This article was paid for by a contributing third party.

FX market structure in flux – The future of FX derivatives markets

Executive summary

Ten years on from the financial crisis, a wave of global regulation is reshaping the FX market structure. New, non-traditional market-makers are filling the vacuum created by the pullback of many wholesale banks, in effect fragmenting the liquidity pool. At the same time, trading and operational cost pressures – and complexities – are accelerating the quest for more efficient, lower-cost technologies.

Central clearing is one of the major beneficiaries of this changing landscape, providing capital, margin and operational efficiencies. The arrival of uncleared margin rules and the phasing-in of initial and variation margin requirements have accelerated the trend toward central clearing, as have the benefits of tools such as compression and netting. The trend towards clearing is most pronounced in non-deliverable forwards (NDFs), where centrally cleared interbank volumes have risen from 3% of the total market to more than 50% in just two years.

Clearing benefits, particularly lowering costs, have driven dramatic growth in the volumes traded in NDFs – the only over-the-counter (OTC) FX product to clear in volume to date – while the rest of the FX market has seen relatively stagnant volumes over the past two years.

The surge in cleared NDF volumes is likely to be replicated by FX options, following the introduction of a physically settled FX options clearing solution in July this year, with market volumes potentially rising in response.

Survey

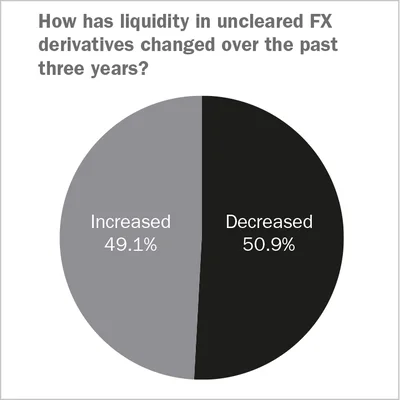

A recent survey of 152 market participants by FX Week revealed sharp discrepancies in how the industry views structural changes that have taken place in the FX market over the past decade. The nature of liquidity provision is a good example of this, with respondents split almost equally between those that think liquidity has increased and those that see a deterioration.

As banks have retrenched following the implementation of the Volcker rule, the introduction of swap-execution facilities in the US and multilateral trading facilities in Europe is further automating the marketplace creating an opportunity for non-bank liquidity providers (NBLPs). As a result, these firms have made major gains over the past three years, with five of them in the top 20 of the 2018 Euromoney FX rankings survey.

While the number of these market-makers is increasing, half of respondents to the FX Week survey reported access to liquidity in bilateral markets as being more difficult than three years ago, with around 23% citing this as a key reason for their dissatisfaction with the current market.

Higher capital costs that filtered through to increased trading costs were another key focus, along with the lack of an efficient matching, clearing and credit platform that combines these functions. This concerned response was offset by the 60.6% of respondents who reported that today’s FX derivatives market was functioning robustly, 80% of whom gave credit to the arrival of NBLPs.

Clearing in vogue

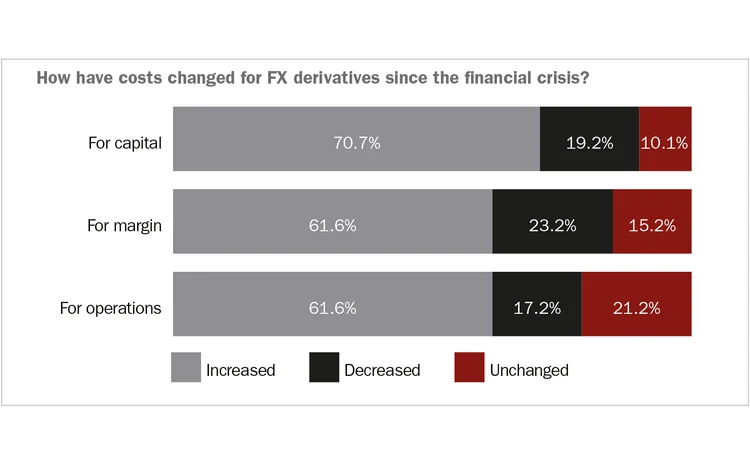

It’s not just in the provision of liquidity that widespread change is being seen. Since the financial crisis, capital costs have risen for more than 70% of survey participants, while margin and operational outlays crept up for more than 60%, despite the availability of new, more efficient tools such as NDF clearing, compression and optimisation. Market infrastructure providers have also been working towards delivering a clearing solution for FX options – a plan that is finally becoming a reality. Even in the absence of a clearing mandate, NDFs have rapidly moved to a predominantly cleared model.

The numbers are compelling. According to a Bank for International Settlements report, only 1% of notional OTC FX trading amounts were centrally cleared at the end of December 2016, whereas between 17% and 30% of the overall NDF market was cleared as of March this year, according to Clarus Financial Technology. This surge in NDF clearing represents an 80% increase in monthly clearing activity in 2018 on the previous year, with 97% of this activity taking place at LCH ForexClear.

Capital drivers

Clearly, one major factor behind the surge in clearing activity is the bilateral margin rules for uncleared derivatives, but liquidity conditions and rising capital costs – as well as the complexity created by dedicated trading facilities – have also added to the pressure to move to a cleared model.

Operational costs rose for 61% of respondents, while more than 70% said capital costs are higher in the bilateral world – highlighting the scale of the benefits of central clearing.

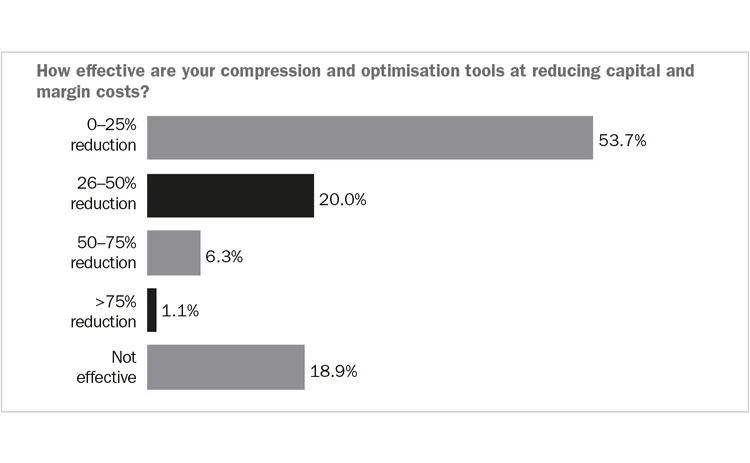

To alleviate the higher costs of trading in bilateral OTC markets, infrastructure providers and platforms have come up with a range of tools. These compression and portfolio optimisation solutions have allowed market participants to reduce net notional, resulting in improved capital usage, regulatory leverage ratios, lower operational risk, and limited counterparty exposure and credit risk. However, as the survey reveals, most participants see a benefit of a 0–25% reduction in costs from optimisation – a fraction of what is available from clearing. The benefits of clearing are only likely to increase as the uncleared margin rules roll out across all market participants, providing ever greater opportunities for netting.

Regulatory impact

FX derivatives markets have always been highly customised in terms of product specifications, terms and tenures.

Variation margin (VM) requirements under global regulations require in-scope counterparties to exchange margin on OTC derivatives contracts that are not cleared through a central counterparty. These rules were implemented in March 2017 and, since then, market participants trading OTC have been obliged to exchange VM, based on exposure at the time and calculated using a mark-to-market position.

The rollout for initial margin (IM), meanwhile, started in September 2016 and will catch all entities by 2020, with the timing dependent on entities’ bilateral notional outstanding. IM covers potential future exposure for the expected time between the last VM exchange and the liquidation of positions on the default of a counterparty.

Market participants need to post IM for FX options, NDFs and other cash-settled FX forwards and swaps under both European Union and US laws, while VM requirements apply to these products as well as to physically settled FX forwards and swaps.

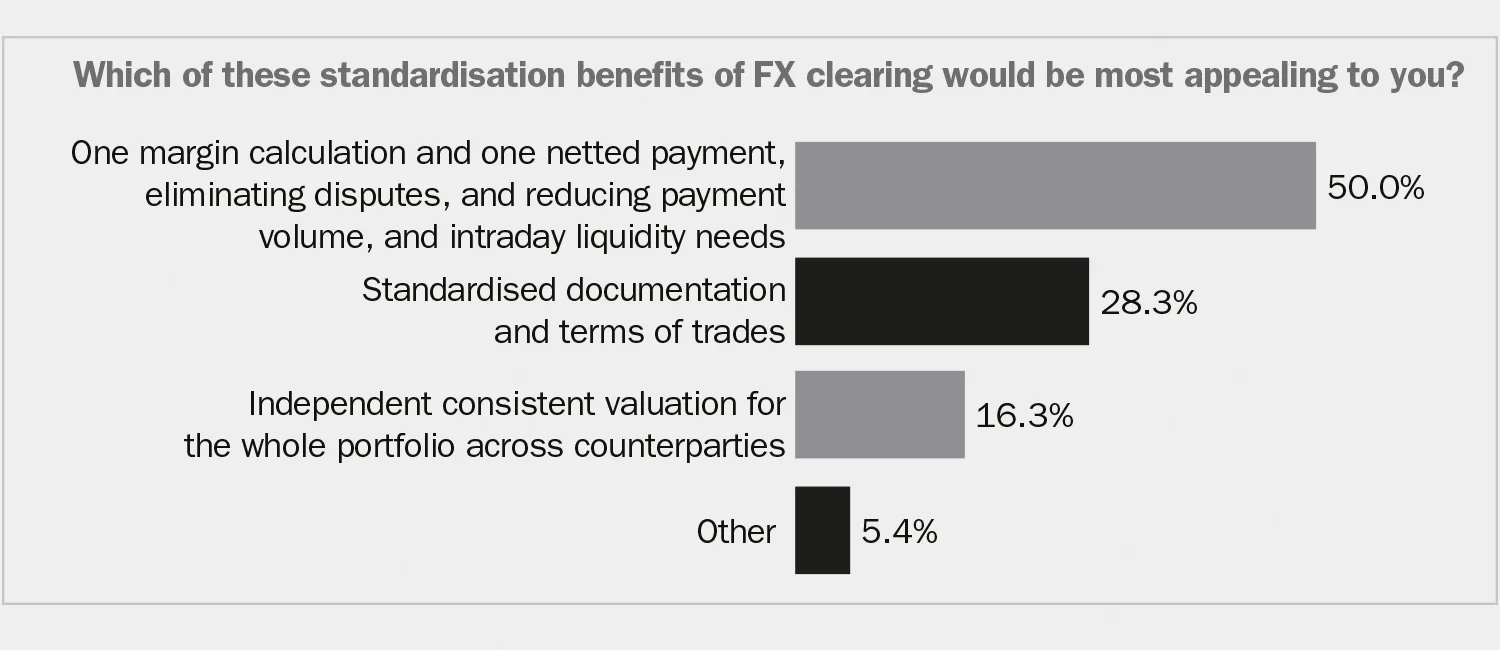

The bilateral margin rules haven’t just added to costs – they have also put a heavier operational burden on market participants choosing to trade bilaterally. Indeed, two-thirds of respondents said clearing can reduce their risk, payment volumes and intraday liquidity needs, as well as eliminate disputes and reconciliation issues as a result of being able to perform one margin calculation and one netted payment.

Download the survey report at Risk Library

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com