EM prices could suffer in September – Swissquote

If the ECB starts tapering, emerging markets could take a profound hit in the short term

CLICK HERE TO DOWNLOAD THE PDF

The converging policy paths of the US Federal Reserve and the European Central Bank could have a profound impact on the pricing of emerging markets (EM) currencies if expectations of a tapering move from the ECB in September prove correct, says Peter Rosenstreich, head of market strategy at Swissquote Bank.

For EM currencies, there is a lot at stake. After nearly a decade of extraordinary easing, the ECB could embark on tapering its bond-buying programme later this year.

“The recent shift in a few G10 central banks’ tones toward normalisation, a rapid rise in yields and weakness in EM currencies indicates there is significant risk in unwinding extraordinary loose policy. In September, we expect Fed and ECB policy will converge, with both taking real policy steps towards tightening, which could have a profound effect on EM prices,” says Rosenstreich.

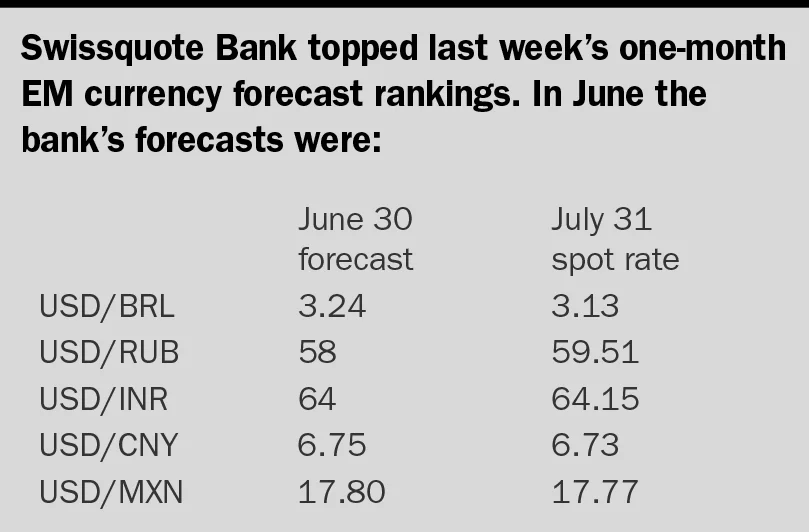

Swissquote topped FX Week’s one-month currency forecast tables.

The convergence between policy paths will be even more amplified as the pace of tightening in the US slows. Since the euphoria and expectations for growth surrounding President Donald Trump’s proposed fiscal stimulus package, hopes have faded that these policies will translate into reality, leading to market participants scaling back the path of rate hikes in the US.

For now, US data points show a moderate, but healthy expansion, with the economy notching up 2.6% growth in the second quarter of this year. But while strong US data and expectations of more tightening from the Fed tend to take the wind out of the sails of EM currencies, the situation could be set for change as the market re-evaluates the US central bank’s likely path.

Trump has failed as a political deal-maker, so anti-China trade rhetoric feels empty while China economic data continues to improve

Peter Rosenstreich, Swissquote Bank

“Developed-market central banks’ normalisation remains a massive risk in our view,” says Rosenstreich. “Weak US economic data and decreased expectations for Fed tightening supports EM risk-taking. In the medium term, we expect EM currencies to appreciate against the dollar, and while we are concerned about the next few months, markets should be able to handle the slow removal of extra loose policy in the medium and longer term.”

Rosenstreich cautions that in the short run, moves could become volatile and sharp, as carry trade positioning is becoming increasingly stretched. “The closer we move towards September, the more cautious traders will get,” he notes.

Meanwhile, the rollback of hopes pinned on Trump’s policy package will benefit China, he says. “Trump has failed as a political deal-maker, so anti-China trade rhetoric feels empty while China economic data continues to improve. We have thought for a while now that China will be the biggest beneficiary of a Trump administration, because greater instability in US policy could lead to Asian nations joining together, with China becoming the regional leader.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@fx-markets.com

More on Monetary Policy

Lagarde promises wide-ranging review of ECB monetary policy

ECB to form digital currency task force as Lagarde calls for EU action on green finance

Fed can now keep rates on hold, senior official says

Recent cuts have provided greater assurance Fed will hit inflation target, Charles Evans says

RBI forms task force on offshore rupee

Task force will examine the effects of the offshore market on exchange rates and domestic liquidity

Powell hints at $1trn goal for Fed balance sheet

Proposed reserves buffer is more than enough, Charles Goodhart says

PBoC issues 20 billion yuan of central bank bills in Hong Kong

Bills could be used to manage offshore yuan liquidity and stabilise exchange rates

RBA governor signals a rate cut more likely in 2019

Uncertain global outlook has rebalanced Reserve Bank of Australia's policy options

Fed strikes a dovish tone in January

US central bank will no longer keep balance-sheet runoff on automatic pilot

BoJ members split ranks on monetary easing

Not all members agree on how low 10-year yields should be