CCP

Indonesian CCP seeks thumbs-up from US, UK and Japan

Growing foreign bank interest pushes IDClear to pursue regulatory approval overseas

Industry urges focus on initial margin instead of intraday VM

CPMI-Iosco says scheduled variation margin is better than ad hoc calls by clearing houses

Emir 3.0 threatens lag for Simm revisions

New EU rules could stall changes aimed at improving risk sensitivity of industry margin models

US dealers slam capital hit on clearing for unreal CVA risk

Fed would diverge from Basel standards by imposing CVA capital on client-cleared trades

Dealers braced for Taiwan swaps clearing mandate

Expected FSC directive on TWD interest rate swaps could spur growth in FX clearing, say bank execs

Clearing members fear CFTC bending rules for crypto

Critics warn new framework for Bitnomial and LedgerX could undermine clearing integrity

Citi and JP Morgan vie to extend collateral optimisation to CCPs

High rates and increasing collateral requirements have ignited race for greater efficiency

Bloating CCP default funds. New margin models. Are the two linked?

Dealers grumble that greater guaranty fund payments could undermine the ‘defaulter pays’ principle of clearing

Clearing members combing rule books after LME lawsuit win

Industry debates whether other CCPs and exchanges would cancel trades if faced with similar crisis

UK to permanently recognise US CCPs

Regulators also launching review on long-term status of UK pension fund clearing exemption

Operational hurdles slowing buy-side NDF clearing uptake

FX Markets USA: Artisan Partners’ O’Brien says problems must be tackled to make clearing more attractive

Late EU clearing house recognition spooks dealers

Bank capital requirements on exposures to affected foreign CCPs could jump after June 28 deadline

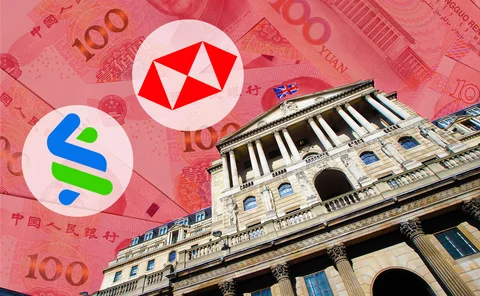

HSBC, StanChart face capital hit on cleared renminbi trades

Lack of UK recognition for Shanghai Clearing House could prompt banks to reduce exposures

Margin rules lead to rise in Asian NDF clearing volumes

LCH and Eurex position themselves for NDF clearing uptick ahead of next UMR phase

Futures aim to put a dent in FX swaps supremacy

Advent of margin rules sharpens appeal of exchange-traded instruments for buy-siders

CFTC rule change sparks dealer-client margin scuffle

FCMs fear “race to the bottom” as funds lobby dealers for lower margin status

CFTC urged to take lead on CCP margin models

Advisory committee unable to agree steps on margin period of risk, model transparency

HKEX to clear SOFR cross-currency swaps from early 2021

Legacy Libor cross-currency swaps could move to SOFR discounting at the same time

LCH to accept Sing dollar bonds as collateral

Singapore’s banks hope move will ease margin funding burdens, and speed direct membership

The FX swaps client clearing comeback

With possible price savings and non-bank competition, chatter about the service is picking up again – but significant hurdles remain

Goldman signs up as NDF client clearer at LCH

US bank expecting jump in cleared trades when initial margin rules hit buy side