SGX AsiaClear aims to be Asia's CCP for rates and FX swaps

AsiaClear, the over-the-counter derivatives clearing arm set up by the Singapore Exchange (SGX) in 2006, has moved a step closer to becoming the regional central counterparty (CCP) clearer for both Singapore and US dollar interest rate swaps for Asian local banks that are not members of global independent clearers, such as the LCH.SwapClear.

SGX president, Muthukrishnan Ramaswami, said OTC interest rate derivatives will start being cleared the week of October 18, subject to securing final

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Exchanges

Moscow Exchange expands Asia and Middle East presence with Avelacom

Co-operation with tech firm lets exchange improve PoP in London, reducing latency by five milliseconds

Crypto to look more like FX market in 2019, says B2C2

Over-the-counter tipped to gain in importance, but faces funding and credit constraints, says cryptocurrency market-maker

SGX snaps up 20% stake in BidFX

Exchange invests $25m in TradingScreen spinoff, expects to boost liquidity by adding OTC to FX futures

CBOE pulls plug on bitcoin futures trading

First mainstream exchange to offer bitcoin futures calls halt as it reviews approach to crypto

Independent Reserve joins OTCXN network

Australian crypto exchange joins to attract more institutional liquidity

CME to retire Nex, revives EBS as sub-brand

The deal between the two firms will go ahead after full regulatory approval in all jurisdictions

CME shifts FX options expirations in step with OTC

Latest move by exchange to make FX offering more harmonised and engaged with over-the-counter space

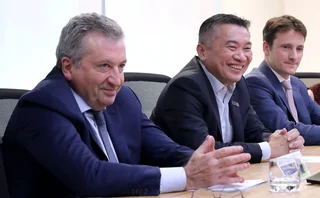

SGX’s Lam in bid to bring together two worlds

SGX set to launch FlexC FX Futures in August, with the aim of combining the best that OTC and futures have to offer