

Market moved to home-working for resilience – it may linger for convenience

Andreas König’s crisis playbook meets Covid-19

Interview: Trading from home may be odd, but Amundi’s FX head was ready for other stresses

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

Investors trade the drama out of the crisis

How LGIM, AXA, Manulife and other buy-siders tackled the toughest markets since 2008

Market turmoil causes traders to pull back to vanilla strategies

Emerging markets spreads tighten but liquidity still patchy

NDF access will help tame rupee volatility, say dealers

Lifting of restrictions stopping Indian banks trading rupee NDFs allows RBI to intervene offshore

FX options, NDFs trading slows as Covid fears ease

Analysis of transaction data shows lower notional volumes and tighter spreads for most currency pairs

Buy side eyes outsourced trading amid Covid disruption

Pressure on trading continuity drives in-house desks to look outwards

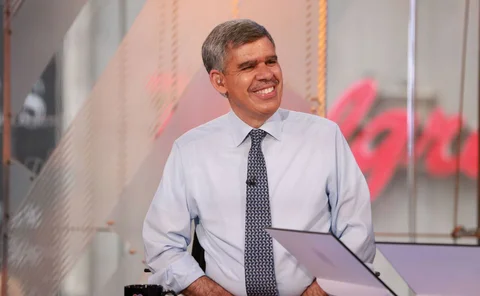

El-Erian on Covid-19 policy risks and ‘zombie’ markets

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load