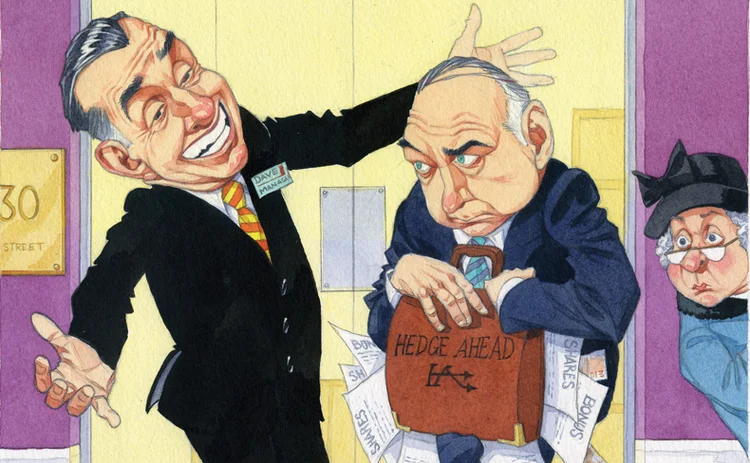

Ban on rehypothecation could increase derivatives costs

Clinging to collateral

The final version of the Dodd-Frank Wall Street Reform and Consumer Protection Act is 848 pages long, but you might not think so from reading media coverage of its passage into law. Much of the attention has focused on the clearing obligation for certain over-the-counter derivatives, the inclusion of the Volcker rule, and a requirement to split particular derivatives operations into separate affiliates. But the act, which passed into law in July, contains much, much more – and plenty of it will

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Collateral Risk Management

StanChart prime services to accept Chinese bonds as collateral

Inclusion will reduce collateral drag for PB clients ahead of stricter initial margin rules

CloudMargin secures $10m to fund growth

Provider of collateral and margin management deepens relationship with IHS Markit

Buy side explores cloud for collateral management

Asset managers with FX positions are looking at cloud-based solutions as a means of coping with variation margin rules

Lombard Risk launches buy-side collateral management tool

As asset managers and investment firms prepare for uncleared margin rules due in March 2017

Banks push for greater adoption of two-way CSAs

The Bank of England's decision in 2012 to start using two-way collateral model fails to spur change, and traders are calling for more to adopt the model

CFTC's Gensler defends swaps vs futures margin disparity

Forthcoming Sef rules will not address margin concerns raised by Bloomberg

Basel Committee and Iosco reopen FX exemption debate

A second consultative document from the Working Group on Margining Requirements gives the industry until March 15 to make its case again for an exemption from mandatory margin

‘Near-final’ margin rules to be issued within days, says Iosco chief

Secretary general of Iosco confirms that further work is needed to assess the economic impact of margin requirements for uncleared derivatives