This article was paid for by a contributing third party.

Smarter trading in a fragmented world

Read/download the white paper at Risk Library

FX Week recently hosted a webinar in partnership with Refinitiv to ask FX industry leaders to discuss geopolitical challenges, market changes and developments, and evolving technologies, and how they have shaped FX markets in Asia.

The panel

- Ken Cheung, Chief Asian FX Strategist, Mizuho Bank

- Leo Tay, Head of FX Trading Asia, ING Bank

- Selene Chong, Head of Global FX and Commodities, Asia-Pacific, HSBC

- Jonathan Woodward, Head of Asia-Pacific, Transaction Sales, Refinitiv

- Moderator: Brandon Kirk, Contributing Editor, FX Week

The audience for the interactive webinar comprised 48% sell side, 20% buy side and 33% other.

How are macroeconomic factors affecting the FX market in Asia?

While the global outlook for growth has been slowing, traders expect more capital to continue flowing into Asia, despite a slowdown of China’s GDP growth below to 6%. Other indicators to consider include central bank policies including potential increases in fiscal spending. Asia still has the potential for greater returns, notwithstanding trade tensions affecting currency markets.

At this point, I feel there’s a certain level of ‘market fatigue’ in terms of reaction to news related to Brexit and the US–China trade war; the reactions we’re seeing in the market have been a lot less volatile

Leo Tay, ING Bank

What currency pairs and types of contracts are seeing the most activity?

With huge potential growth in the volume of renminbi trading, the ongoing trade war is unlikely to stop capital inflows – especially via passive investment – as the Chinese government is determined to open up its equities and bond markets to foreign investors. With further global inclusion, FX hedging needs will continue to grow, as will the forwards and spot market for renminbi.

Meanwhile, other emerging economies in Asia stand to benefit from the trade war, and their currencies may gain more attention in the coming year. Regulations on over-the-counter clearing are resulting in more interest in exchange-traded products such as FX futures.

It’s just the natural progression of things … We’ve seen a lot of people adopt that auto-execution capability, where they get thousands of trades done over hundreds of accounts really efficiently

Jonathan Woodward, Refinitiv

Will smart execution and smart order types become more prevalent in the future?

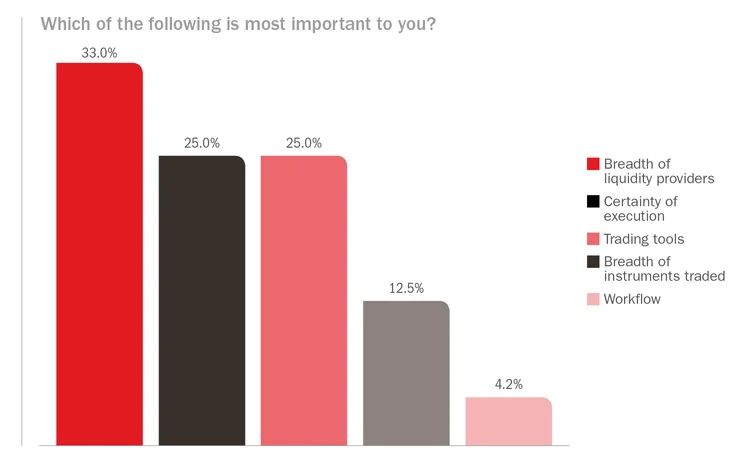

As noted in a recent FX Week survey, at least half of traders in the region believe this will be the case in the next 18 months. The many benefits are in line with the development of the market, which is following the global trend towards greater reliance on technology and automation of orders.

Smarter execution can be of particular help when algorithmic strategies take into account the different behaviours of different venues, or different order functionalities, and can help minimise market impact, allow for pre-trade analytics and reduce execution costs. The volume of algorithmic trading has dramatically increased over the past year globally, as well as in Asia‑Pacific.

Banks are increasingly relying on algorithms for auto-execution, particularly of smaller orders, allowing them to more efficiently access multiple venues for the best available price in a low-touch environment. It also allows for breaking down large orders using an ‘iceberg’ strategy based on predefined parameters, which frees up traders to focus on other orders while reducing signalling risk, and as such is becoming more prevalent. The overall impact is less time-specific volatility and a smoother intraday price, as well as the transfer of price risk from market-maker to price-taker.

All of this taken together goes to show that perhaps [the industry] shares a similar view in terms of looking at the marginal costs versus the benefits of providing or connecting to these various venues

Selene Chong, HSBC

How has the continued growth in number of venues affected liquidity?

Despite the significant growth in the number of venues for trading FX, there has not necessarily been a corresponding growth in liquidity – and so the question remains, are there too many venues?

Some see signs of possible consolidation, or the market reaching its capacity, as many seem to be accessing the same underlying liquidity pools. There are signs from at least one major bank that the cost of access isn’t matched by requisite benefits. Meanwhile, banks are choosing to internalise their FX flows, and the ability to define what an ‘efficient’ market looks like has become more difficult.

Most traders agree there is a point at which, depending on the quality of the liquidity, additional venues no longer bring incremental benefits. The overall trend towards growth seems to at least be seeing a retracement, and it may soon be the case that the cost of maintaining multiple venues becomes more than the market is willing to bear.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com